Plastics Industry M&A Activity Tracking

Global Plastics M&A activity slowed in December, recording only 19 transactions, which was the lowest monthly transaction volume in 2022 and significantly below last December’s levels. December was the fourth consecutive month with less than 30 transactions as plastics M&A activity continued to report lower levels of activity in part due to economic uncertainty and challenging credit markets. Despite the recent slowdown in transaction activity, 2022 was an exceptional year overall with 363 deals, making it the 2nd highest volume year since 2012.

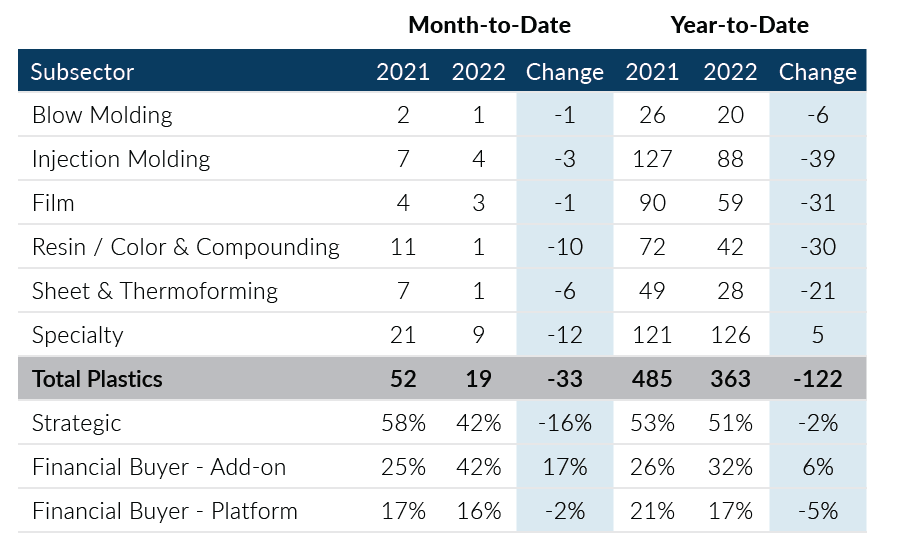

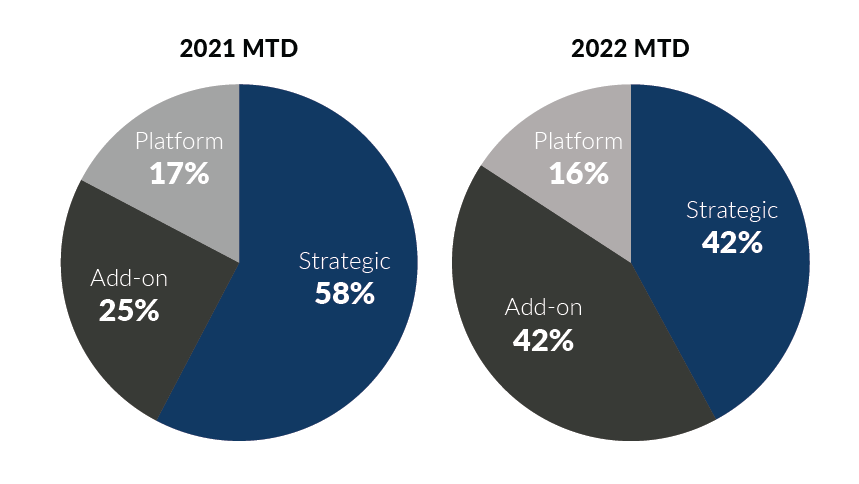

- Private equity plastics transactions accounted for over 50% of deal activity for the third consecutive month. Add-on acquisitions remained the primary driver for private equity activity, accounting for 73% of private equity transactions

- Strategic buyers remained conservative in December, recording eight plastics transactions for the third consecutive month which is eight transactions below the average monthly transaction volume for strategic buyers in 2022

- The Specialty subsector led all subsectors in transaction activity for the second straight month, accounting for 47% of deal activity in December. Specialty transactions, which include distribution, foam, and machinery deals, accounted for 126 deals in 2022 which was the most of any subsector

- For the first month since July, foreign plastic transaction activity was greater than domestic plastic transaction activity. Foreign deals accounted for 47% of monthly transaction volumes in December and 38% of transactions for the year

Global Plastics M&A activity ended the year on a low note as buyers and sellers continued to grapple with rising interest rates, inflation, and uncertain macroeconomic conditions. Plastics deals continue to be completed at attractive multiples but at much lower levels of activity. Recovery of plastic M&A volume in 2023 will largely be dependent on improvements in the macroeconomy and credit markets. If you are a plastics company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of December 31, 2022

Plastics M&A By Subsector

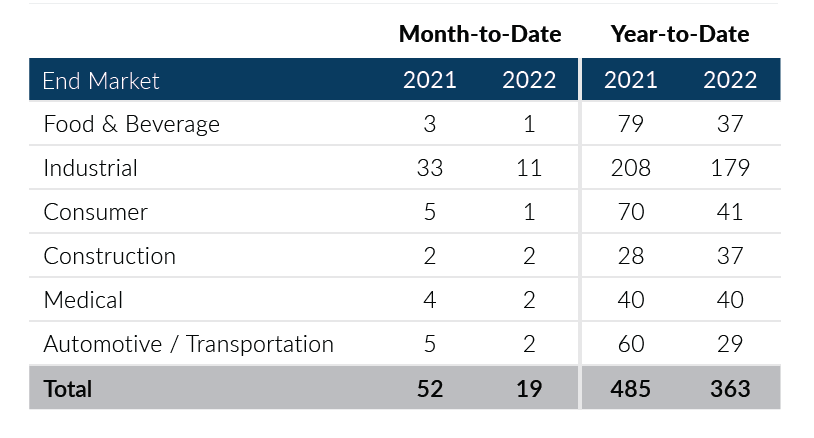

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

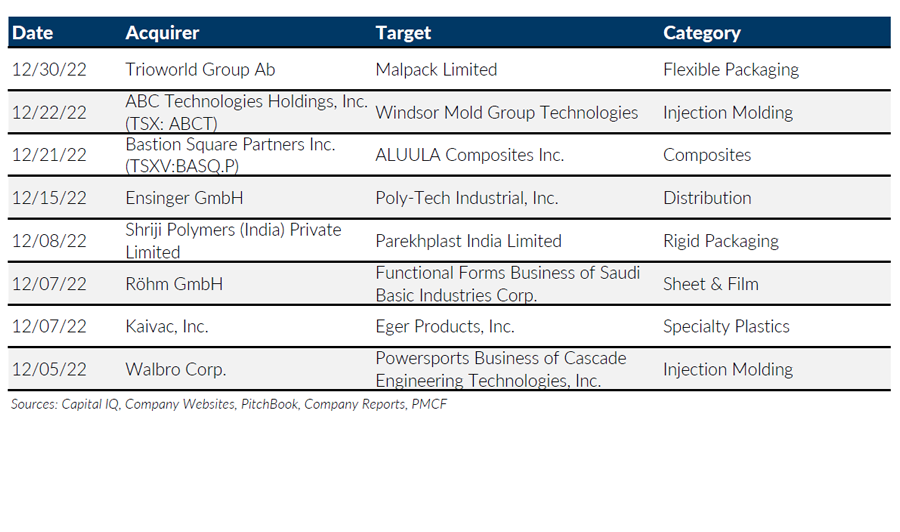

Notable M&A Activity

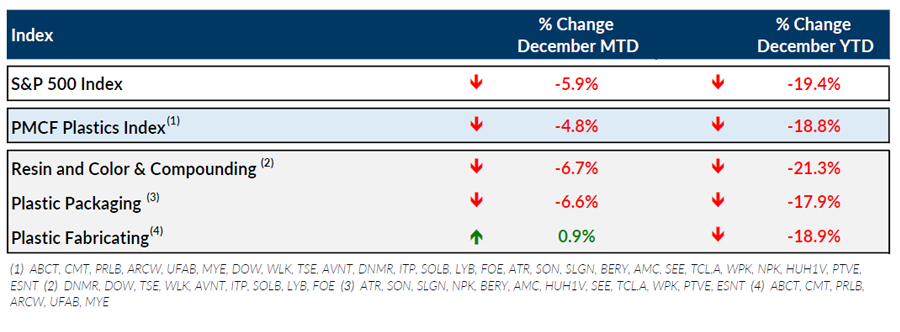

Public Entity Performance

Major News

- High Inventories Lead to Lower Prices for Some Engineering Resins (Plastics News)

https://www.plasticsnews.com/resin-pricing/engineering-resin-prices-fall-heading-2023 - U.S. Inflation Slowed for Sixth Straight Month in December (The Wall Street Journal)

https://www.wsj.com/articles/us-inflation-december-2022-consumer-price-index-11673485441 - U.S. Jobless Claims Tick Up, Economy Grows Faster Than Previously Thought (The Wall Street Journal)

https://www.wsj.com/articles/jobless-claims-rose-by-2-000-last-week-remain-below-prepandemic-average-11671716760 - Resin Buyers, Makers Take a Wild Ride in 2022 (Plastics News)

https://www.plasticsnews.com/materials/resin-markets-end-year-report-wild-ride#:~:text=New%20polypropylene%20supplier%20Heartland%20Polymers,billion%20pounds%20of%20PP%20annually - Lawmakers Urge Biden to Set ‘Meaningful Standards’ for Plastics Treaty (Plastics News)

https://www.plasticsnews.com/public-policy/lawmakers-urge-biden-set-meaningful-standards-plastics-treaty#:~:text=Noting%20ongoing%20talks%20toward%20a,and%20Alan%20Lowenthal%20and%20Sens

Download Plastics M&A Update – December 2022