Packaging Industry M&A Activity Tracking

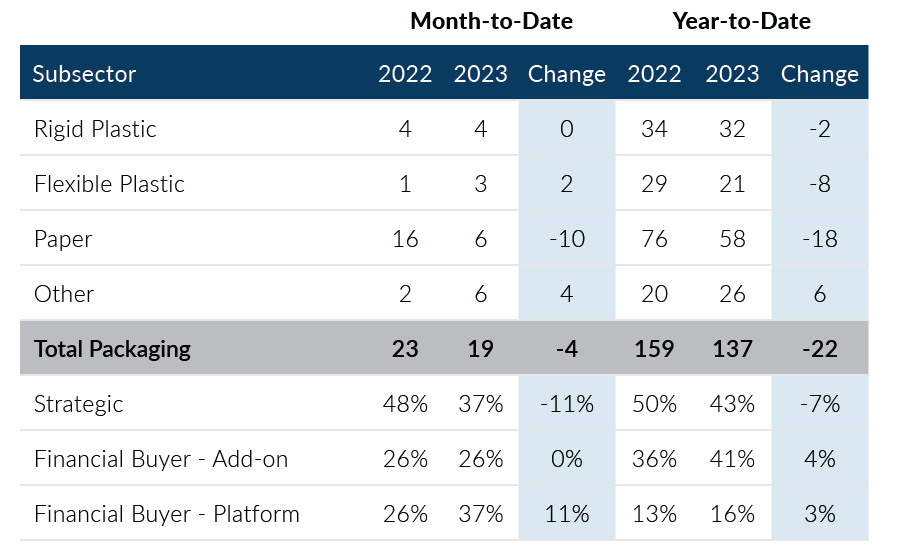

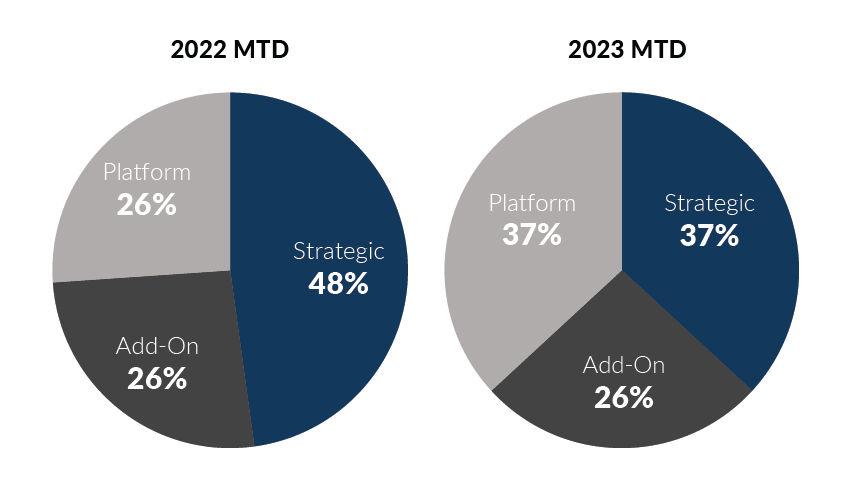

Global Packaging M&A posted 19 transactions in July, up one from June levels. Add-on transactions fell below the monthly average of eight deals, but an increase in private equity platform transactions more than offset this decline. Strategic buyers, on the other hand, posted their second-lowest month from a deal standpoint in July. Packaging M&A has primarily been driven by financial buyers and strong add-on activity while strategic buyers have generally pulled back from the market. PMCF will continue to monitor these trends as the year continues.

- Strategic buyers accounted for seven deals, or 37% of the deal volume in July. In the year-to-date period, strategic buyers have recorded 43% of all transaction activity, which would be their lowest mark since PMCF began tracking M&A activity in the industry

- Deals attributable to financial buyers rose by four transactions month-over-month. Platform private equity buyers recorded seven deals in July, which represents the most acquisitive month for platform buyers since November 2021

- The Other Packaging subsector continues to post strong monthly activity levels, recording six deals in July. The subsector is on pace to surpass 2022 volumes

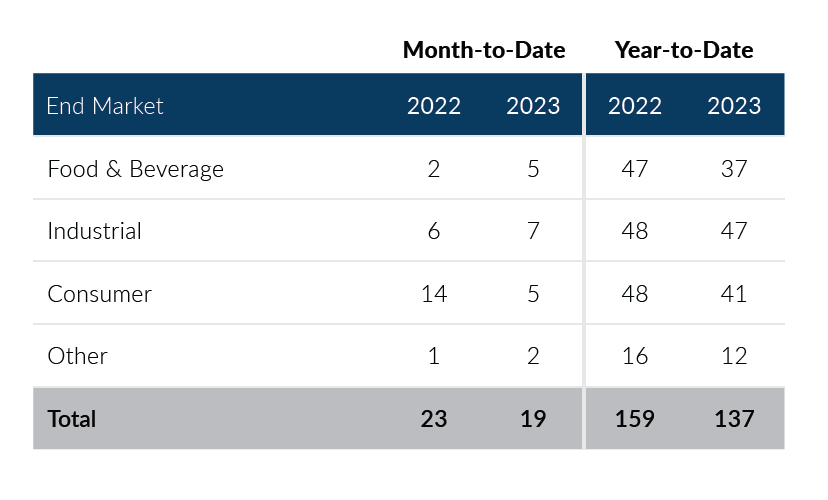

- The Medical end market posted two transactions in July and 12 transactions in the year-to-date period. At current levels, the end market is on track to surpass 2022 levels and is on par with 2021 volumes

Global Packaging M&A has experienced lower deal volumes in 2023. Weak M&A activity is due in part to core volumes declining across many sectors of packaging, macroeconomic uncertainty, and challenging credit markets. Despite lower activity levels, well-positioned packaging companies remain in demand and continue to draw interest from strategic and financial buyers. If you are a packaging company considering a merger, acquisition, sale, or recapitalization in the short or longer term please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of July 31, 2023

Packaging M&A By Subsector

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

Notable M&A Activity

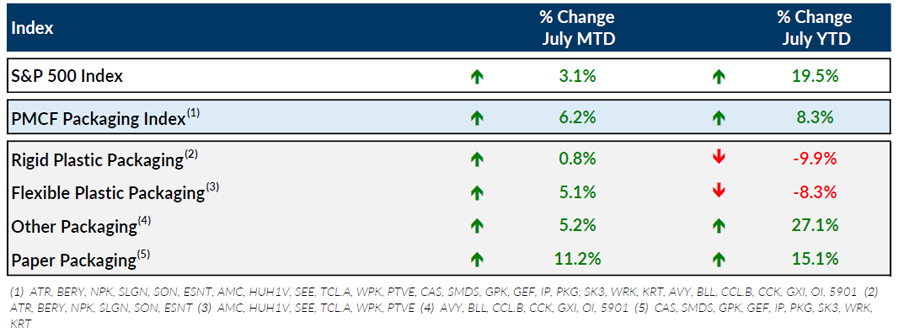

Public Entity Performance

Major News

- The Hottest Food & Beverage Packages Right Now (Packaging Digest)

https://www.packagingdigest.com/food-beverage/hottest-food-beverage-packages-right-now - Packaging ‘Durability, Not Disposability’ Focus of Senate Hearing (Plastics News)

https://www.plasticsnews.com/public-policy/packaging-durability-not-disposability-focus-senate-hearing - EPA Proposal to Cut Plastics, Chemical Plant Emissions Draws Intense Interest (Plastics News)

https://www.plasticsnews.com/public-policy/epa-proposal-cut-plastics-chemical-plant-emissions-draws-intense-interest - How the U.S. Economy Is Sticking the Soft Landing (The Wall Street Journal)

https://www.wsj.com/articles/how-the-u-s-economy-is-sticking-the-soft-landing-cf140c04?mod=economy_more_pos2 - U.S. Economic Growth Accelerates, Defying Slowdown Expectations (The Wall Street Journal)

https://www.wsj.com/articles/us-gdp-report-economic-growth-92482437?mod=economy_more_pos5

Download Packaging M&A Update – July 2023