Plastics Industry M&A Activity Tracking

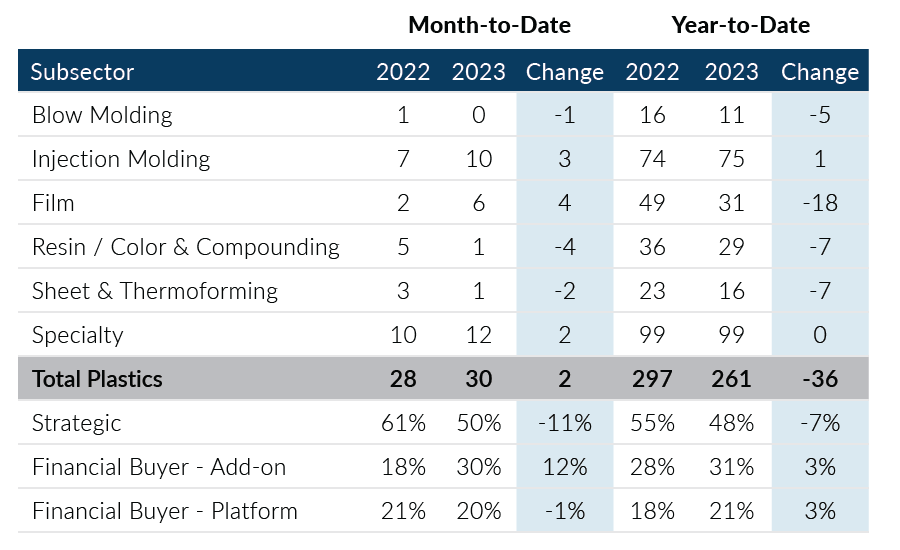

Global Plastics M&A recorded 30 deals in September, which marked the second consecutive month with 30 or more transactions. September deal volumes were driven by private equity platform buyers, which continued to display elevated levels of activity. Overall, Q3 outpaced both Q1 and Q2 from a deal volume standpoint, recording 90 deals in the three-month period. Increased levels of M&A activity in Q3 represented a positive development for the plastics industry, which has dealt with varied demand trends amid a slowing macroeconomy.

- Strategic buyers recorded 15 deals in September and 42 deals in Q3. When compared to Q2, strategic deal activity fell by 10 deals, however, deal volumes remained above sluggish Q1 levels

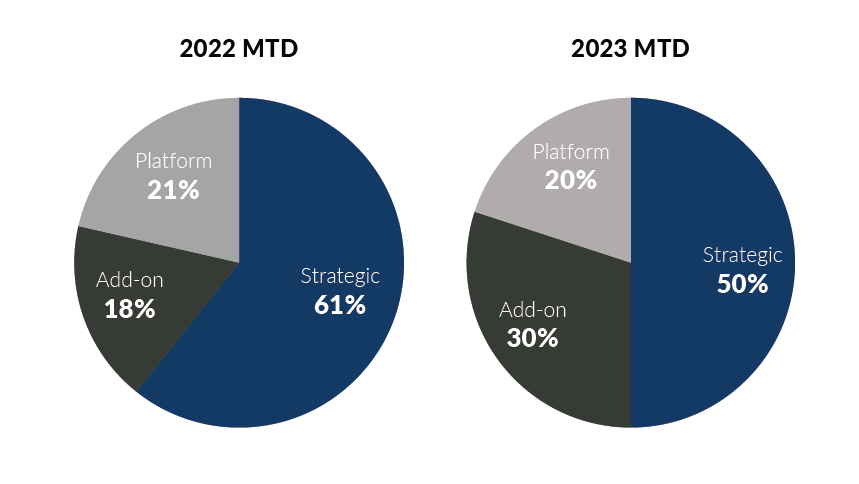

- Financial buyers accounted for 50% or more of the total transaction activity for the third straight month and 53% of deal volumes in the quarter. Financial buyer activity was driven by platform acquisitions, which accounted for 52% of all financial deals in Q3

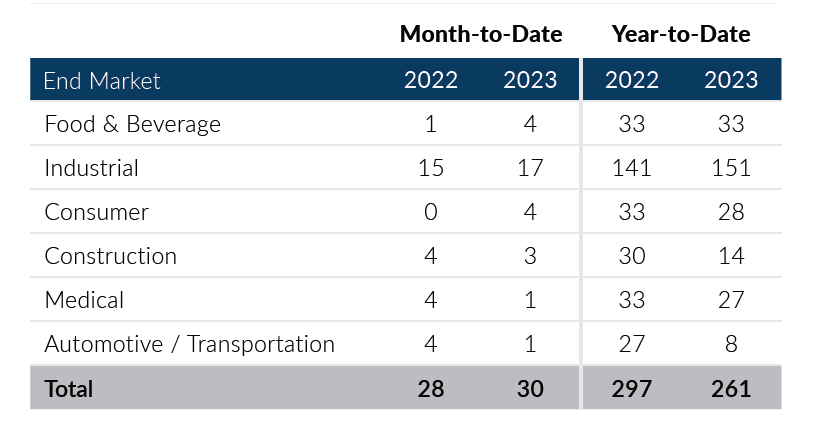

- The Food & Beverage end market recorded over 10 deals for the second consecutive quarter. While this marks an improvement over recent activity levels, Food & Beverage transaction activity remains below pre-pandemic averages

- The Injection Molding subsector recorded 31 deals in Q3 and was the second most active subsector. Injection molding transaction activity has increased in each of the last three quarters and has reached its highest volumes since Q4 2021

The Global Plastics M&A market displayed positive trends in Q3 2023, achieving higher deal volume than in the two preceding quarters despite rising interest rates, more challenging credit markets, and slowing demand. Private equity activity has had a major impact on the increased M&A volume seen in Q3 and has more than offset lower strategic buyer activity. If you are a plastics company considering a merger, acquisition, sale, or recapitalization in the short or longer term please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of September 30, 2023

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

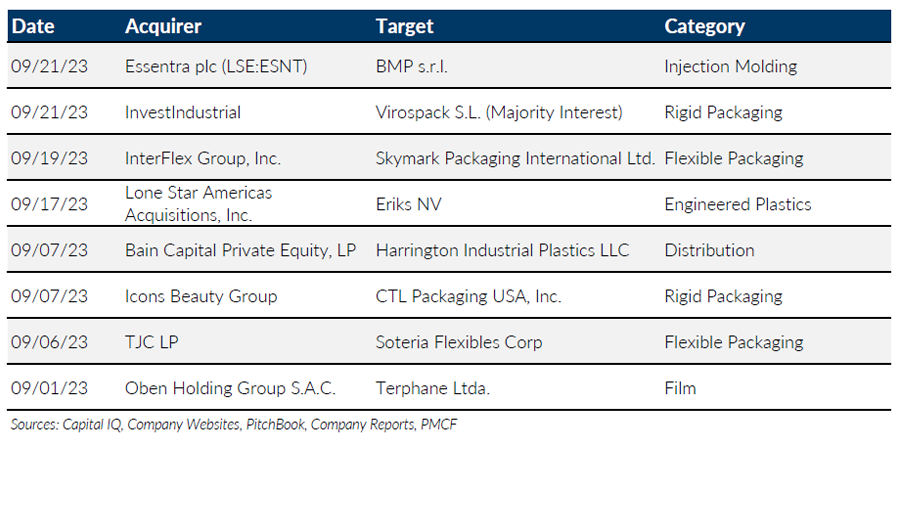

Notable M&A Activity

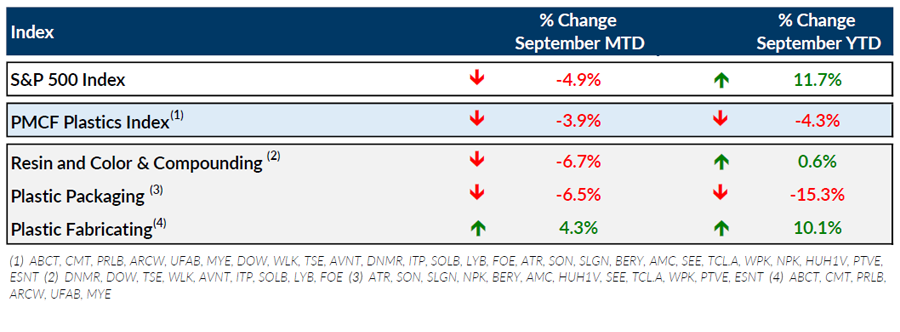

Public Entity Performance

Major News

- Job Gains Eased in Summer Months; Unemployment Increased in August (The Wall Street Journal)

https://www.wsj.com/economy/jobs/jobs-report-august-today-unemployment-economy-de847415?mod=jobs_more_article_pos6 - A Recession Is No Longer the Consensus (The Wall Street Journal)

https://www.wsj.com/economy/a-recession-is-no-longer-the-consensus-3ad0c3a3?mod=central-banking_news_article_pos1 - Report: US Plastics Shipments Grow 3%, Workforce Tops 1M (Plastics News)

https://www.plasticsnews.com/news/plastics-shipments-grow-3-2022-us-workforce-tops-1m-association-report-says - Plastics Treaty Must Avoid Climate Mistakes, UNEP Leader Says (Plastics News)

https://www.plasticsnews.com/news/plastics-treaty-must-avoid-climate-mistakes-unep-leader-says - US Finalizing Plans to Phase out Single-Use Plastics Across Public Lands (Plastics News)

https://www.plasticsnews.com/news/us-finalizing-plans-phase-out-single-use-plastics-across-public-lands

Download Plastics M&A Update – September 2023