After years of volatility and transformation, the Human Capital Management (HCM) industry now finds itself navigating a landscape where geopolitical tensions and technological acceleration collide to create both unique challenges and new frontiers for growth.

As PMCF Investment Banking looks to 2026, this year appears to be a definitive inflection point for organizations capable of marrying authenticated talent networks with scalable, automated placement architectures. Prospective acquirors across the HCM landscape continue to demonstrate increased interest in premium assets, setting the stage for a productive year of dealmaking.

2025 HCM M&A Review – Strategic Specialization Defines Market

The HCM industry navigated an exceptionally dynamic environment over the past several years, defined by a lengthy period of normalization following exceptional performance in 2021-2022, where macroeconomic headwinds have collided with rapid technological acceleration in outsourcing services. Geopolitical tensions and trade restrictions, most notably the shifting dynamics in the U.S.-China trade policy and the associated tariff costs, have introduced new hurdles for the light industrial, manufacturing, and warehousing staffing sectors.

On a broader scale, international staffing firms have been forced to remain agile in response to the evolving trade restrictions and overall market uncertainty.

Despite a lack of larger HCM industry growth in 2025, premium players across the workforce solutions landscape have found avenues for differentiation by leaning into high-growth verticals, such as IT services, engineering and architectural services, as well as aerospace and defense while leveraging the tailwinds of aging workforce demographics.

The increasing need for a contingent workforce remains a fundamental pillar of staffing demand as clients prioritize flexible resource models with variable costs to hedge against economic uncertainty. Additionally, the industry is transitioning from an initial experimentation with advanced technologies across outsourcing services to the disciplined, strategic deployment of proprietary software and artificial intelligence solutions to enhance their value proposition in a highly fragmented, competitive market.

Premium players across the HCM industry are commanding increased buy-side interest as inorganic growth emerges as the most opportune pathway to rapid expansion, both from a capabilities and geographical perspective.

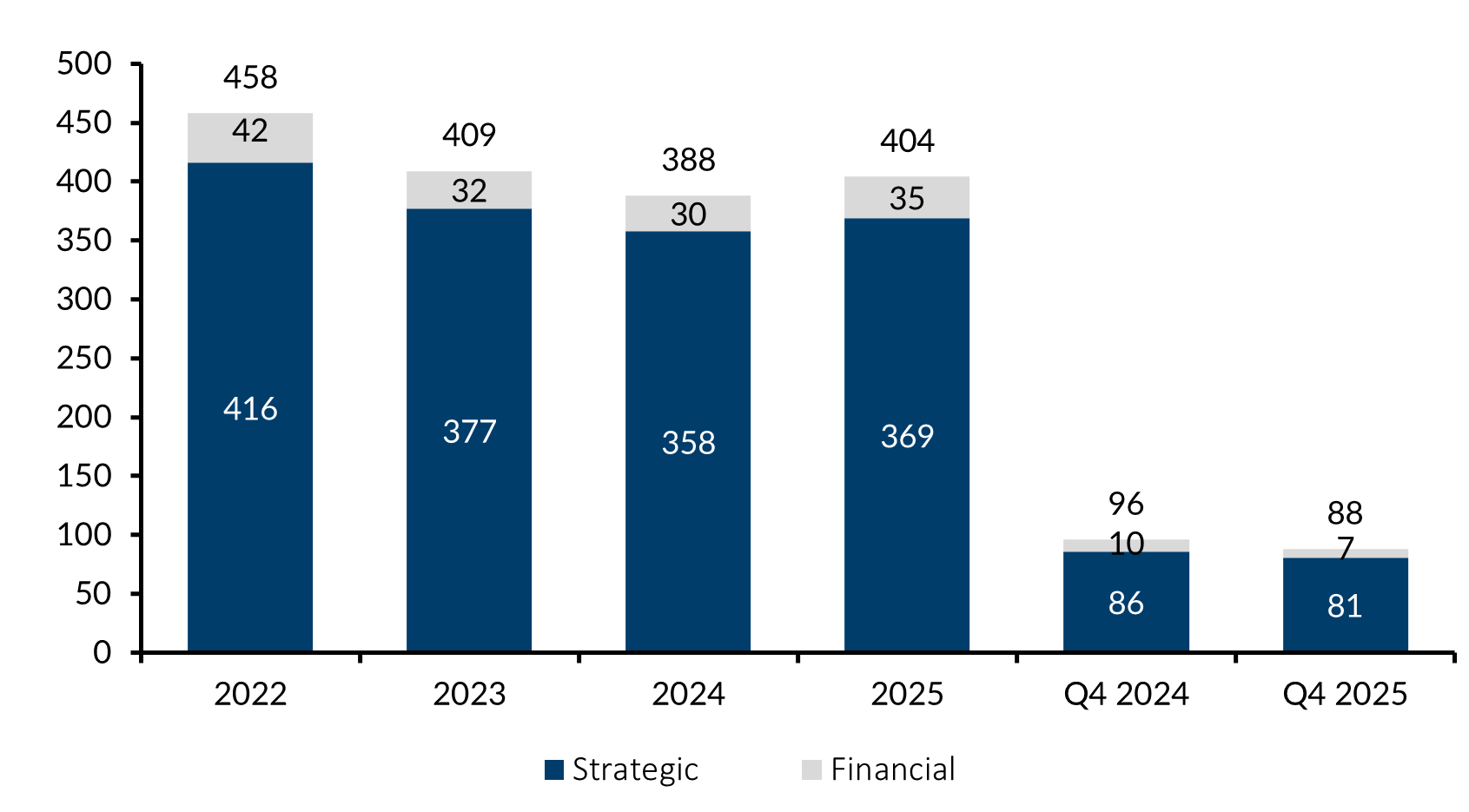

Slow But Steady Growth in M&A Deal Volumes

M&A volumes in the staffing and outsourcing services space remained remarkably resilient in 2025, reaching their highest transaction levels since 2023 despite a stagnant organic growth environment.

North American staffing M&A activity eclipsed 200 announced transactions through December, representing a material increase versus 2024 North American transaction volumes and exceeding 400 announced transactions globally, with the second most prominent region being Europe, Middle East, and Africa (EMEA) followed by Latin America. As a continued theme across the HCM M&A market, nearly 90% of all transactions involved strategic acquirors, as established players in staffing and outsourcing services continued to execute inorganic growth strategies as a means of acquiring new books of business, establishing a footprint in new geographies, and gaining control of proprietary technologies to further differentiate their capabilities.

Valuation multiples showed a widening dispersion based on specialization with professional, healthcare, and technology staffing solutions driving stronger enterprise value to EBITDA (EV/EBITDA) multiples, sometimes well into the double digits, versus manufacturing, light industrial, and commercial staffing which remained in the low-to-middle-single-digit range, reflecting higher operational risks, narrower margins, and lower barriers to entry.

The continued push towards differentiation highlights a market where strategic consolidators are willing to pay a premium for staffing solutions providers that have successfully navigated the post-pandemic labor normalization and are showing continued signs of growth despite economic headwinds.

HCM M&A Transaction Volume by Buyer Type(1)

-

- Sources: Staffing Industry Analysts (SIA), S&P Capital IQ, PMCF Proprietary Research

Maximizing Value in the Current HCM Market

For staffing solutions providers contemplating a near-term sale, maximizing value requires a proactive focus on three key pillars: robust analytics & reporting, technology stack optimization, and a diverse talent network.

First, prospective sellers must standardize their KPI reporting practices to be able to demonstrate underlying business health through metrics such as fill rates, time-to-fill, average markup by position staffed, and recruiter productivity as a key focus area of sophisticated strategic buyers and private equity funds.

Second, an optimized technology stack, specifically the development of proprietary solutions and AI integration, has taken center stage as a critical margin driver. Industry leaders have demonstrated the strength of a robust technology stack, scaling AI recruiter toolkits to increase placement rates while operating on global technology platforms that are highly scalable.

Lastly, the development and retention of a diverse talent network through skills-based hiring and enhanced client experience remains essential to driving buyer interest and commanding stronger valuation multiples. In an area where AI can easily fabricate work histories on resumes, the value of a premium staffing firm resides in its ability to authenticate qualifications and provide proprietary data on actual candidate history and performance. Sellers who can prove they have differentiated recruiting and talent retention expertise are likely to drive stronger valuations.

Optimistic Outlook for M&A Activity in 2026

As we look ahead to 2026, the industry faces a cautious, but optimistic outlook with many staffing experts viewing the current period as a major inflection point for sustainable growth. While uncertainty regarding the precise timing of a broad-based labor recovery persists, recent M&A volumes provide a strong signal of continued dealmaking confidence this year. Large-cap players, such as Robert Half and ManpowerGroup, have already reported a return to sequential growth for the first time in over three years, anticipating continued quarter-by-quarter growth as we progress through 2026. The market stagnation which characterized much of 2024 and 2025 appears to be easing, with small to medium businesses facing pent-up demand for skilled professionals as workforce augmentation becomes a top priority.

To capitalize on an evolving HCM M&A landscape, organizations must engage the right strategic advisors to navigate a diverse and increasingly sophisticated network of strategic and private equity buyers to drive bidding competition and boost valuations.

Additionally, for those considering a longer‑term liquidity option, early preparation remains a powerful advantage as the market continues to shift. A thoughtful strategic assessment ensures organizations are ready to act when timing and valuation conditions align.

An experienced advisor is critical to positioning a firm’s vertical specialization, tech-enablement, and talent acquisition process to ensure that high-performing organizations achieve a premium valuation as the M&A cycle shows no signs of slowing down.