2017 has extended a robust environment for packaging M&A activity with 230 deals being recorded through Q3 2017. Although deal volume declined sharply from Q2 2017 to Q3 2017, 2017’s year to date total remains on pace to potentially exceed the 5-year high point of deals reached in 2016.

Driving higher volume, new private equity platforms continue to increase as a percentage of packaging transactions. These investments represent continued interest in the space and may foreshadow an elevated level of add-on acquisitions over the next 1 to 3 years.

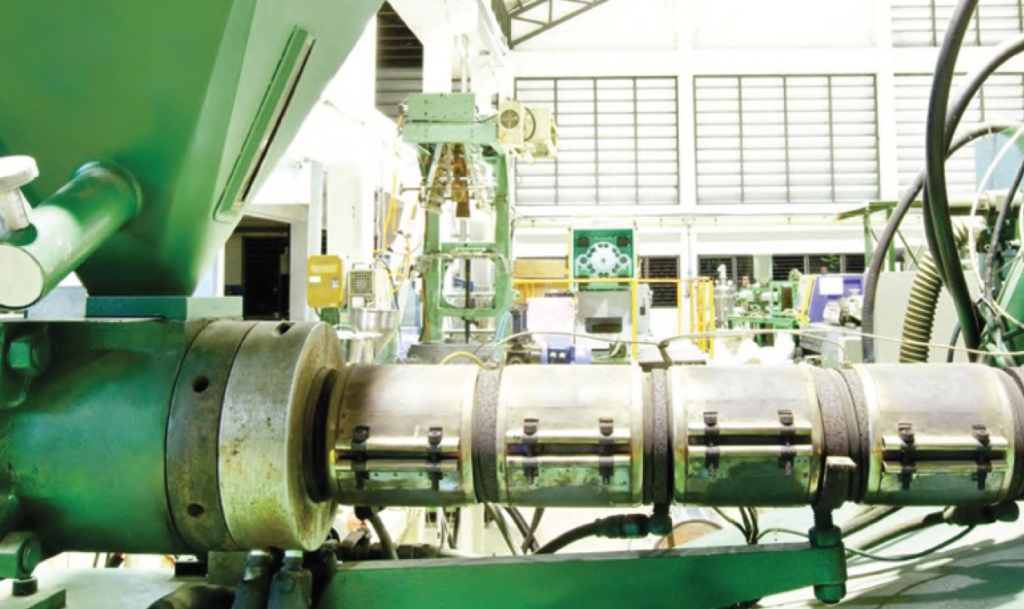

Increasing by 5 transactions quarter over quarter, rigid plastic remains a highly sought after segment for M&A. Amongst other sectors, flexible packaging activity was flat, while paper packaging experienced a slight increase in deals. Outside of paper and plastic, there was a slight pullback in machinery/equipment and metal deals, and an increase in the volume of glass and distributor transactions.

A number of marquee transactions took place in Q3 2017:

- Multi-Color Corp. (NASDAQ:LABL) acquired Constantia Flexibles Group labels division for $1.3 billion

- ProAmpac, acquired by the Pritzer Group in 2016, bought both PolyFirst Packaging and Clondalkin Flexible Packaging Orlando

- Packaging Corporation of America (NYSE:PKG) acquired Sacramento Container Corp for $265 million

- Georgia Pacific, owned by Koch Industries, acquired Pax Corrugated Products

Pricing for packaging deals continues to be very favorable for sellers as deal multiples are at multi-year highs. These strong valuations can be attributed to the availability and low cost of capital, a fair level of optimism in the economy, and increased competition for a limited number of quality acquisition targets. Public buyers remain highly acquisitive, using M&A to offset low GDP growth and meet shareholder growth expectations. Private equity, with significant available capital and strong interest in the positive attributes of the packaging industry, have been paying up to acquire new platforms. These dynamics have driven up pricing and created a unique environment for prospective sellers of packaging businesses.

The current buyer dynamics create a strong outlook for packaging M&A for the balance of 2017 and throughout 2018. With M&A multiples at multi-year highs, we believe it may prompt additional sellers and even traditionally longer term investors to contemplate a transaction in the short term. We are uncertain as to how long this strong “sellers” market will last but we do know that the current cycle has extended beyond historical time periods and will ultimately revert.