Packaging Industry M&A Activity Tracking

Global Packaging M&A posted 19 transactions in April, which was an increase of eight deals over March levels. Much of the rebound in deal volume was driven by a resurgence in strategic and private equity platform activity. However, private equity add-on buyers only recorded five deals in April, after a strong start to the year. Overall, Global Packaging M&A activity has been lower due in part to varied demand from strategic buyers, but an uptick in activity from this group in April was an encouraging sign for the sector.

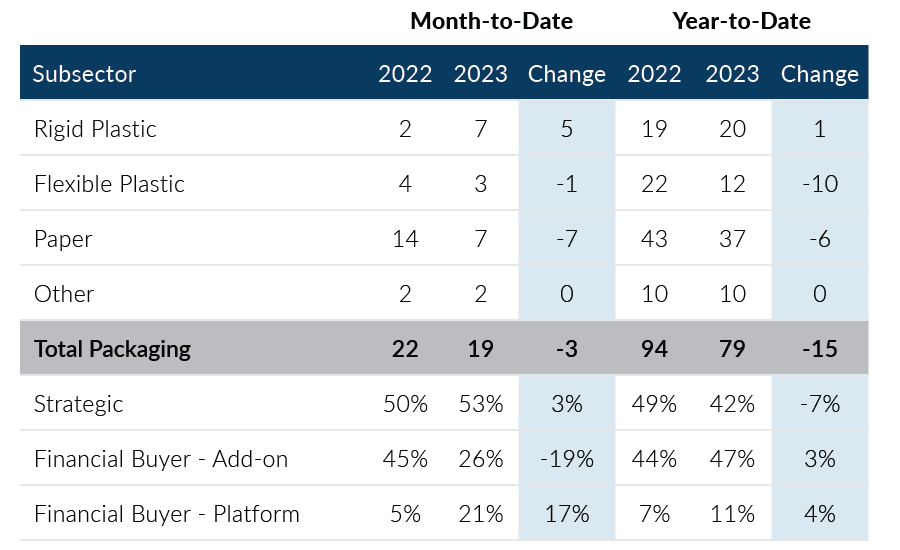

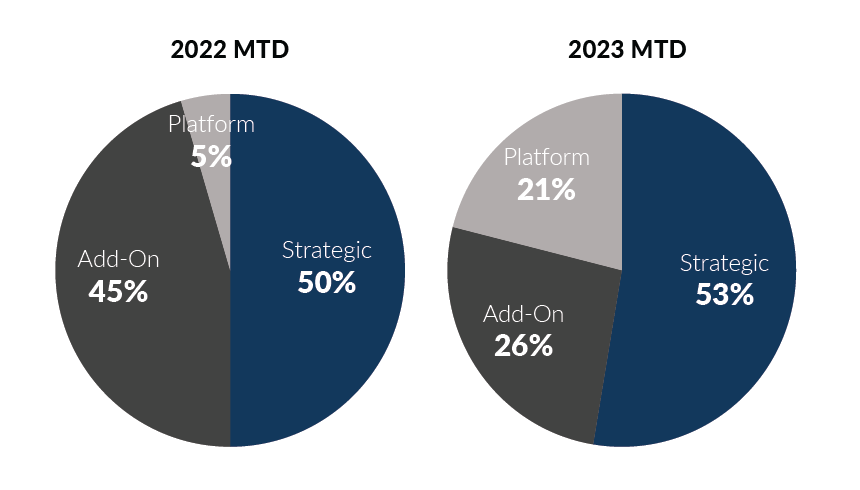

- Strategic buyers accounted for 10 deals in April, or 53% of the month’s activity, and increased five deals month-over-month. Strategic buyers have, however, recorded 13 fewer deals when compared to the same year-to-date period in 2022

- In April, platform private equity buyers posted their highest monthly volume since December 2022, recording four deals in the month

- The Rigid Plastic subsector posted seven deals in April, which represented the subsector’s most acquisitive month since November 2022. Subsector activity was driven by transactions involving bottle and specialty rigid packaging manufacturers

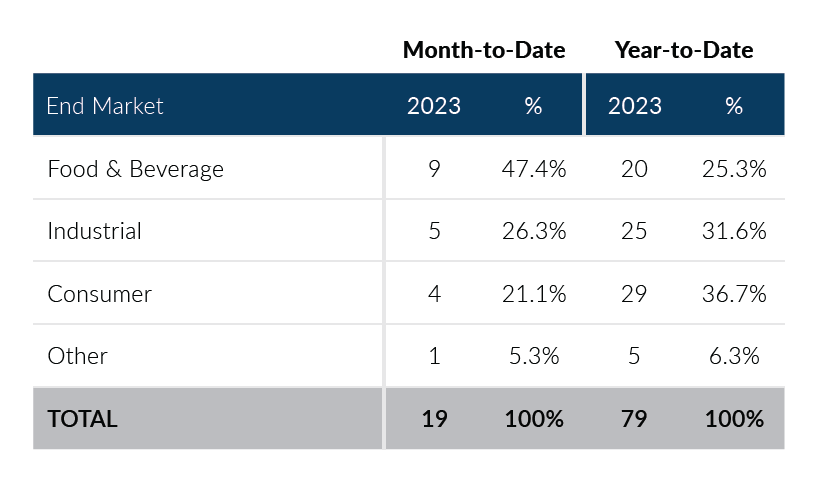

- The Food & Beverage end market recorded nine deals in April, up six from March levels. April volumes represented the end market’s highest level of activity since March 2022

Global Packaging M&A in April reported a welcomed increase over historically low March volume levels. Despite increases in both strategic and private equity platform activity, year-to-date volumes remain below 2022 volumes due in part to continued macroeconomic uncertainty and high acquisition debt financing costs. Nevertheless, buyer interest in well-positioned packaging companies remains high and valuation multiples have largely remained consistent for the past several months.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of April 30, 2023

Packaging M&A By Subsector

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

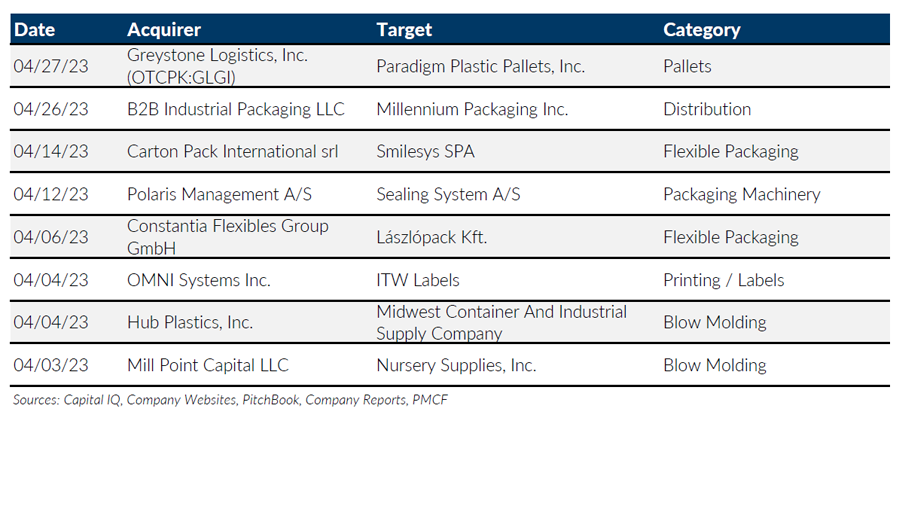

Notable M&A Activity

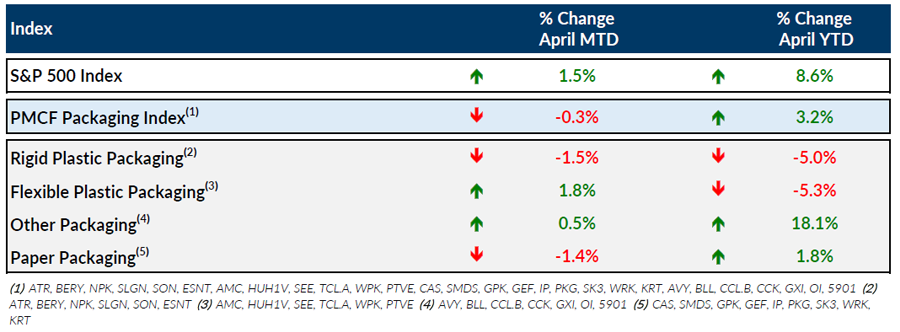

Public Entity Performance

Major News

- Manufacturers Optimistic Amid Challenges (Plastics News)

https://www.plasticsnews.com/news/2023-outlook-plastics-manufacturers-after-q1 - Plastics Execs Hit DC to Lobby R&D Tax Breaks Amid Growing “Firestorm” (Plastics News)

https://www.plasticsnews.com/public-policy/plastics-industry-leaders-lobby-congress-research-and-development-tax-breaks - GDP Report Shows Economic Growth Slowed in First Quarter (The Wall Street Journal)

https://www.wsj.com/articles/us-gdp-economic-growth-first-quarter-2023-2ff4348c - IMF Says Banking Troubles Create Headwinds for Global Economy (The Wall Street Journal)

https://www.wsj.com/articles/imf-says-banking-troubles-create-headwinds-for-global-economy-f6fef59e?mod=Searchresults_pos3&page=4 - Charting Sustainable Packaging’s Global Growth (Packaging Digest)

https://www.packagingdigest.com/sustainability/charting-sustainable-packagings-global-growth

Download Packaging M&A Update – April 2023