Packaging Industry M&A Activity Tracking

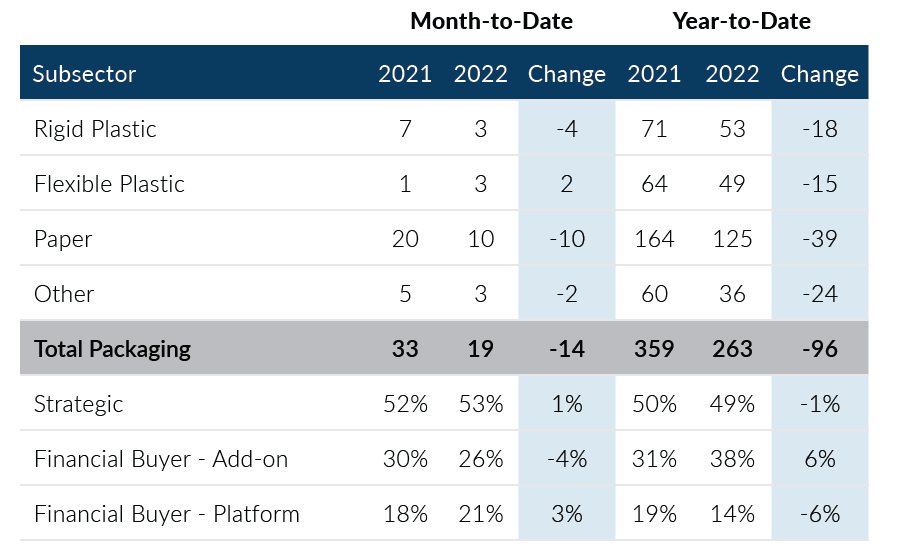

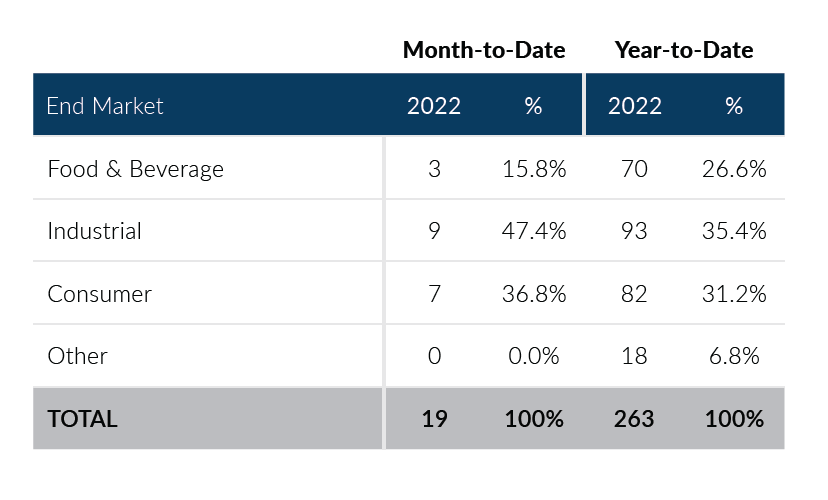

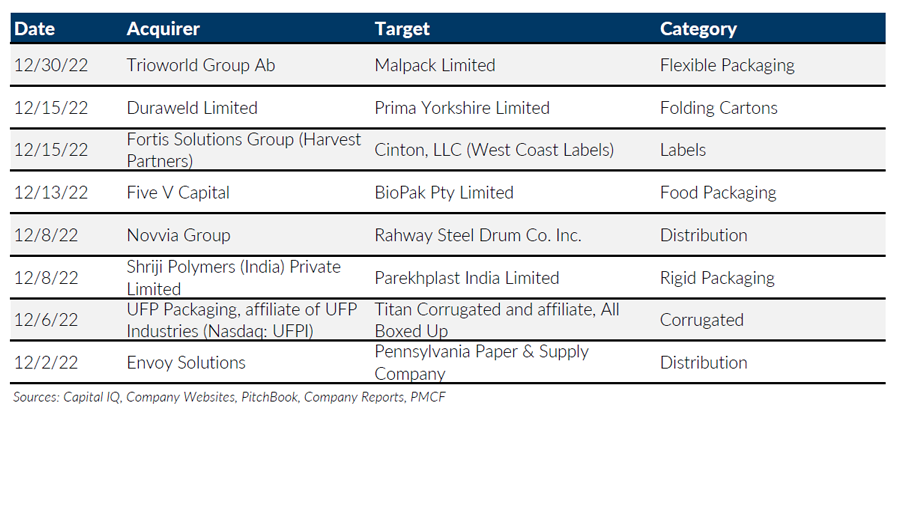

Global Packaging M&A activity recorded 19 transactions, down four deals from November activity levels and significantly below last December’s levels. The decline in activity levels stemmed from less acquisitive private equity-backed strategic buyers, as add-on transactions accounted for four fewer deals month-over-month. Packaging M&A has varied throughout 2022, recording between 17 and 25 deals per month. Overall, 2022 was a down year for packaging M&A as transaction levels fell below pre-pandemic volumes.

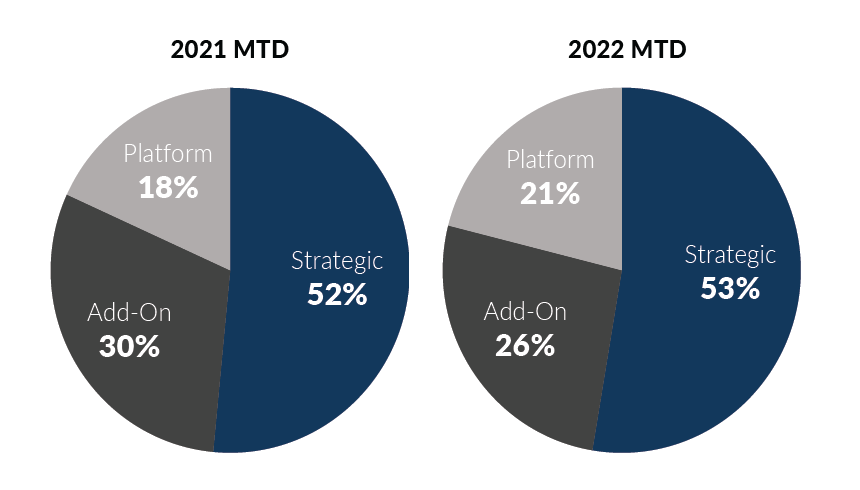

- Strategic buyers accounted for 53% of recorded transactions in December, which marked the seventh time in 2022 that strategic buyers have accounted for over 50% of transaction volumes

- Private equity platform transactions bounced back in December, posting four transactions, up three from the prior month. On average, three platform acquisitions were announced per month in 2022, which was consistent with December volumes

- Private equity add-on transactions pulled back from 2021 levels, but still had a strong year in 2022. Add-on transactions accounted for 99 transactions in 2022, which is 21 deals higher than the average four-year activity levels

- The Paper subsector recorded 10 deals for the second consecutive month and accounted for 53% of overall activity in December, which was the fifth time in 2022 that the Paper subsector has accounted for over 50% of the deal volume

Global Packaging M&A experienced a pullback in transaction activity in December 2022, as financing challenges and macroeconomic uncertainty continued to suppress activity levels. Packaging deals continue to be completed at attractive multiples but at lower levels of activity. Recovery in packaging M&A volume in 2023 will largely be dependent on improvements in the macroeconomy and the credit markets. If you are a packaging company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of December 31, 2022

Packaging M&A By Subsector

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

Notable M&A Activity

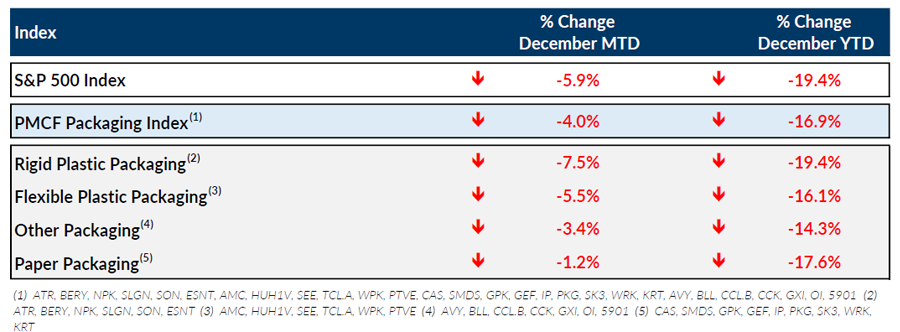

Public Entity Performance

Major News

- U.S. Inflation Slowed for Sixth Straight Month in December (The Wall Street Journal)

https://www.wsj.com/articles/us-inflation-december-2022-consumer-price-index-11673485441 - U.S. Jobless Claims Tick Up, Economy Grows Faster Than Previously Thought (The Wall Street Journal)

https://www.wsj.com/articles/jobless-claims-rose-by-2-000-last-week-remain-below-prepandemic-average-11671716760 - Lawmakers Urge Biden to Set ‘Meaningful Standards’ for Plastics Treaty (Plastics News)

https://www.plasticsnews.com/public-policy/lawmakers-urge-biden-set-meaningful-standards-plastics-treaty#:~:text=Noting%20ongoing%20talks%20toward%20a,and%20Alan%20Lowenthal%20and%20Sens - Los Angeles, San Diego Pass New Plastic Bans (Plastics News)

https://www.plasticsnews.com/public-policy/los-angeles-san-diego-pass-new-plastic-bans - Packaging Trends: Balancing Sustainability with Profits (Plastics Today)

https://www.plasticstoday.com/packaging/packaging-trends-balancing-sustainability-profits

Download Packaging M&A Update – December 2022