Packaging Industry M&A Activity Tracking

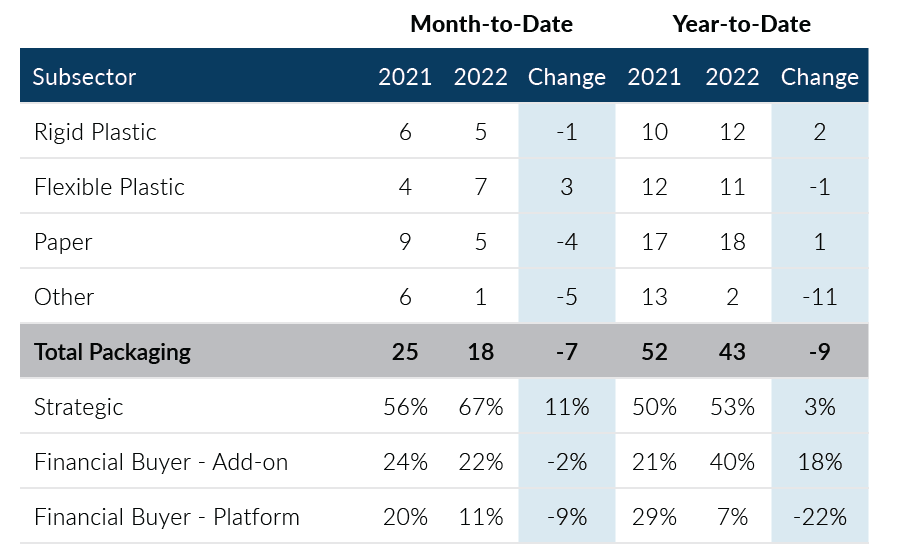

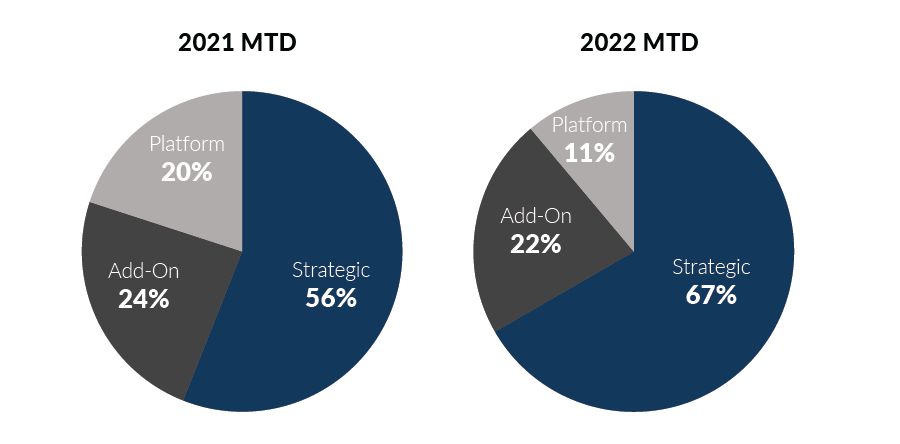

Global Packaging M&A slowed in February 2022 when compared to levels seen in January and at the end of 2021. There was a total of 18 deals recorded in the month which was down from January levels and a decrease of 7 transactions year-over-year. Private equity buyers were not as active in February as they were in January, which contributed to lower overall deal volumes. Acceleration of transaction closings at year-end 2021 is the likely culprit for lower activity to start the year.

- Private equity buyers accounted for 6 deals in February, or 33% of deal volume, which is much lower than the 14 deals contributed in January

- Strategic buyer transaction volume remained relatively flat in February, increasing by 1 transaction month-over-month and totaling 12 transactions in February

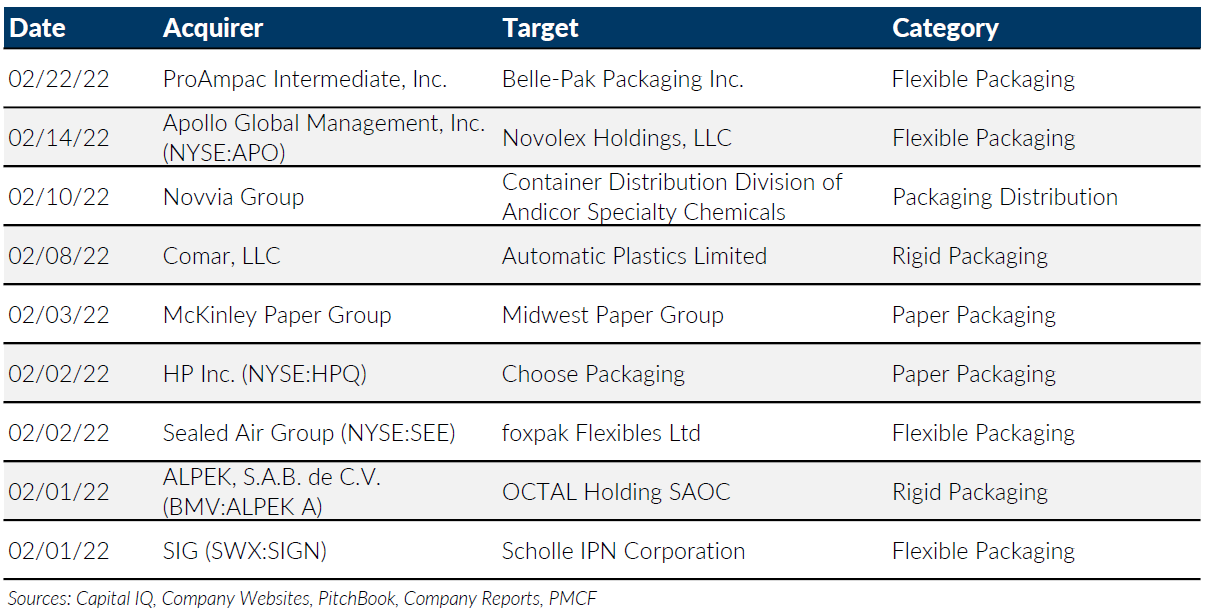

- Flexible Plastic transactions led all Packaging subsectors, accounting for 7 deals on the month which was up from 4 deals in February 2021

- Paper packaging transactions accounted for only 5 deals in February, declining by 8 transactions month-over-month; this is the lowest level of monthly activity in the subsector since 2020

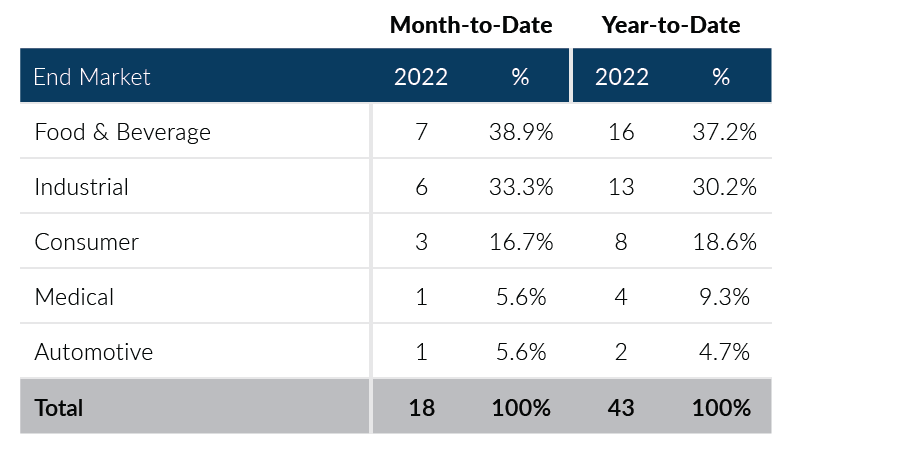

- Food & Beverage and Industrial end markets accounted for 13 deals in February; these two end markets have accounted for 67% of the transaction volume year-to-date

Overall, Global Packaging M&A transaction activity has been a little slower out of the gate when compared to last year’s M&A levels. Importantly, the current level of deal volumes is in line with historic levels excluding 2021 and could grow in future months if strategic buyers become more active as the year progresses. If you are a packaging company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Packaging M&A By Subsector

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

Notable M&A Activity

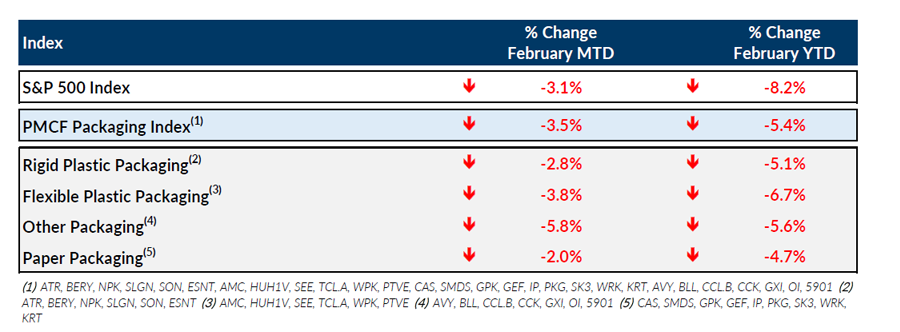

Public Entity Performance

Major News

- Economy Gained Momentum in February Despite Inflation Worries (Wall Street Journal)

https://www.wsj.com/articles/economy-gained-momentum-in-february-despite-inflation-worries-11645551346 - Supplies Recovered For Some Materials to Start 2022 Others Remain Turbulent (Plastics News)

https://www.plasticsnews.com/news/supplies-recovered-some-materials-start-2022-others-remain-turbulent - Fed Seeks Sweet Spot Between Slowing Inflation, Aiding Growth (Plastics News)

https://www.plasticsnews.com/news/fed-seeks-sweet-spot-between-slowing-inflation-aiding-growth - Despite Packed Ports, Cargo Ships Hauled Record Volumes in 2021 (Plastics News)

https://www.plasticsnews.com/news/despite-packed-ports-cargo-ships-hauled-record-volumes-2021