Packaging Industry M&A Activity Tracking

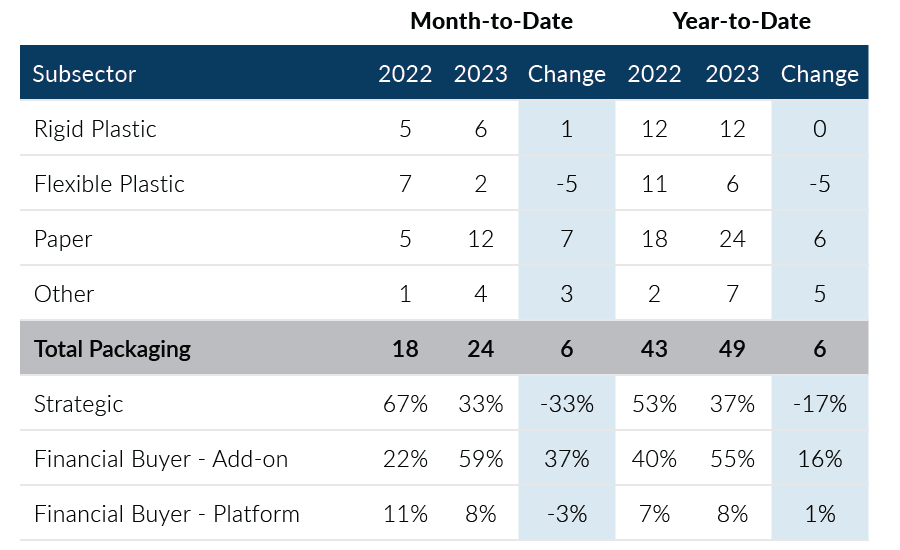

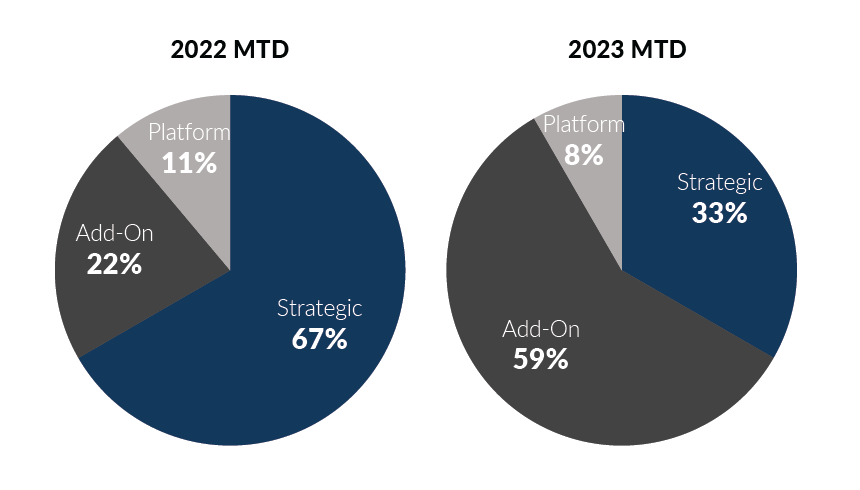

Global Packaging M&A reported another robust month in February 2023 and has started the year strong, rebounding from the sluggish end to 2022. 24 deals were recorded in February, which was 6 deals higher than last year and within 1 deal of last month. Deals in the month were driven primarily by private equity add-on activity which increased slightly from last month and continued a shift seen over the last several months. New private equity platform transaction activity, however, continued to report lower volumes, a trend we saw most of 2022.

- Private equity buyers accounted for 16 deals overall in February, or 67% of deal volume, which is on par with the 15 deals contributed in January. Private equity transaction volume continues to be driven by add-on acquisitions, which recorded 13 and 14 transactions over the past two months, respectively

- Strategic buyer transaction volumes have declined considerably compared to last year, accounting for only 33% of monthly transaction volume and 37% on a year-to-date basis

- Paper transactions led all Packaging subsectors, accounting for 12 deals in the month, up seven deals when compared to February 2022. Paper transactions remained above the average deal volume from the trailing 12 months of 11 deals

- Rigid Plastic transactions accounted for six deals in February, consistent with January levels and in line with pre-pandemic levels

Through the first two months of the year, Global Packaging M&A transaction activity reported a welcome uptick in volume compared to the second half of 2022. Acquisition financing continues to create some challenges but appears to be improving for Packaging M&A transactions compared to the latter half of 2022. If you are a packaging company considering a merger, acquisition, sale, or recapitalization in the short or long term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of February 28, 2023

Packaging M&A By Subsector

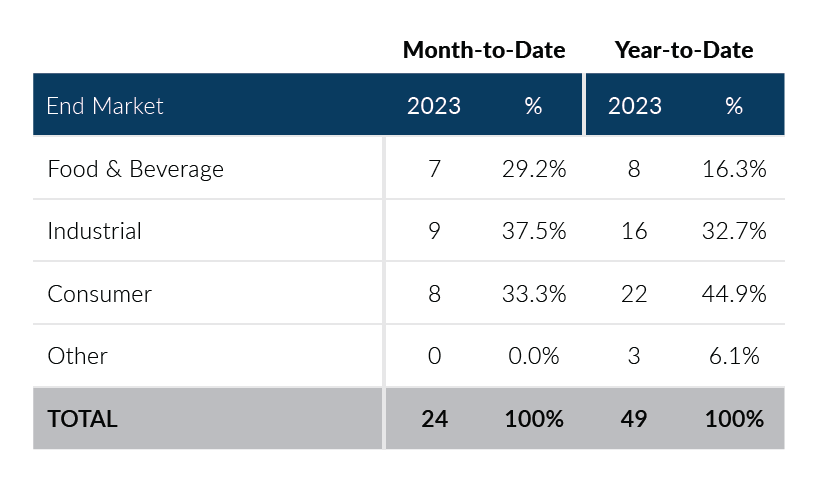

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

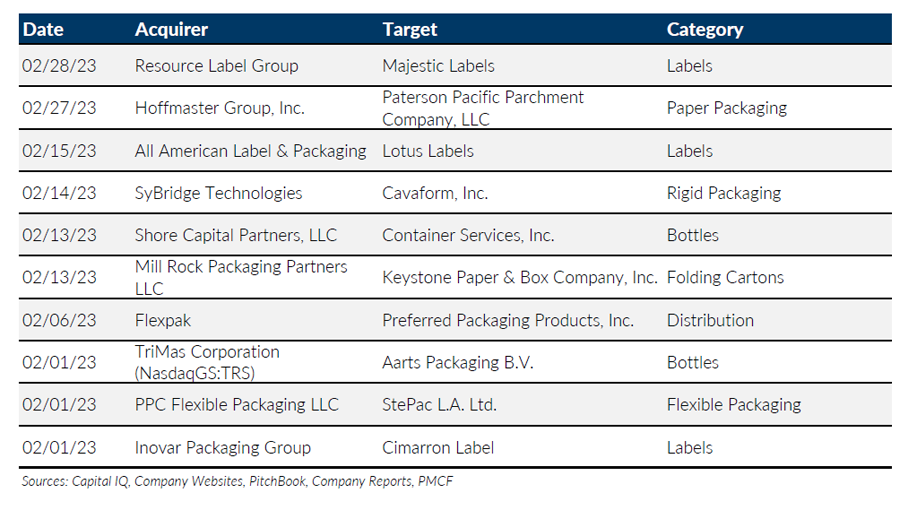

Notable M&A Activity

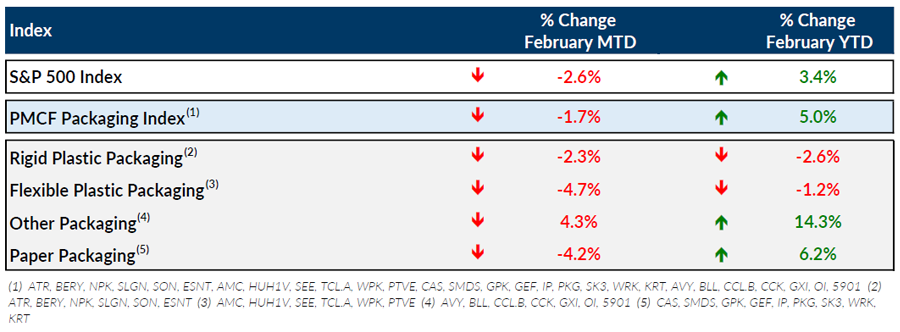

Public Entity Performance

Major News

- Economic Data is Full of Drama. What Does That Mean for Plastics? (Plastics News)

https://www.plasticsnews.com/news/economy-data-full-drama-what-does-mean-plastics - Some Large Companies Urge Biden to End China Mold Tariffs (Plastics News)

https://www.plasticsnews.com/news/some-large-manufacturers-urge-biden-remove-tariffs-chinese-molds - Packaging Thermoformers Lead the Way for Growth (Plastics News)

https://www.plasticsnews.com/all-things-data/packaging-thermoformers-see-growth - Economy Showing Strength in Early 2023 After Last Quarter’s GDP Gain Revised Modestly Lower (The Wall Street Journal)

https://www.wsj.com/articles/economy-showing-strength-in-early-2023-after-last-quarters-gdp-gain-revised-modestly-lower-5b068ade?mod=Searchresults_pos12&page=1 - Fed’s Barkin Supports Measured Pace of Interest-Rate Increases (The Wall Street Journal)

https://www.wsj.com/articles/feds-barkin-supports-measured-pace-of-interest-rate-increases-1ca6425b?mod=Searchresults_pos2&page=7

Download Packaging M&A Update – February 2023