Packaging Industry M&A Activity Tracking

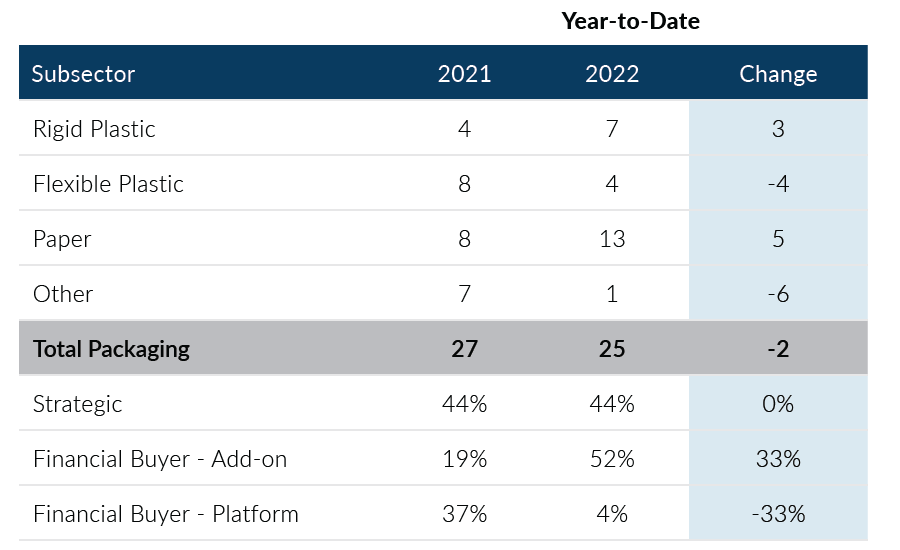

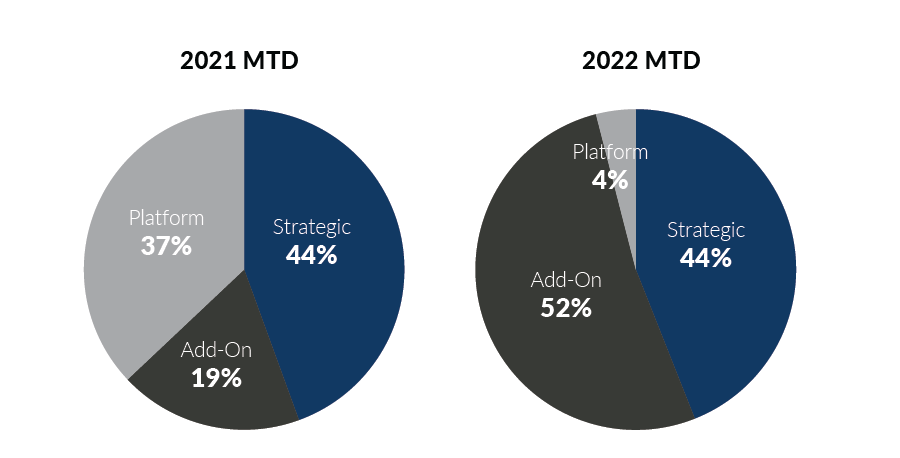

Global Packaging M&A dipped slightly from a transaction volume standpoint in January 2022 relative to months in 2021. Total deals in the month amounted to 25 transactions while average monthly deal volume in 2021 was 30 transactions. Of the 25 transactions, 14 were attributed to private equity firms which is unique as historically strategic buyers have been more active in the space. Overall, Global Packaging M&A activity remains strong after a record year in 2021.

- Private equity add-on transactions accounted for 13 deals, or 52% of deal volume, the highest monthly mark for add-on transactions from a volume mix standpoint in the last 3 years

- Strategic volume was down 1 transaction in the month relative to January 2021; it is typical for strategics to be relatively passive to start the year. January 2021 was the second lowest mark for strategics in 2021

- Paper Packaging transactions led all Packaging subsectors, accounting for 13 deals in the month which was up from 8 in January 2021

- Rigid Plastic transactions accounted for 7 deals in the month which was an activity level in line with the subsector’s monthly average of 6 in 2021

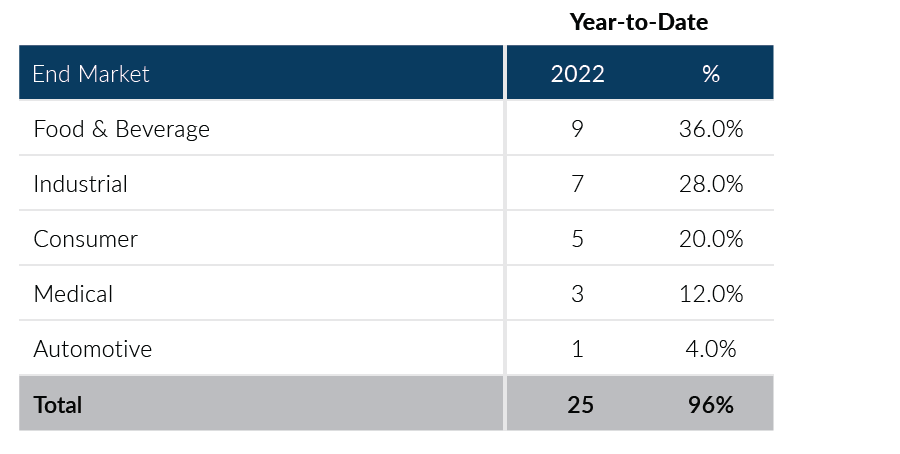

- Food & Beverage and Consumer end markets accounted for 14 deals in the month and together led all subsectors, however, this is a decrease from the 24 combined deals totaled from the two subsectors in January 2021

Overall, Global Packaging M&A transaction activity has been a little slower out of the gate when compared to last year’s M&A levels. Importantly, the current level of deal volumes is in line with historic levels excluding 2021 and could grow in future months if strategic buyers become more active as the year progresses. If you are a packaging company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Packaging M&A By Subsector

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

Notable M&A Activity

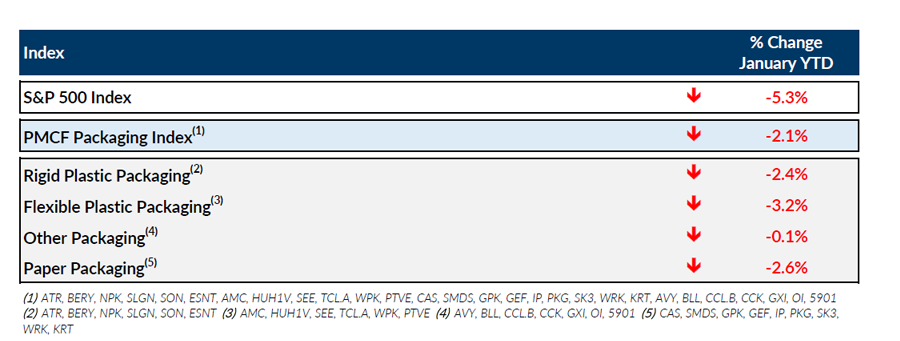

Public Entity Performance

Major News

- Big Deals, Big Money in 2021 M&A Final Numbers (Plastics News)

https://www.plasticsnews.com/news/big-deals-big-money-2021-ma-final-numbers - Inflation, Supply Chain, Omicron Expected to Take a Bigger Toll on Global Growth (Wall Street Journal)

https://www.wsj.com/articles/inflation-supply-chain-omicron-expected-to-take-a-bigger-toll-on-global-growth-11643119381 - US Plastics Pact, Backed By Big Firms, Pushes Cuts in ‘Problematic’ Packaging (Plastics News)

https://www.plasticsnews.com/news/us-plastics-pact-lists-11-plastics-materials-products-phase-out-packaging - 6 Sustainability Principles Help Inform Decisions (Packaging Digest)

https://www.packagingdigest.com/sustainability/6-sustainability-principles-help-inform-decisions