Packaging Industry M&A Activity Tracking

Global Packaging M&A began the year on a high note recording 25 deals in January, which represents a month-over-month increase of six deals. Deal activity in the month was primarily driven by private equity add-on transactions, which accounted for 13 deals. After historic levels of transaction activity in 2021, Packaging M&A over the past year has been hampered by macroeconomic uncertainty and rising interest rates, but January deal activity rose above the average monthly volume from 2022 and was a welcome uptick in deal activity.

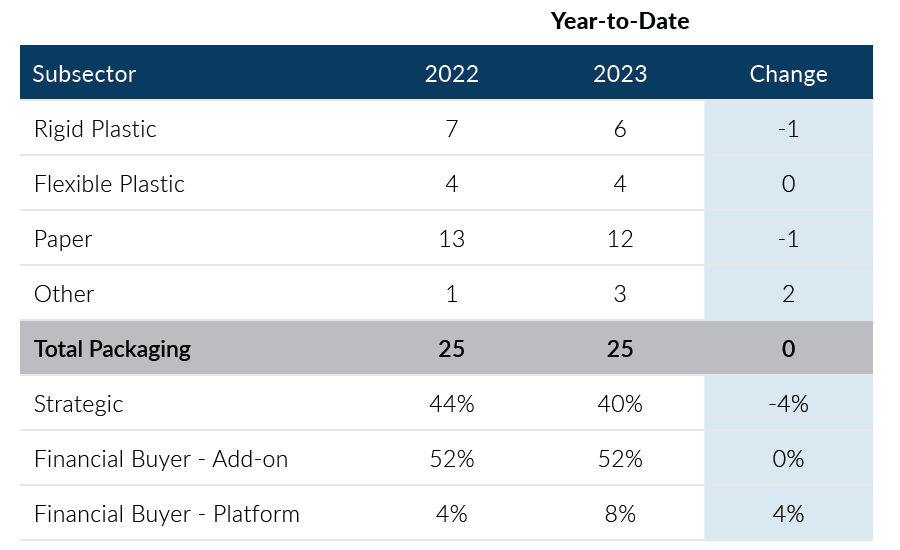

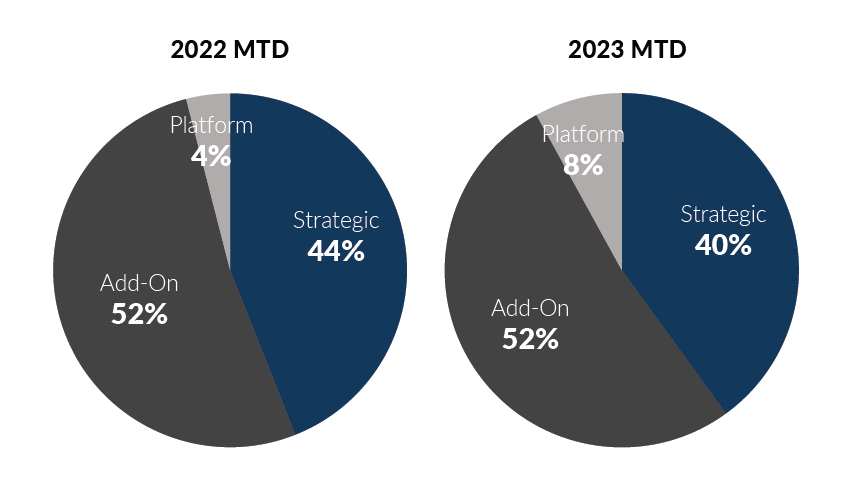

- Private equity platform transactions continued to be lower in January 2023, given challenging credit markets. Meanwhile, private equity add-on activity remained strong, accounting for 52% of deal volume

- Strategic volume was down one transaction in the month relative to January 2022. Strategic buyers remained on pace with the average monthly volume seen in H2 2022

- Paper Packaging transactions led all Packaging subsectors, accounting for 12 deals in the month. January’s transaction volume represents the subsector’s best month since last July

- Rigid Plastic transactions accounted for six deals on the month, which was above the subsector’s monthly average of four in 2022

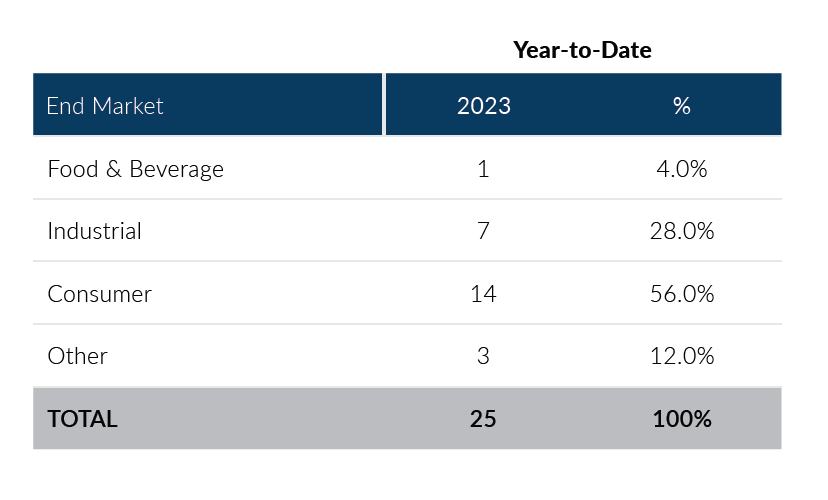

- The Consumer end market accounted for 14 deals in the month and led all end markets. Deal activity for the end market in January matched the 2022 high and represented a month-over-month increase of seven deals

Overall, Global Packaging M&A transaction activity posted a strong month when compared to the second half of 2022. Notably, the current level of packaging deal volumes is in line with pre-pandemic levels. It remains too early to tell if January levels will continue in the first half 2023. If you are a packaging company considering a merger, acquisition, sale, or recapitalization in the short or long term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of January 31, 2023

Packaging M&A By Subsector

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

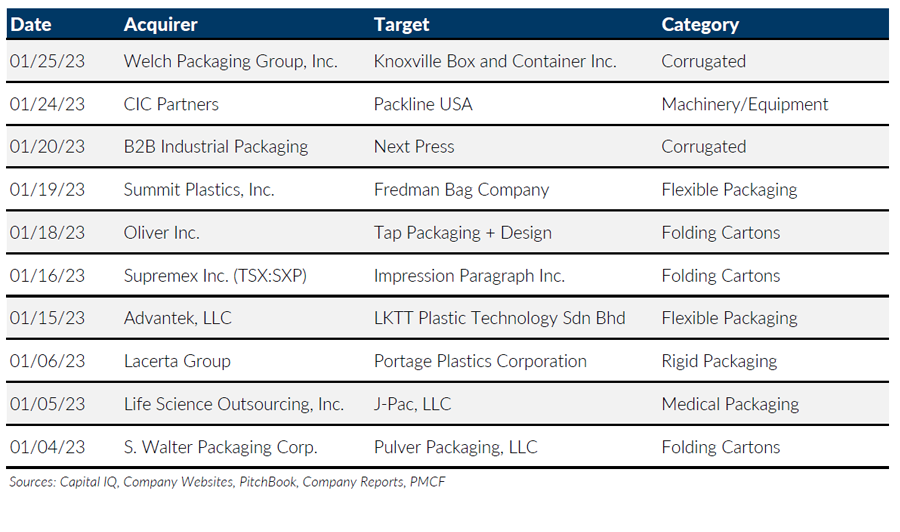

Notable M&A Activity

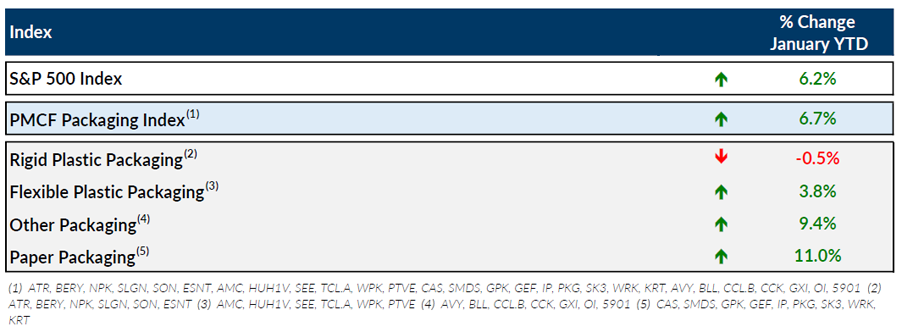

Public Entity Performance

Major News

- U.S. Nears Debt Ceiling, Begins Extraordinary Measures to Avoid Default (Wall Street Journal)

https://www.wsj.com/articles/treasury-to-begin-extraordinary-measures-to-pay-bills-amid-debt-ceiling-debate-11674091179?mod=Searchresults_pos1&page=1 - Labor Market Boom Cooled Some in 2022 (Wall Street Journal)

https://www.wsj.com/articles/labor-market-boom-cooled-some-in-2022-11673024967?mod=Searchresults_pos12&page=2 - Researchers Examine Impact of Single-Use vs. Reusable Takeout Containers (Plastics News)

https://www.plasticsnews.com/news/single-use-vs-reusable-containers-examined-university-michigan-research - Packaging by the Numbers 4Q22 (Packaging Digest)

https://www.packagingdigest.com/packaging-design/packaging-numbers-4q22 - A Packaging Review of the Global Commitment 2022 Report (Packaging Digest)

https://www.packagingdigest.com/sustainability/packaging-review-global-commitment-2022-report

Download Packaging M&A Update – January 2023