Packaging Industry M&A Activity Tracking

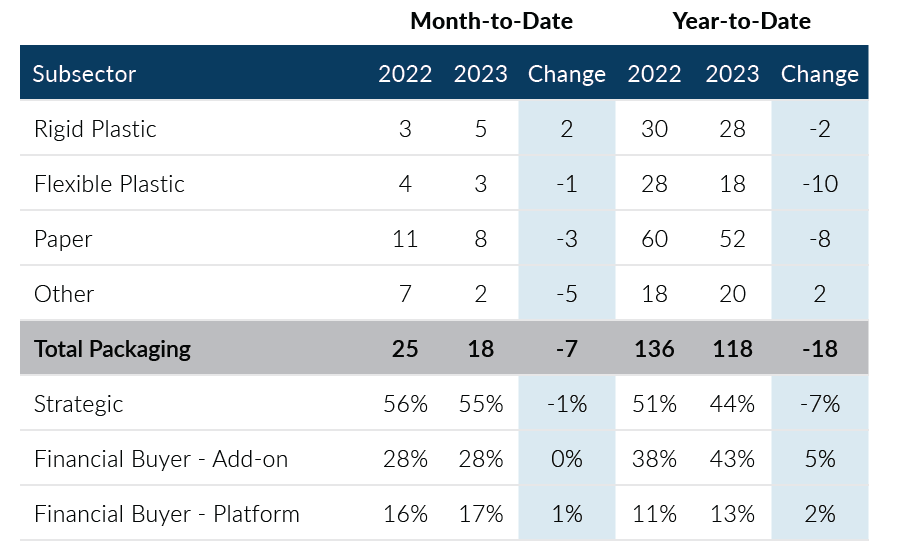

Global Packaging M&A posted 18 transactions in June, which was a decrease of three deals from May levels, but in line with the monthly average for the first half of the year. Packaging M&A ended up at 118 deals for H1 2023, which was 9 deals lower than H2 2022 and 18 deals lower than H1 2022. Overall, Packaging M&A activity continues to be lower than pre-pandemic levels due in part to lower activity by strategic buyers, which has been partially offset by strong private equity add-on activity.

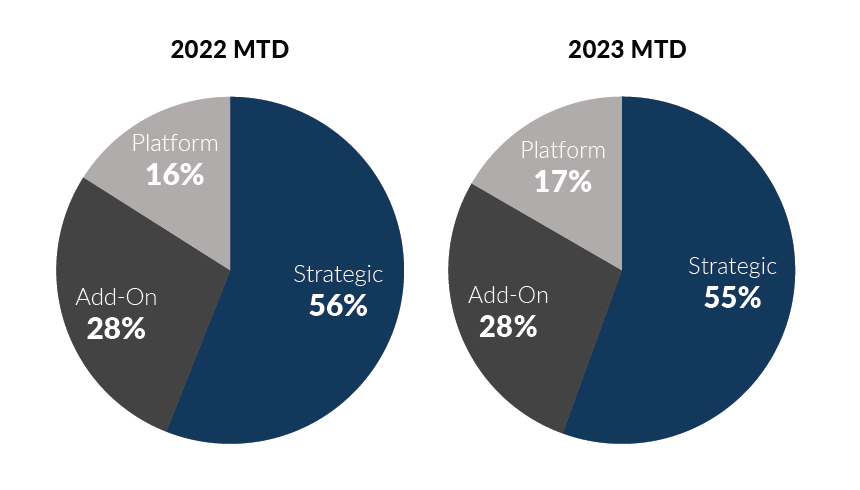

- Private equity add-on transactions continue to be a driving force in Packaging M&A activity. Through June of 2023, 51 of the 66 deals attributable to private equity have been add-on transactions, which was on par with H1 2022 and above H2 2022 add-on levels

- Strategic buyers accounted for over 50% of the deal volume in June. Through H1 2023, strategic buyers have accounted for 44% of the deal activity which was the lowest mark since PMCF began tracking the space

- Paper Packaging posted eight transactions in June, which was one above May levels and increased the subsector’s 2023 total to 52 deals. Through June of 2023, the Paper Packaging subsector is eight deals below H1 2022 levels

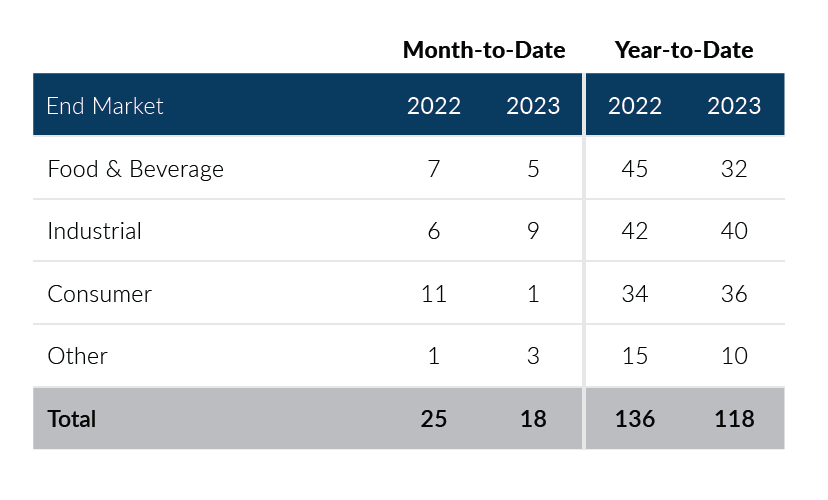

- The Consumer end market only posted one deal in June, which was the lowest month of the year. Despite the decline in June, the Consumer end market has increased by two transactions over H1 2022 levels

Global Packaging M&A has faced some headwinds since its record year in 2021 including lower core demand, raw material pricing volatility, and challenging credit markets. Despite slowing deal activity, well-positioned packaging businesses remain in demand and continue to command strong valuations. If you are a packaging company considering a merger, acquisition, sale, or recapitalization in the short or longer term please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of June 30, 2023

Packaging M&A By Subsector

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

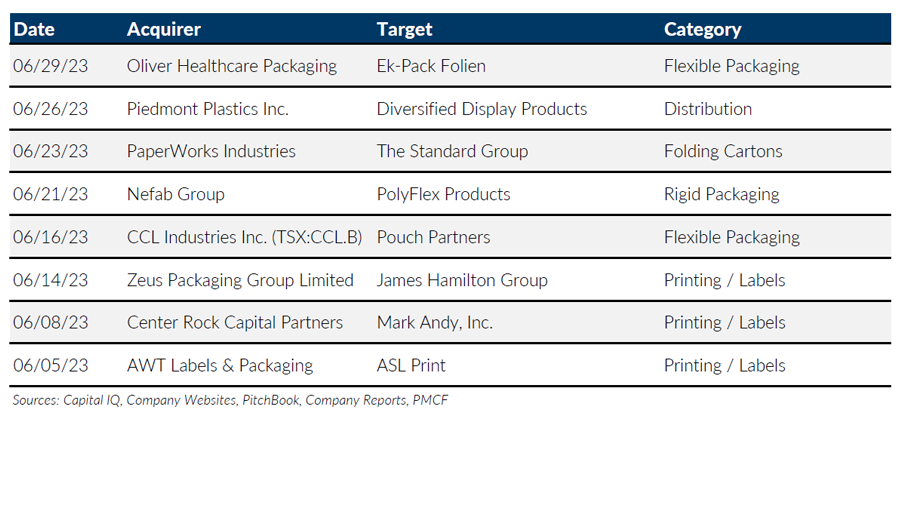

Notable M&A Activity

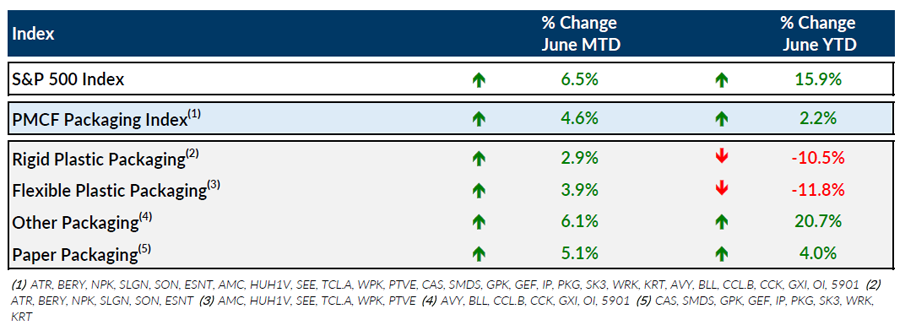

Public Entity Performance

Major News

- Packaging Sustainability by Design: 7 Steps to Circular Success (Packaging Digest)

https://www.packagingdigest.com/sustainability/packaging-sustainability-design-7-steps-circular-success - Connecticut Passes Plastic Bottle Recycled-Content Mandate (Plastics News)

https://www.plasticsnews.com/public-policy/connecticut-passes-plastic-bottle-recycled-content-mandate - New report Urges Packaging Producers to Act Quickly on Sustainability (Plastics News)

https://www.plasticsnews.com/news/rabobank-report-calls-packaging-producers-act-now - Inflation Eased to 3% in June, Slowest Pace in More Than Two Years (The Wall Street Journal)

https://www.wsj.com/articles/consumer-price-index-report-june-inflation-ede7f4b1?mod=economy_more_pos14 - U.S. Economy Shows Surprising Vigor in First Half of 2023 (The Wall Street Journal)

https://www.wsj.com/articles/u-s-economy-shows-surprising-vigor-in-first-half-of-2023-1a8a32eb?mod=economy_more_pos31

Download Packaging M&A Update – June 2023