Packaging Industry M&A Activity Tracking

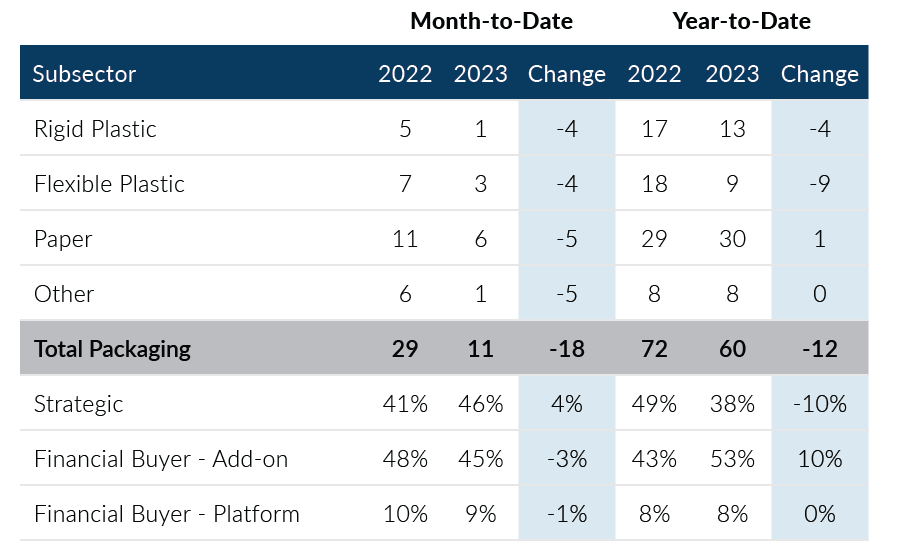

Global Packaging M&A slowed in March, posting only 11 transactions, which represented a decline of 13 deals from last month and 18 deals from March 2022. March activity levels were the lowest since April 2020, wiping out the higher levels reported for the first two months of the year. The lower level of Packaging M&A experienced in March is likely due to deals being delayed or put on hold in the latter part of 2022. Due, in part, to low transaction volumes in March, Q1 2023 reported two fewer transactions than Q4 2022 levels.

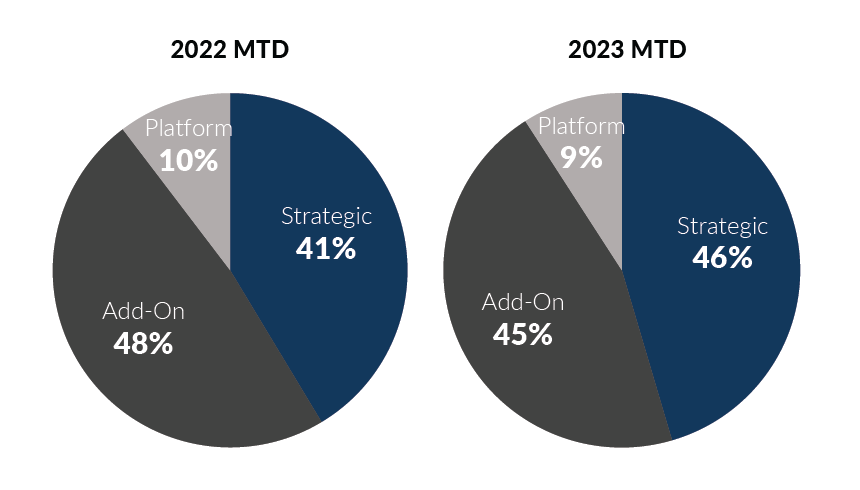

- Private equity add-on transactions accounted for only five deals in March, down from 14 in February. However, private equity add-on transactions for Q1 2023 exceeded 30 deals for only the third time since PMCF began tracking Global Packaging M&A

- Strategic buyer participation remains weak and was a key factor in lower Q1 2023 transaction volumes. In the first quarter, strategic buyers posted their lowest level of activity on record, accounting for only 23 transactions

- The Paper Packaging subsector posted six deals in March and led all subsectors in transaction activity for the 10th consecutive month. The subsector recorded 30 deals in Q1 2023, an increase of one deal over Q4 2022

- Despite only recording one deal in March, the Rigid Packaging subsector recorded 13 deals in the first quarter which represents the subsector’s best quarter since Q2 2022

Global Packaging M&A posted its third consecutive quarter of lower activity levels and remains on track to report slightly better results than the depressed levels experienced during 2020. Core volume declines in some sectors, economic uncertainty, and challenges with acquisition financing are all likely factors contributing to the lower levels of activity. Despite these challenges, packaging deals are still getting done at attractive multiples. If you are a packaging company considering a merger, acquisition, sale, or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of March 31, 2023

Packaging M&A By Subsector

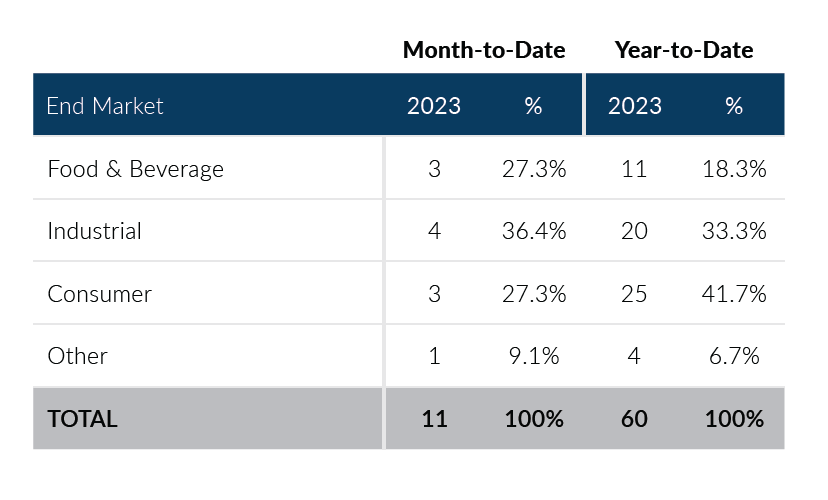

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

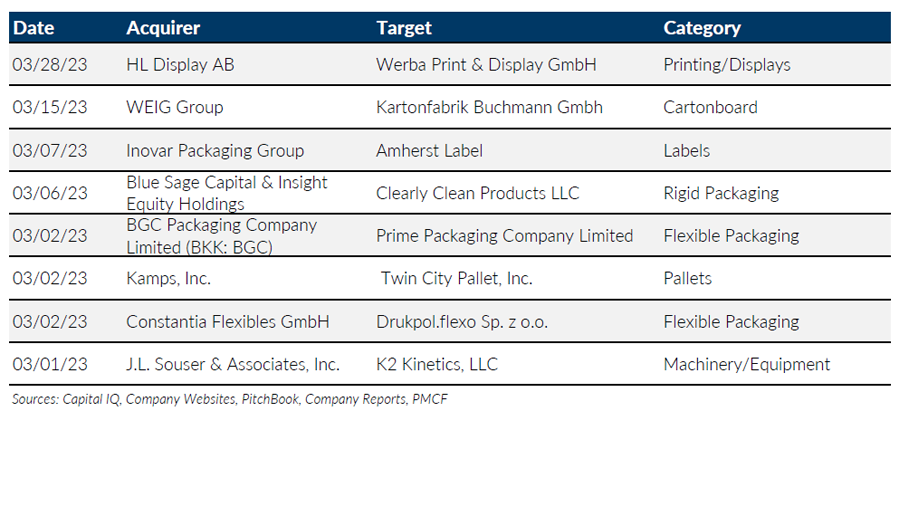

Notable M&A Activity

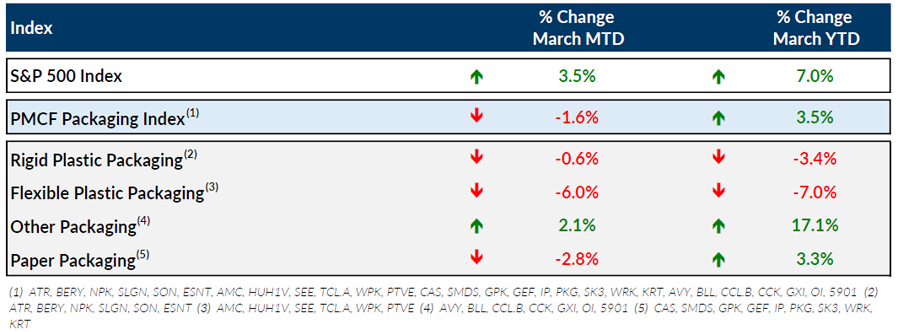

Public Entity Performance

Major News

- Packaging by the Numbers 1Q23 (Packaging Digest)

https://www.packagingdigest.com/market-research/packaging-numbers-1q23 - Bank Failures Complicate the Picture for the US Economy (Plastics News)

https://www.plasticsnews.com/news/bank-failures-complicate-picture-us-economy - White House: Bioplastics Goal Part of “Huge Urgency” on Climate (Plastics News)

https://www.plasticsnews.com/public-policy/biden-bioplastics-goal-reflects-huge-urgency-climate-adviser-says - 5 Packaging Design Trends (Packaging Digest)

https://www.packagingdigest.com/packaging-design/5-packaging-design-trends - Low Jobless Claims Show Labor Market Shrugs Off Economy’s Clouds (The Wall Street Journal)

https://www.wsj.com/articles/low-jobless-claims-show-labor-market-shrugs-off-economys-clouds-dfb48962?mod=economy_more_pos16

Download Packaging M&A Update – March 2023