Packaging Industry M&A Activity Tracking

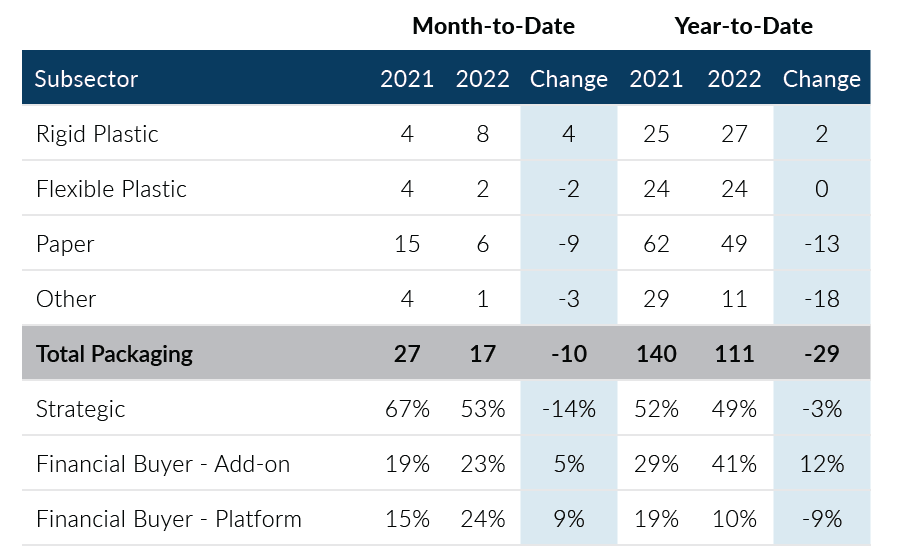

Global Packaging M&A had a slow month in May, recording 17 deals compared to 27 transactions in May 2021. For the year, Packaging M&A has been lower than the 2021 elevated levels and has dipped slightly below pre-pandemic volumes. Despite potential macroeconomic headwinds on the horizon, PMCF has not seen any pullback from packaging buyers in terms of interest level or valuations. Despite lower M&A activity, packaging company fundamentals appear to remain strong.

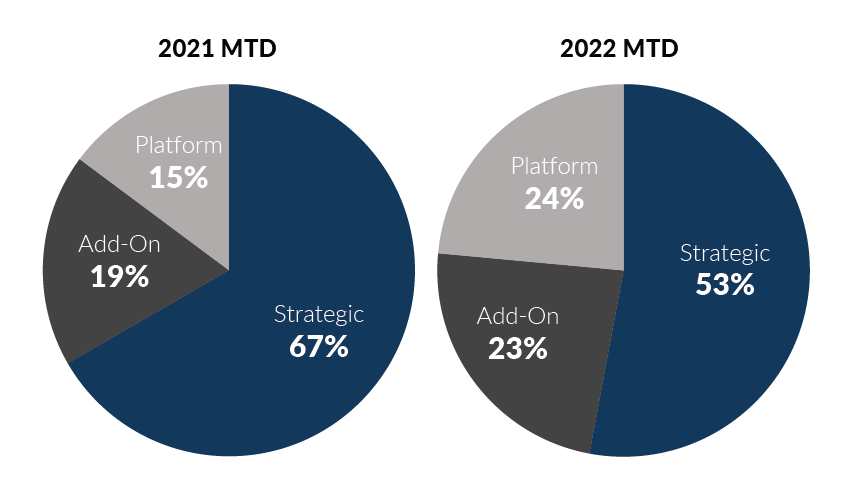

- Private equity buyers accounted for 47% of the deal volume in the month; through the first five months of the year financial buyers have accounted for 51% of the deal volume

- For the first month of the year, platform and add-on transactions had an equal share of the total transaction activity; platform activity had not exceeded 20% of deal volume in the first four months of the year

- Paper packaging only posted 6 transactions in the month down from the YTD monthly average of 11 deals

- The Rigid Plastic packaging subsector increased month-over-month, posting 8 transactions in May 2022; this was the largest total of the year for the subsector and the first time Rigid Plastic transactions led all subsectors

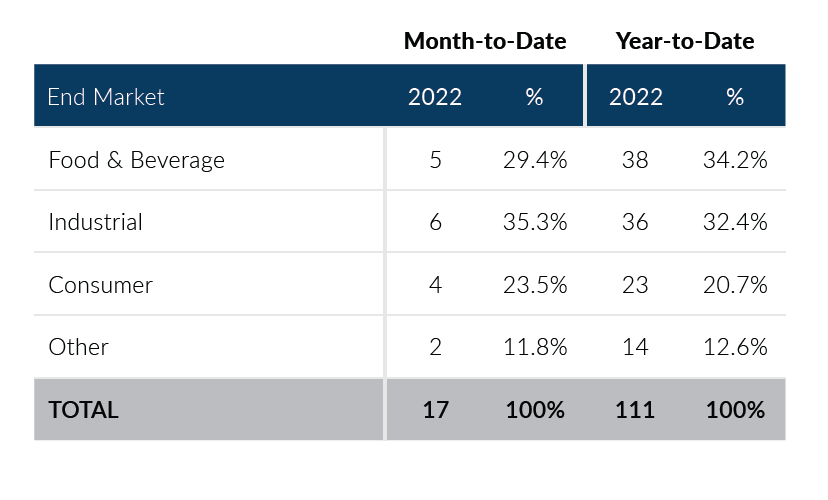

- The Industrial end-market led all end-markets with 6 transactions in the month; the Industrial end-market and Other end-market have both increased year-over-year

Global Packaging M&A activity levels through the year-to-date have dipped below pre-pandemic levels experienced in 2019 and 2018. The lower deal volumes experienced for the first 5 months of 2022 could be the result of fewer sellers or the activity levels experienced in 2021. With that being said, there has not been any conclusive evidence of a slowdown in the sector and there continues to be marquee transaction closings. As the year continues, we will be monitoring macroeconomic factors and the effects, if any, these may have on H2 2022 Packaging M&A volume.

Packaging M&A By Subsector

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

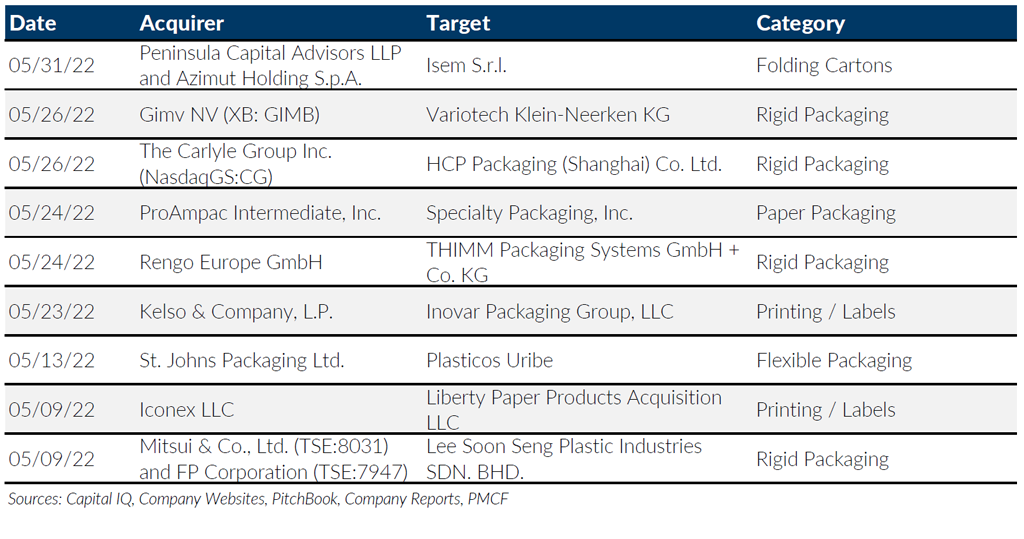

Notable M&A Activity

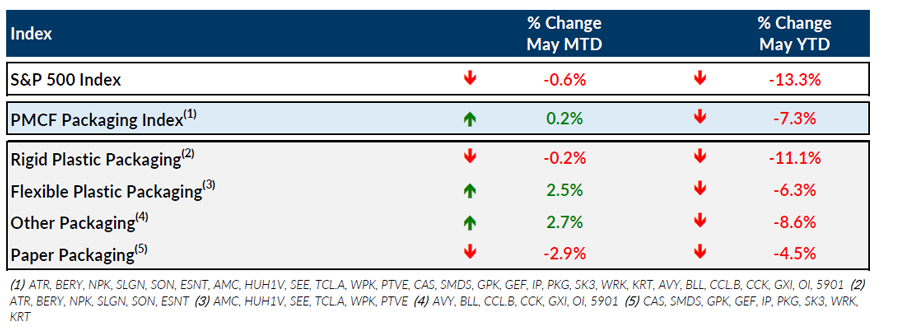

Public Entity Performance

Major News

- Colorado Legislature Passes EPR Bill (Plastics News)

https://www.plasticsnews.com/public-policy/colorado-legislature-passes-epr-responsibility-bill-measure-sent-governor - How Will Inflation Affect Packaging Material Costs in 2022?

https://www.packworld.com/issues/business-intelligence/article/22171833/rabobanks-packaging-material-inflation-outlook - Global Supply Chain Pressure Index: May 2022 Update (Liberty Street Economics)

https://libertystreeteconomics.newyorkfed.org/2022/05/global-supply-chain-pressure-index-may-2022-update - Folding Carton Demand Set to Outstrip Supply in 2022

https://www.thepackagingportal.com/industry-news/folding-carton-demand-set-to-outstrip-supply-in-2022 - Rapid Pace of U.S. Job Growth Stretched Into April (Wall Street Journal)

https://www.wsj.com/articles/april-jobs-report-unemployment-rate-2022-11651789328

Download Packaging M&A Update – May 2022