Packaging Industry M&A Activity Tracking

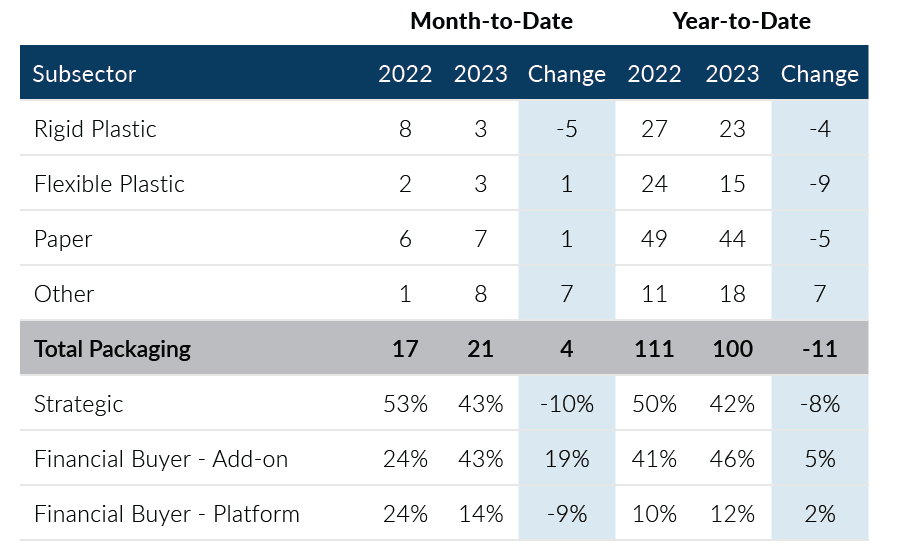

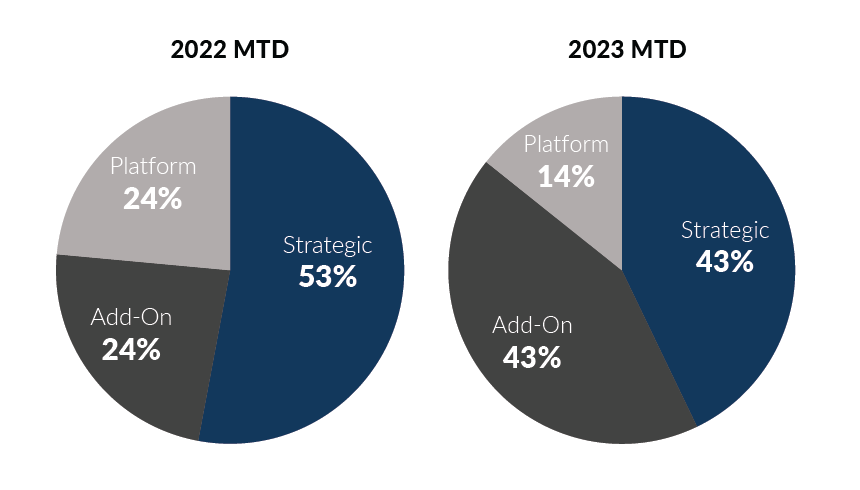

Global Packaging M&A posted 21 transactions in May, which was an increase of two deals over April levels. With the exception of record-low volumes in March, Packaging M&A activity has been largely in line with 2022 levels. Financial buyers continued to contribute significantly to overall volume, accounting for over 50% of the deal volume for the fourth time this year due to increased add-on activity. Overall, Global Packaging M&A activity has been generally consistent over the last 17 months, reporting deal activity slightly below pre-pandemic levels.

- Financial buyers recorded 12 deals in May, up four transactions from April levels. A majority of private equity deal volume continues to be driven by add-on acquisitions, which have accounted for 79% of private equity deal volumes

- Strategic buyers accounted for nine deals in the month, which was above the average monthly deal volume through the year-to-date. Strategic buyers have been less active in 2023 when compared to 2022 likely due to macroeconomic challenges

- The Other Packaging subsector is up 7 deals year-over-year, driven by an increase in machinery / equipment transactions. May activity levels represented the subsector’s most active month from a deal volume standpoint since June 2021

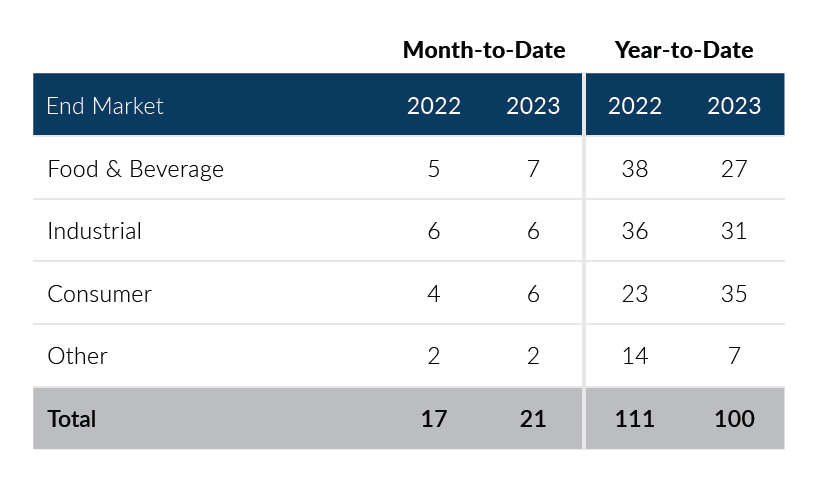

- The Food & Beverage end market recorded seven deals in May, which was down two from April levels. May marked the second month in a row that the Food & Beverage end market led all end markets in deal activity

Global Packaging M&A levels in May were in line with volumes seen in April and Q4 2022. Private equity add-on buyers continued to drive volume in the space meanwhile strategic and private equity platform buyers have exhibited relative consistency. Packaging M&A activity has been consistent over the last 17 months, but remains below pre-pandemic levels. If you are a packaging company considering a merger, acquisition, sale, or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of May 31, 2023

Packaging M&A By Subsector

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

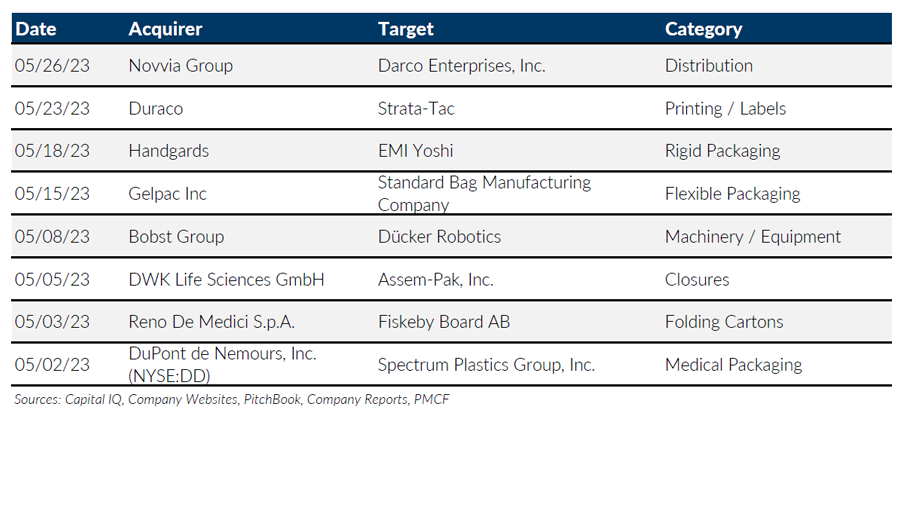

Notable M&A Activity

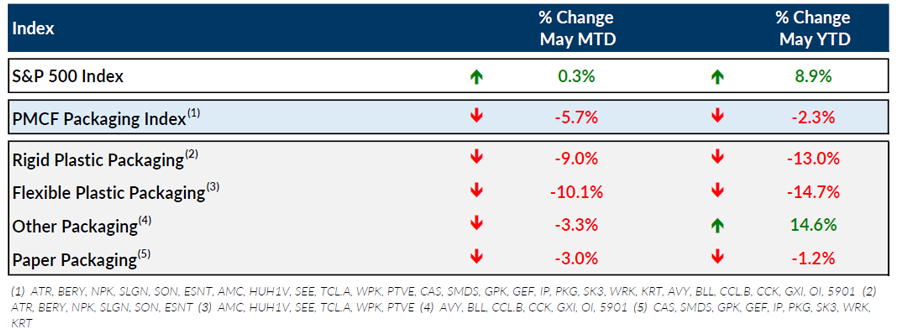

Public Entity Performance

Major News

- Ditching Plastic? Paper-Packaging Market Says ‘Welcome!’ (Packaging Digest)

https://www.packagingdigest.com/sustainability/ditching-plastic-paper-packaging-market-says-welcome - Plastics Will Maintain Dominance as Protective Packaging Material of Choice, Study Says (Packaging Digest)

https://www.packagingdigest.com/ecommercesupply-chain/plastics-will-maintain-dominance-protective-packaging-material-choice-study - Global Plastics Recycling Market to Grow 50% by 2030, Report Says (Plastics News)

https://www.plasticsnews.com/news/global-plastics-recycling-grow-50-2030-report-says - Inflation Eased in April but Remains Stubbornly High (The Wall Street Journal)

https://www.wsj.com/articles/us-inflation-april-2023-consumer-price-index-48f0eac5?mod=Searchresults_pos2&page=1 - Robust Hiring in April Shows U.S. Job Market Remains Hot in Cooling Economy (The Wall Street Journal)

https://www.wsj.com/articles/april-jobs-report-unemployment-rate-economy-growth-2023-a500d302?mod=Searchresults_pos14&page=1

Download Packaging M&A Update – May 2023