Packaging Industry M&A Activity Tracking

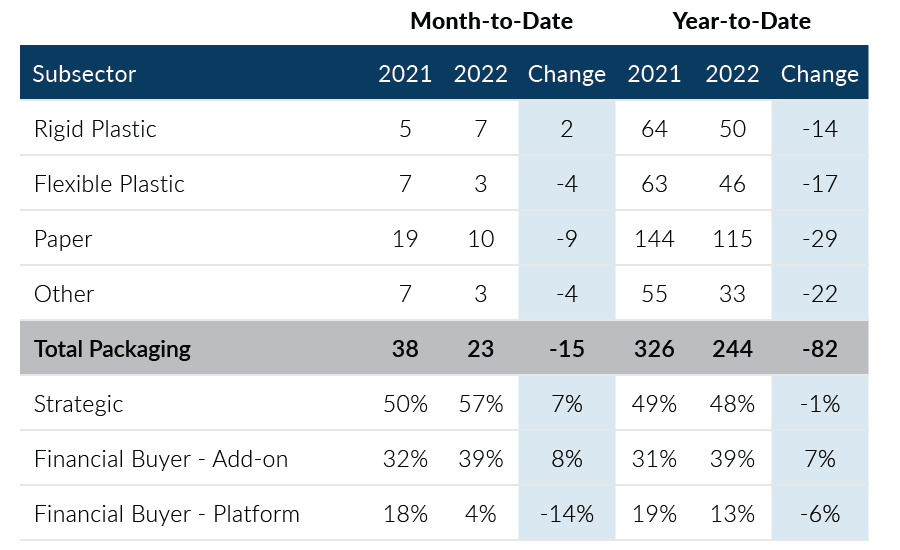

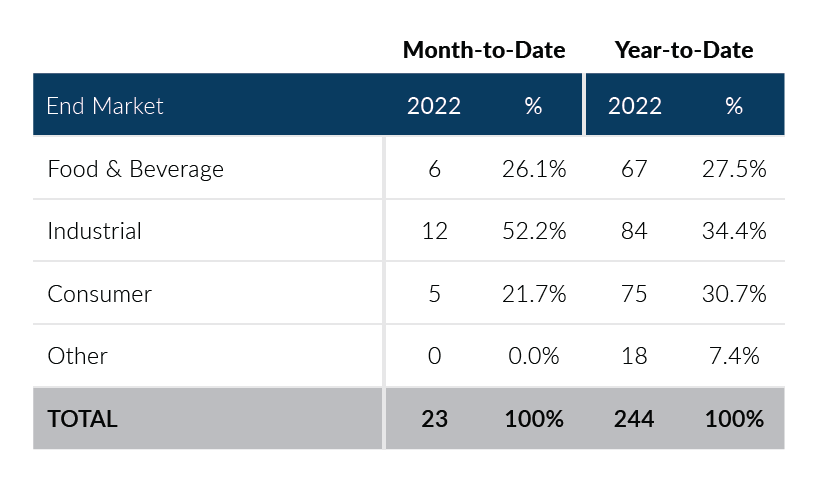

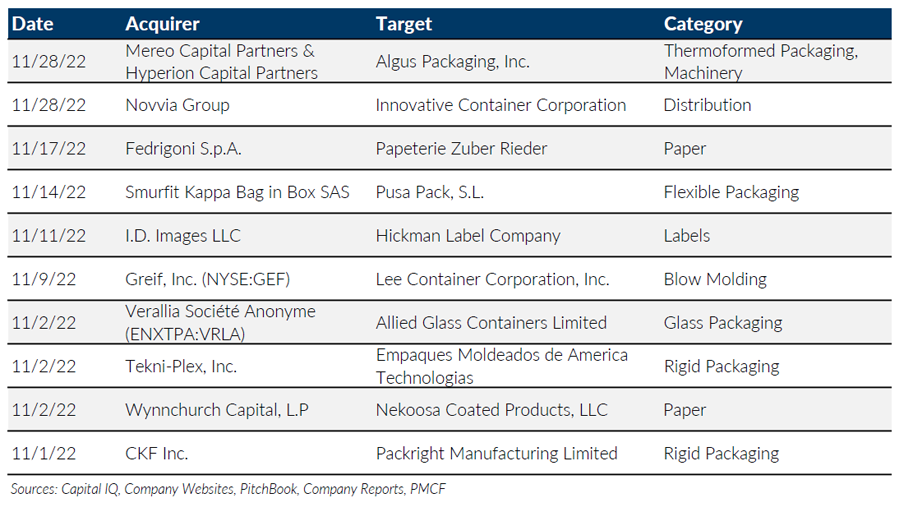

Global Packaging M&A posted 23 deals in November which was an increase of three transactions over October levels. November marked the highest level of deal volumes since July and was slightly above the monthly average for 2022. Transaction activity in the month was driven by an increase in strategic and private equity add-on transactions. Overall, Packaging M&A volume continues to track lower than 2021 elevated levels but has remained relatively consistent from a volume-level standpoint despite macroeconomic concerns and challenging debt markets.

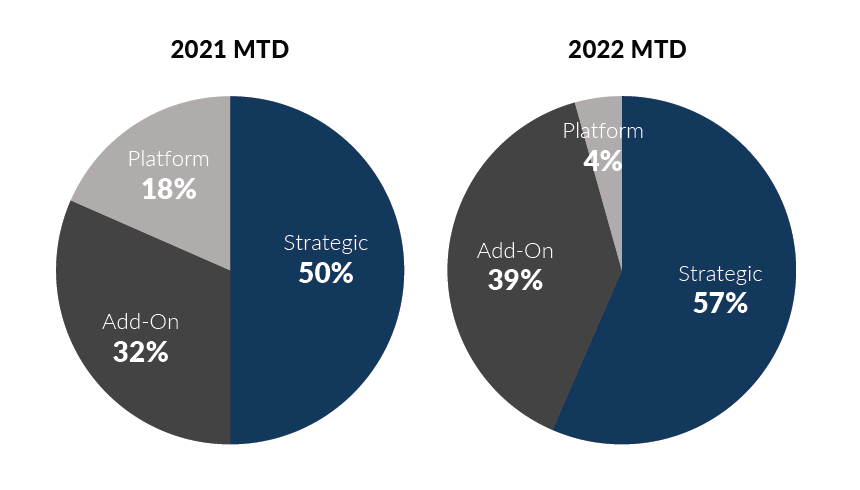

- Strategic buyers led the deal volume increases in November, accounting for 13 deals, or 57% of the monthly transaction volume. These levels marked the second most active month of the year for strategic buyers from a deal volume standpoint

- Private equity add-on transactions posted another strong month, accounting for nine deals, or 39% of transaction activity. Private equity platform activity, however, remained sluggish in November, recording only one transaction

- The Paper subsector led all subsectors in transactions for a sixth consecutive month. The subsector recorded 10 deals in November, which is on par with its average monthly transaction volume for the year

- Rebounding from October transaction levels, the Rigid Plastic subsector recorded seven deals in November, which represents the subsector’s second most active month of 2022

Global Packaging M&A experienced a welcomed increase in November due to strong strategic buyer activity. Financing challenges continue to suppress private equity platform transactions and, in many cases, have constrained larger transactions. Nevertheless, packaging deals continue to get done at attractive multiples, and activity has remained consistent despite recent challenges in the M&A market. If you are a packaging company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of November 30, 2022

Packaging M&A By Subsector

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

Notable M&A Activity

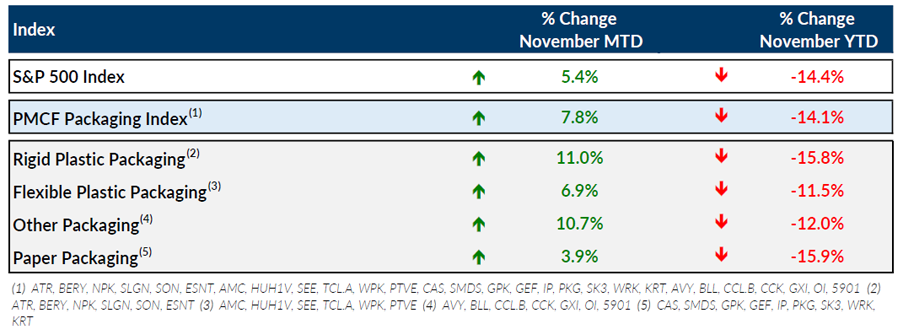

Public Entity Performance

Major News

- Manufacturers Consider Automation to Address Workforce Shortages (Packaging World)

https://www.packworld.com/news/workforce/article/22565428/skilled-workforce-recruitment-proves-difficult-for-manufacturers - US Corrugated Board CEOs Optimistic About Long-Term Business Despite Short-Term Challenges (Fastmarkets RISI)

https://www.risiinfo.com/ic/news/pulpandpaper/us-corrugated-board-ceos-optimistic-about-long-term-business-despite-short-term-challenges221711.html - US Economic Growth Slowed This Fall, Fed’s Beige Book Says (Wall Street Journal)

https://www.wsj.com/articles/u-s-economic-growth-slowed-this-fall-feds-beige-book-says-11669836396 - Third-Quarter US Growth Was Stronger Than Previously Thought (Wall Street Journal)

https://www.wsj.com/articles/job-openings-hiring-economy-october-2022-11669755543 - Fed Minutes Show Most Officials Favored Slowing Rate Rises Soon (Wall Street Journal)

https://www.wsj.com/articles/fed-minutes-show-most-officials-favored-slowing-rate-rises-soon-11669230432

Download Packaging M&A Update – November 2022