Packaging Industry M&A Activity Tracking

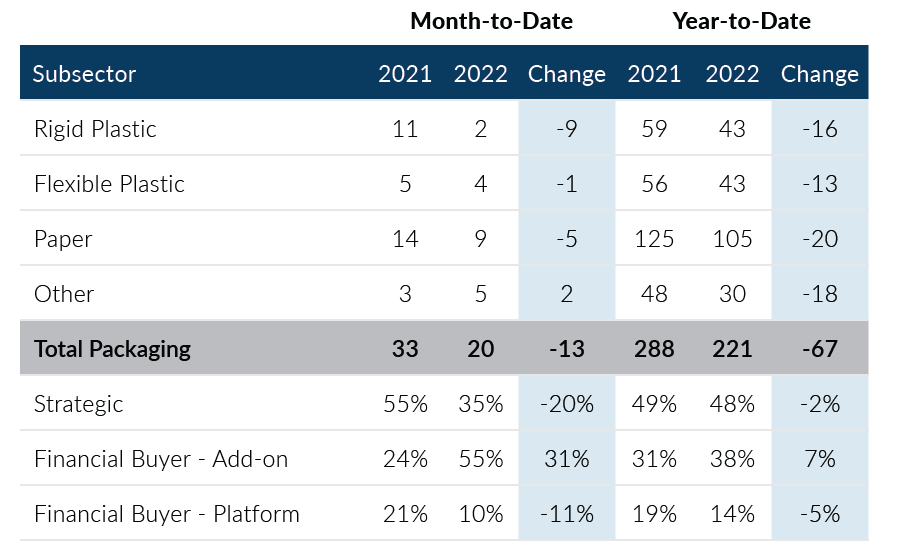

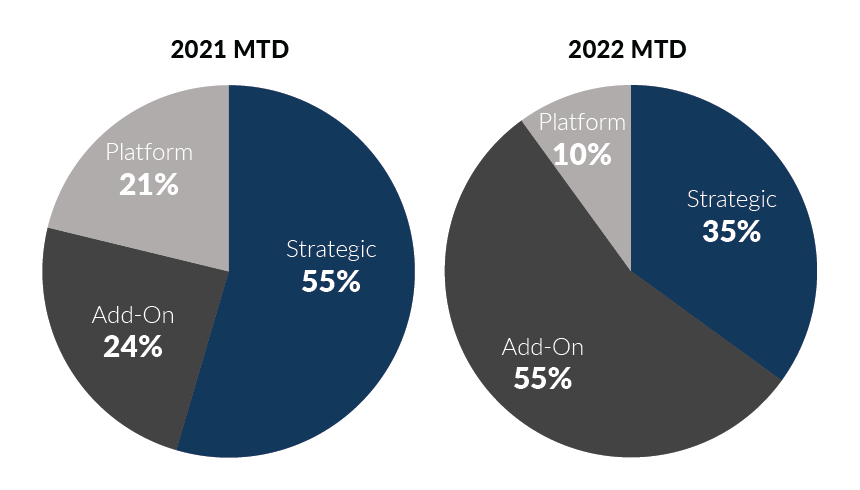

Global Packaging M&A activity recorded 20 deals in October, which matched last month’s activity but is slightly below the average monthly transaction volume of 22 for the year. Transaction activity for October was primarily driven by private equity add-on transactions, while both strategic and private equity platform deals regressed from September volumes. Overall, Packaging M&A volume has been consistent for the last several months but has not shown any signs of recovery to last year or even pre-pandemic levels.

- Private equity add-on buyers were highly acquisitive in October, recording 11 deals and leading all transaction types in the month

- Strategic buyers accounted for seven transactions, or 35% of deal flow for the month. From a volume standpoint, strategic buyers had their worst month of the year

- The Paper subsector recorded nine deals in October and led all subsectors in transaction volume for a fifth consecutive month. However, the Paper subsector fell below its 2022 average monthly transaction volume of 11 deals

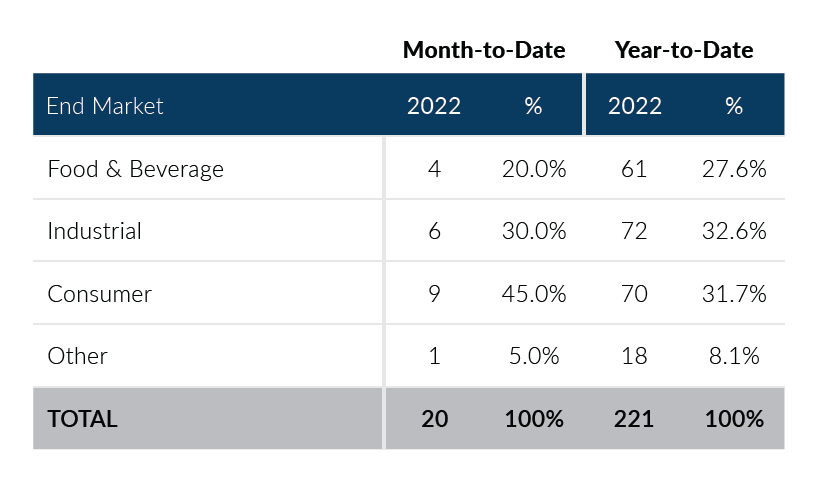

- The Consumer end market recorded its best month since July, recording nine deals in the month and continuing the recent elevated level of activity seen from this end market

- Rebounding from September transaction figures, the Flexible Plastic subsector recorded four deals in October, up two from September levels

Global Packaging M&A continued to show lower levels of activity in October which is likely due to macroeconomic uncertainty and challenging capital markets. Packaging deals are still getting done at attractive multiples but the mix is in favor of private equity add-ons or strategic transactions where capital markets are not as much of a factor. This lower level of activity will likely continue for the balance of the 4th quarter. If you are a packaging company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of October 31, 2022

Packaging M&A By Subsector

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

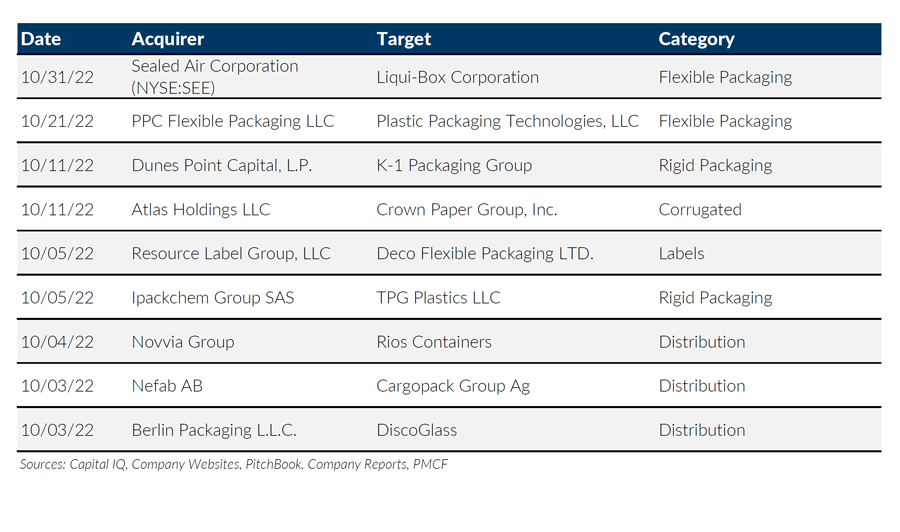

Notable M&A Activity

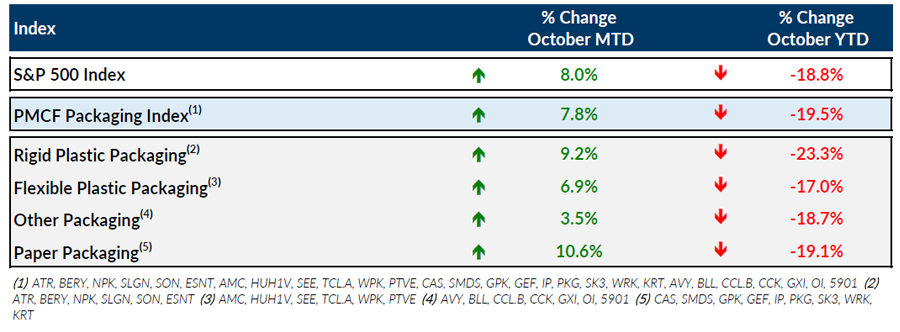

Public Entity Performance

Major News

- Packaging by the Numbers 3Q22 (Packaging Digest)

https://www.packagingdigest.com/market-research/packaging-numbers-3q22 - Why the October Jobs Report is so Strong Despite Tech Layoffs (Wall Street Journal)

https://www.wsj.com/articles/why-the-october-jobs-report-is-so-strong-despite-tech-layoffs-11667591383 - European Resin Demand Restrained by Worries Over Economy (Plastics News)

https://www.plasticsnews.com/news/european-resin-demand-restrained-worries-over-economy - A Sneak Peek into Upcoming Plastic Treaty Talks (Plastics News)

https://www.plasticsnews.com/news/k-2022-panel-has-eyes-plastics-treaty-waste-changes - U.S. Economy Grew 2.6% in Third Quarter, GDP Report Shows (Wall Street Journal)

https://www.wsj.com/articles/us-gdp-economic-growth-third-quarter-2022-11666830253

Download Packaging M&A Update – October 2022