Packaging Industry M&A Activity Tracking

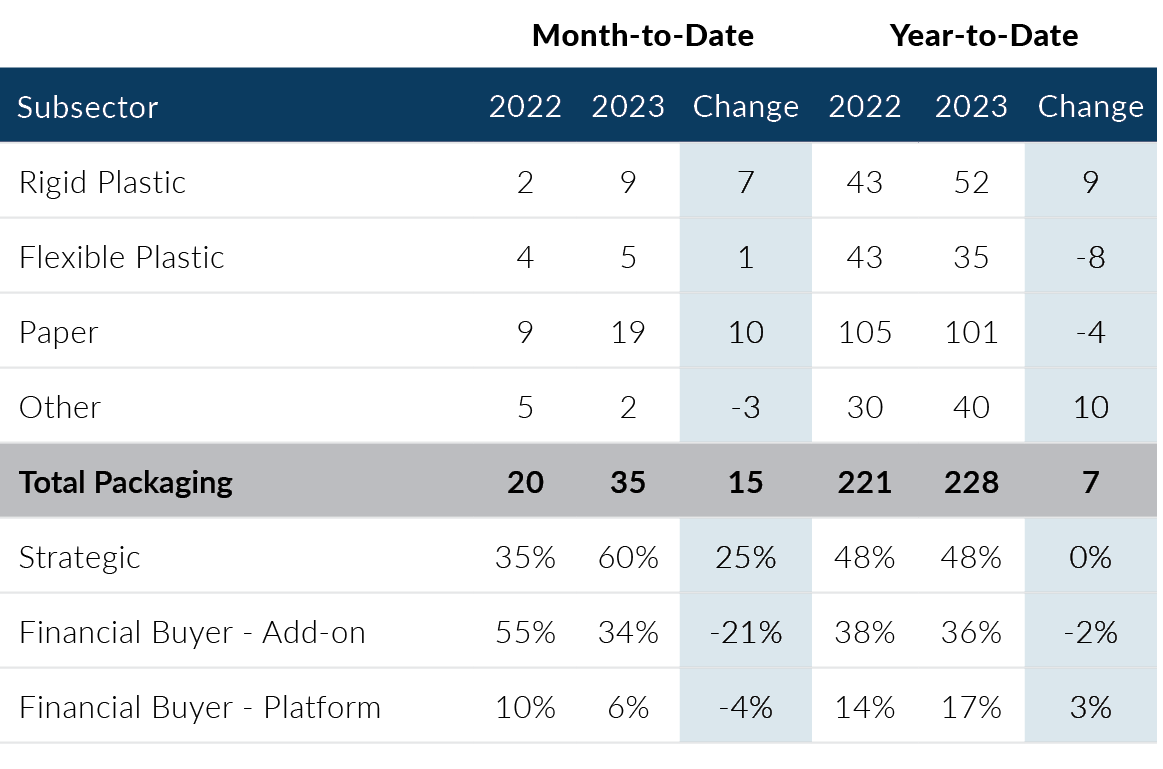

Global Packaging M&A recorded 35 deals in October, up six from September levels. October marked the highest monthly deal volume in the past two years and has propelled year-to-date deal volumes above 2022 levels when compared to the same period. Increased deal volume was driven by robust strategic and private equity add-on activity, however, platform deals fell after several months of strong activity. Overall, Global Packaging M&A remains below pre-pandemic levels, but recent activity is an encouraging sign for the sector.

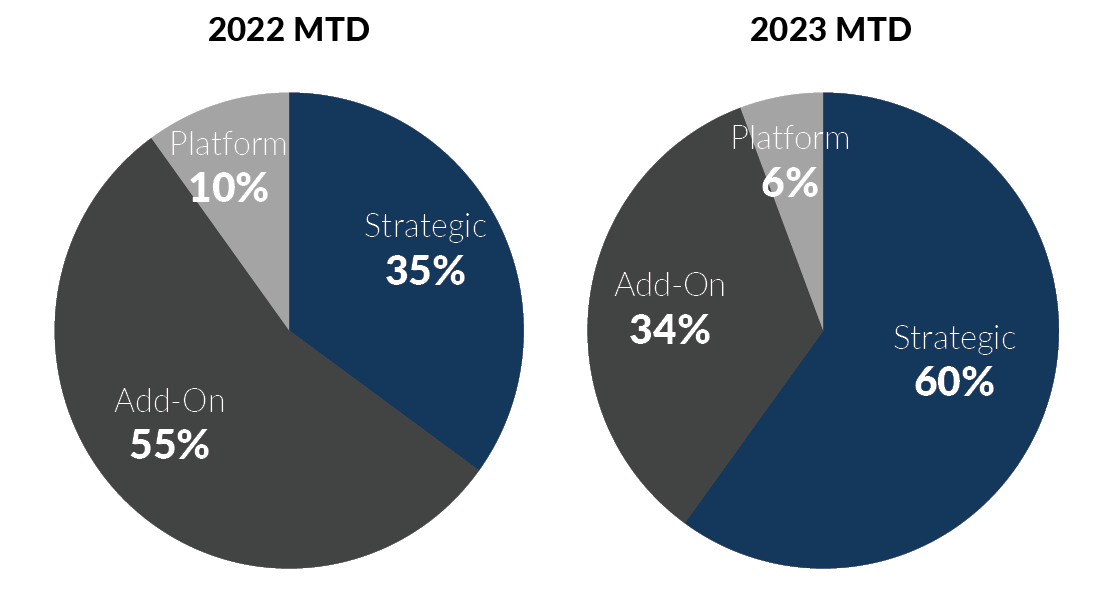

- Strategic buyers recorded 21 deals in October, accounting for 60% of the total transaction volume. October marks the most acquisitive month since 2018 for strategic buyers and doubled the average monthly activity in 2023

- Financial buyers accounted for 14 deals in October, down two from the previous month. Financial buyer activity was driven by add-on acquisitions, which represented 12 of the 14 financial buyer transactions recorded in October

- The Paper Packaging subsector recorded 19 deals in October, up 10 from the previous month, and was responsible for 53% of monthly deal activity. October represented the highest monthly deal volume for this subsector since 2021

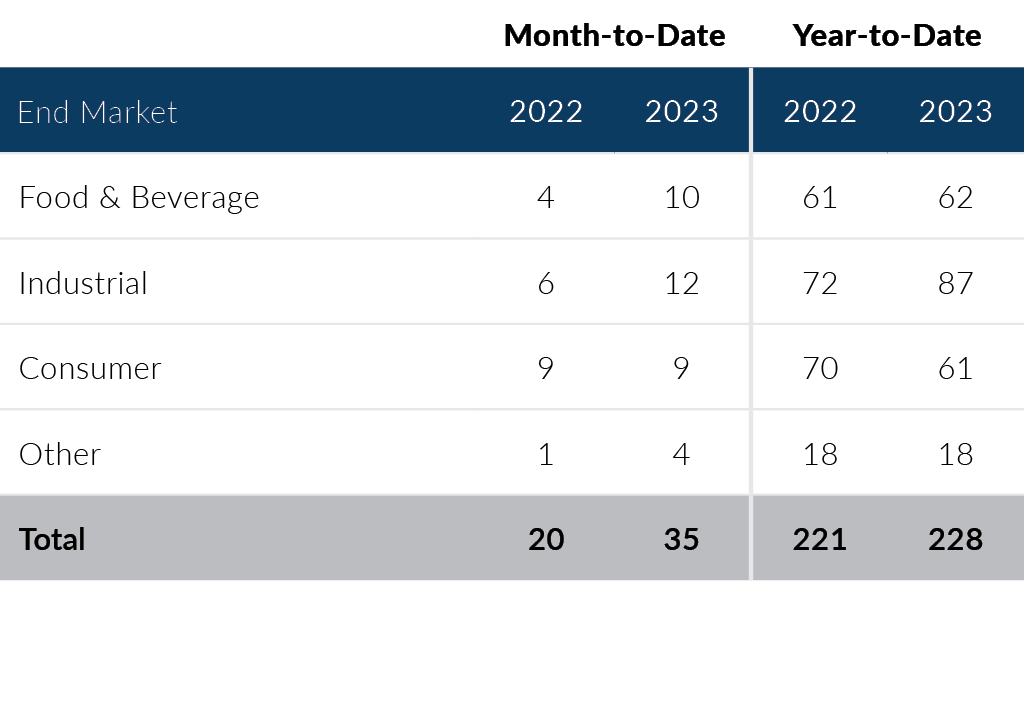

- The Food & Beverage end market recorded 10 deals in October, which was four deals higher than the average monthly deal volume in 2023. Additionally, October represented the most active month for the end market since March 2022

Three consecutive months of elevated deal activity provides some optimism for the Global Packaging M&A market, which has faced lower transaction levels for a majority of the year. While October’s elevated deal activity was a positive sign, the pullback in platform deals and above-average strategic buyer activity brings the sustainability of current M&A levels into question. If you are a packaging company considering a merger, acquisition, sale, or recapitalization in the short or longer term please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of October 31, 2023

Packaging M&A By Subsector

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

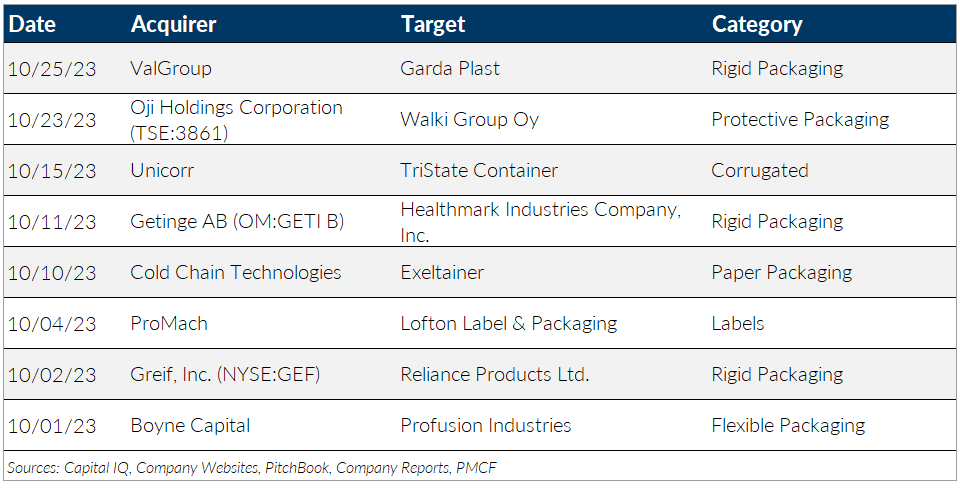

Notable M&A Activity

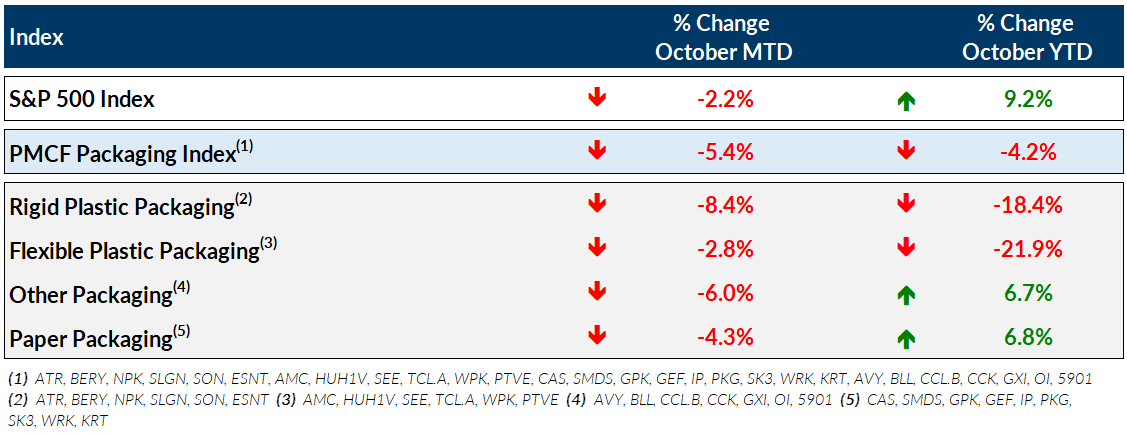

Public Entity Performance

Major News

- The Improbably Strong Economy (The Wall Street Journal)

- Despite Economic Risks, Companies Are Hanging On to the Workers They Have (The Wall Street Journal)

- How Packaging Operations Can Profit from Sustainability and AI (Packaging Digest)

- Newsom Blocks Bill Aimed at Preventing ‘Regrettable’ Plastics Replacements (Plastics News)

- McKinsey Says Changes Needed to Meet 2030 Recycled PET Demand (Plastics News)

Download Packaging M&A Update – October 2023