Packaging Industry M&A Activity Tracking

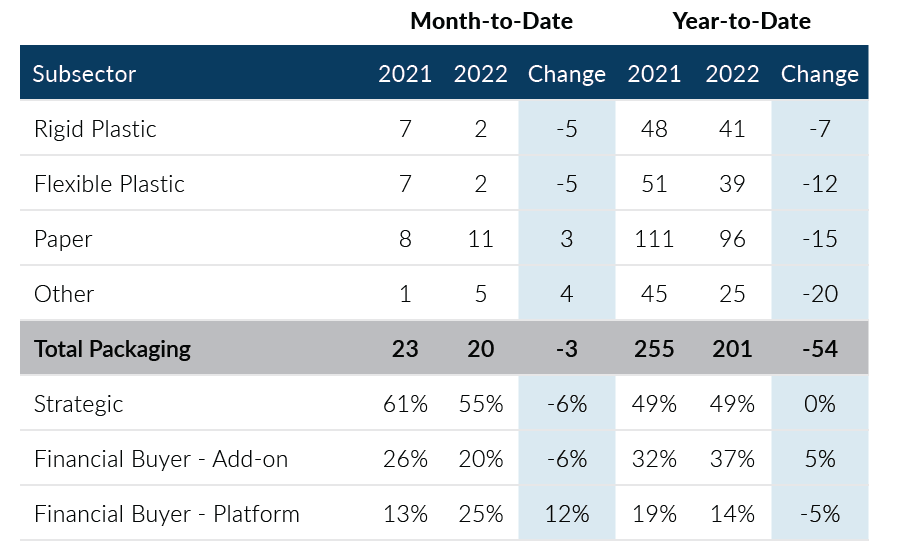

Global Packaging M&A recorded 20 deals in September and 65 transactions in the 3rd quarter, which was slightly lower than last month but overall on par with 2nd quarter deal volume. M&A activity in the quarter was led by an active private equity buyer base and a strong Paper packaging subsector. Overall, Packaging M&A activity remains well below elevated levels experienced last year and continues to trend slightly below pre-pandemic levels experienced in 2018 and 2019.

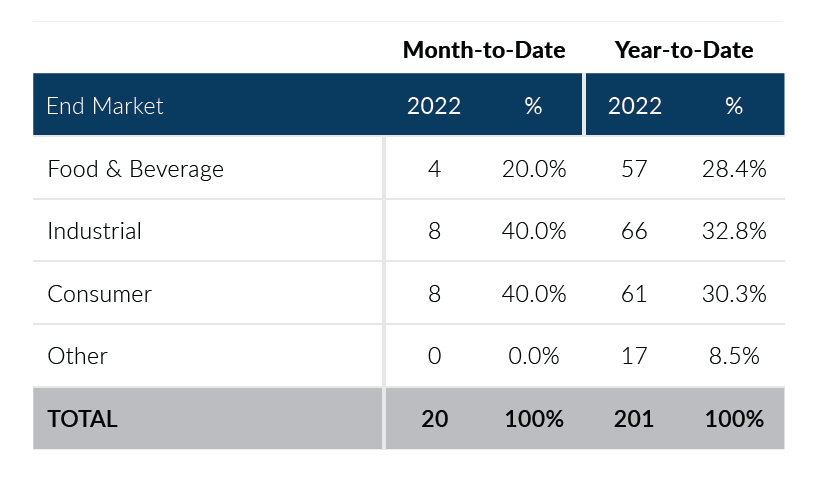

- The Consumer end market recorded its best quarter of the year in Q3, accounting for 27 deals, which was up nine transactions from Q2 and was five deals higher than its best quarter in 2021

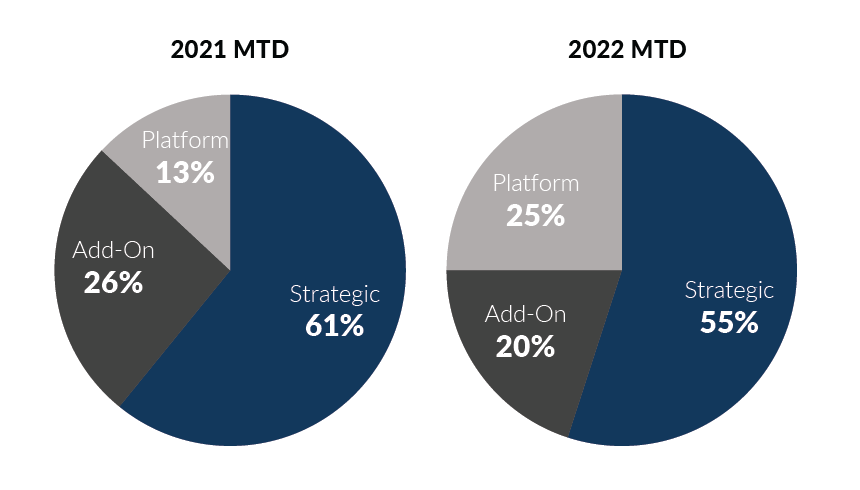

- Private equity transactions in Q3 remained robust, increasing by six deals from Q2. Additionally, Q3 marks the second quarter in 2022 that private equity transactions have accounted for over 50% of deal activity

- The Paper subsector recorded 36 deals in the quarter and accounted for over 55% of transactions, which is the first time the Paper subsector has accounted for over 50% of deals since Q4 2021

- Flexible Plastic transaction activity slowed in September, recording two deals, which was down six transactions when compared to August. The Flexible Plastic subsector recorded 11 deals in Q3, up one transaction from Q2 2022

Global Packaging M&A closed Q3 with deal volumes comparable to the prior quarter but still lower than levels experienced prior to the COVID-19 pandemic. Packaging transaction multiples appear to be continuing at elevated levels but some sellers seem reluctant to launch processes in the uncertain environment or, in other cases, are holding off until company financial performance shows more positive trends. If you are a packaging company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of September 30, 2022

Packaging M&A By Subsector

Total Packaging M&A By End Market

Packaging Transactions By Buyer Type

Notable M&A Activity

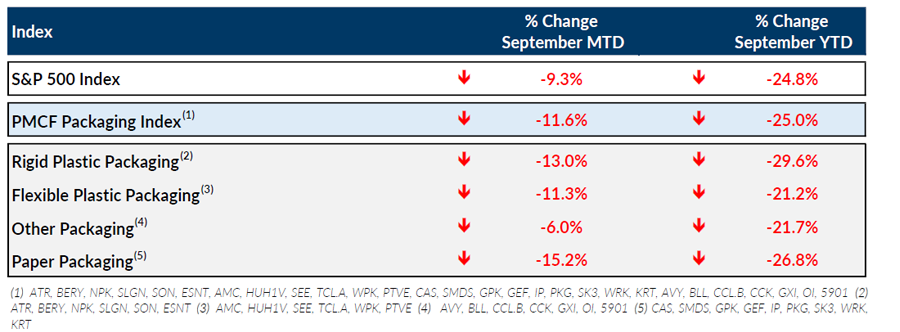

Public Entity Performance

Major News

- Economic Good News: Inflation and Supply Chain Issues Easing (Plastics News)

https://www.plasticsnews.com/news/economic-good-news-inflation-and-supply-chain-issues-easing - U.S. Jobless Claim Hit Lowest Level in Five Months (Wall Street Journal)

https://www.wsj.com/articles/u-s-jobless-claims-hit-lowest-level-in-five-months-11664455866?mod=Searchresults_pos7&page=1 - 10 States Ask Biden for “Aggressive” Action on Single-Use Plastic Buying (Plastics News)

https://www.plasticsnews.com/public-policy/10-states-want-aggressive-biden-policy-plastic-procurement - Reuse is on the Rise, but “Much More Needs to be Done” (Packaging World)

https://www.packworld.com/news/business-intelligence/article/22432226/new-smithers-report-on-reusablerefillable-packaging - How the U.S. is Making a Bottom-Up Recovery (Wall Street Journal)

https://www.wsj.com/articles/how-the-u-s-is-making-a-bottom-up-recovery-11664404427?mod=Searchresults_pos5&page=5

Download Packaging M&A Update – September 2022