Plastics Industry M&A Activity Tracking

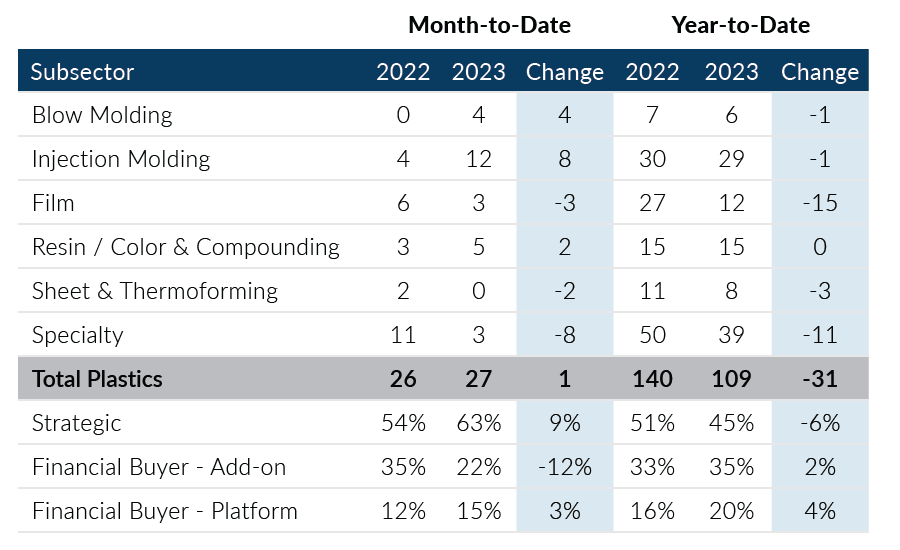

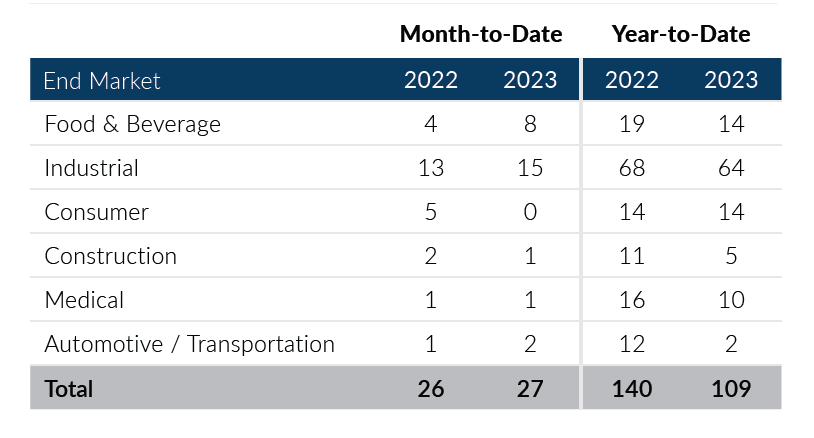

Global Plastics M&A recorded 27 deals in April, which was in line with March and February levels from a deal volume standpoint. Strategic buyers, which have been less active through the first few months of 2023, accounted for a majority of the transaction activity in the month. Financial buyer activity slowed in April as private equity acquisitions posted their lowest volumes of the year. While volumes through the first four months of 2023 remain lower than 2022 levels, the Global Plastics M&A market has experienced relative consistency on a monthly basis.

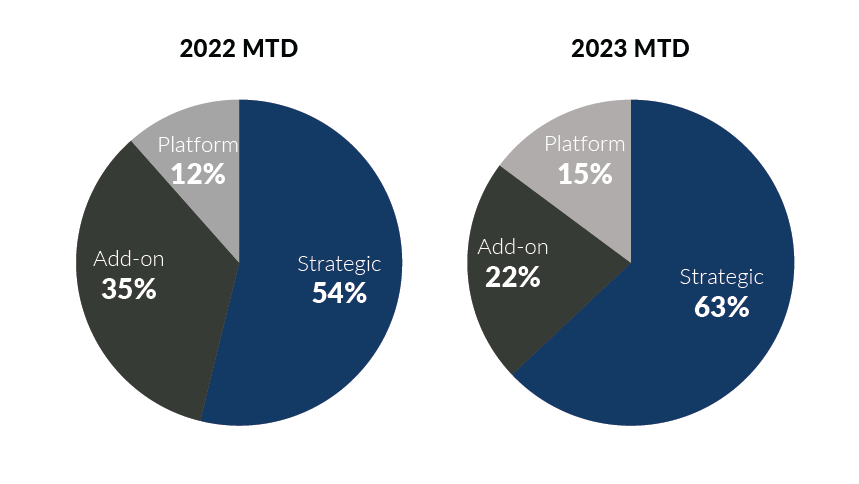

- Private equity platform transaction volume fell by two deals month-over-month and activity throughout the year has been inconsistent. Despite varying levels of activity, as a percent of overall deal volume, platform deals are above 2022 levels

- Strategic transactions increased by six deals month-over-month and posted their highest level of deal activity since September of last year. Notably, a majority of the strategic deals in the month were cross-border transactions or involved a foreign party

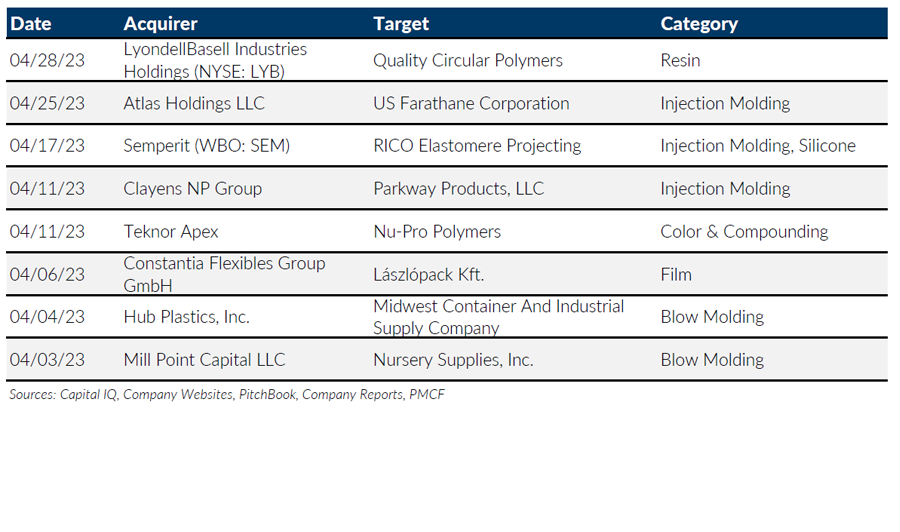

- Injection Molding led all plastics subsectors in deal volume, accounting for 44% of the transaction activity, and increased by seven deals month-over-month. April volumes were the highest they have been since July 2022

- Blow Molding posted four transactions in April, which doubled the subsector’s year-to-date activity and marked a strong rebound after no deals were recorded in March

Global Plastics M&A has been relatively consistent over the past few months but remains lower than 2022 levels. Macroeconomic factors showed some improvement in the month but there remains some uncertainty, which continues to impact Plastics M&A. The increase in strategic buyer activity in the month was a welcome sight after several months of lower transaction activity. If you are a plastics company considering a merger, acquisition, sale, or recapitalization in the short or longer term please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of April 30, 2023

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

Notable M&A Activity

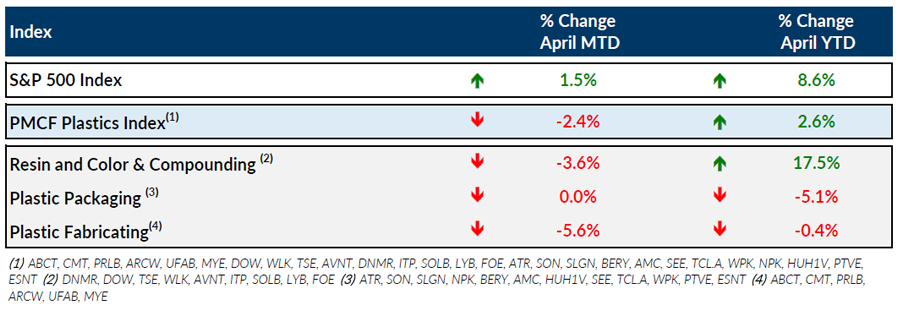

Public Entity Performance

Major News

- Manufacturers Optimistic Amid Challenges (Plastics News)

https://www.plasticsnews.com/news/2023-outlook-plastics-manufacturers-after-q1 - Despite Global Oversupply, Polyethylene Prices Rise in March (Plastics News)

https://www.plasticsnews.com/resin-pricing/despite-global-oversupply-polyethylene-prices-rise-march - California Debates 15% goal for Bioplastic Beverage Bottles (Plastics News)

https://www.plasticsnews.com/public-policy/california-debates-15-goal-bioplastic-beverage-bottles - GDP Report Shows Economic Growth Slowed in First Quarter (The Wall Street Journal)

https://www.wsj.com/articles/us-gdp-economic-growth-first-quarter-2023-2ff4348c - IMF Says Banking Troubles Create Headwinds for Global Economy (The Wall Street Journal)

https://www.wsj.com/articles/imf-says-banking-troubles-create-headwinds-for-global-economy-f6fef59e?mod=Searchresults_pos3&page=4

Download Plastics M&A Update – April 2023