Plastics Industry M&A Activity Tracking

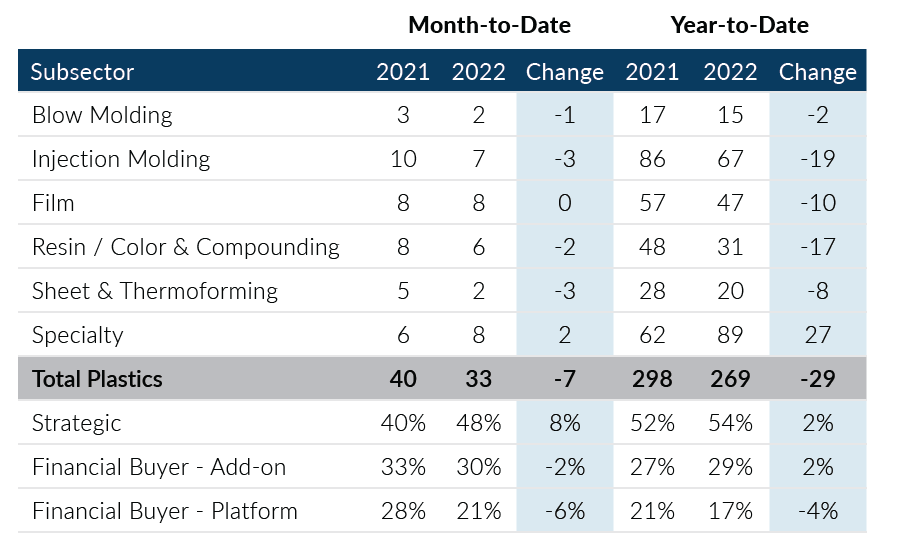

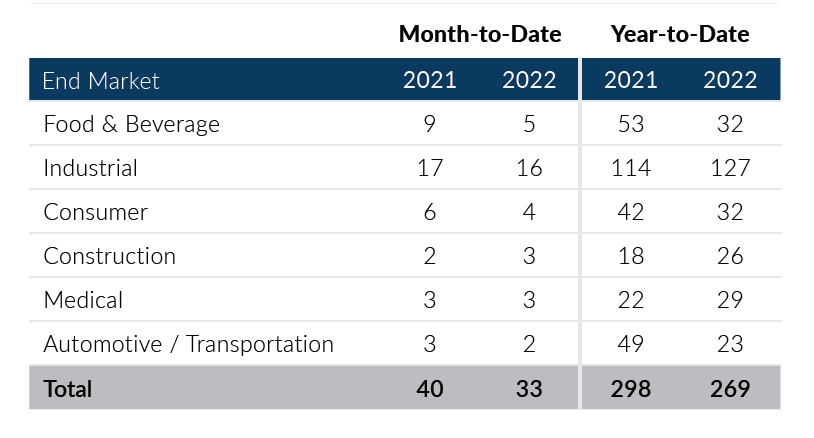

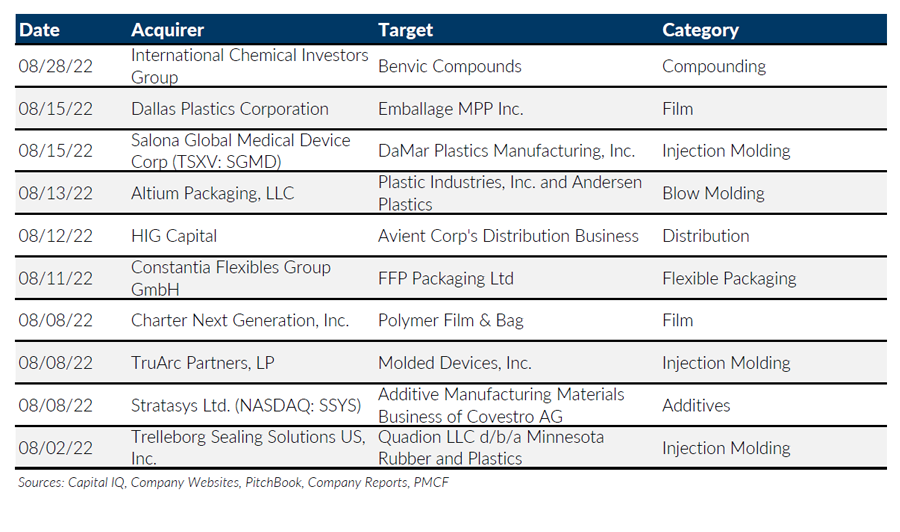

Global Plastics M&A activity totaled 33 transactions in the month of August, which was up two deals from July levels but still lower than elevated levels in 2021. Despite turbulence in the debt and equity markets, both strategic and financial buyers remained active in Plastics from an M&A standpoint. August M&A levels were the second-highest monthly total recorded in the last five months of 2022. While the threat of a contraction looms over the economy, Plastics M&A is poised to close the third quarter on a high note.

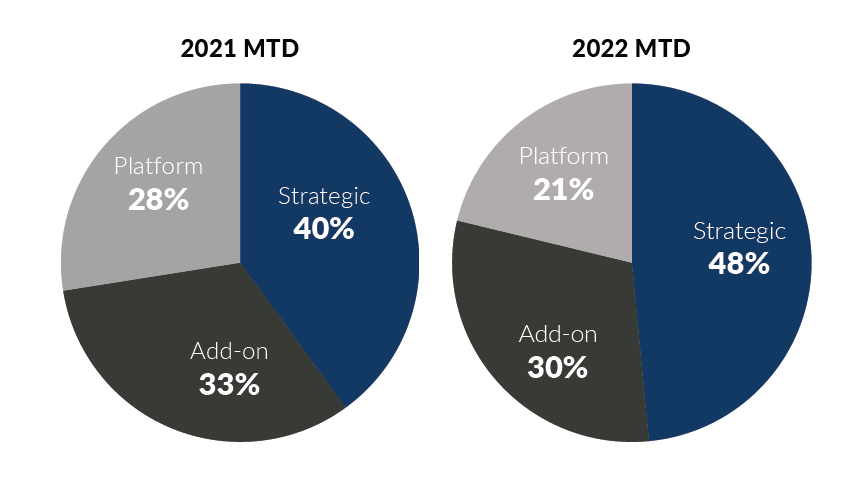

- After a weak month in July, private equity activity rallied to account for ~52% of the deal volume in August; it marked the first time financial buyers accounted for greater than 50% of the deal activity since January 2022

- Resin / Color & Compounding totaled six deals in August, building on a strong July and once again accounting for over 15% of the total transaction volume

- After posting 14 deals in July, Injection Molding M&A activity fell, recording seven deals recorded in August. On average, eight deals are attributable to this subsector per month in 2022 which means the drop in activity is still in line with normal levels

- The Film subsector rebounded in August and posted the highest month-over-month increase of any plastics subsector. Eight Film deals were recorded in August which was the most activity for the subsector from a volume standpoint since January 2022

Through August 2022, Global Plastics M&A continues to display strong transaction volumes. Currently, 269 deals have been recorded in 2022, which is significantly higher than pre-pandemic deal totals. Despite volatility in the overall macroeconomic landscape, current activity would suggest that Plastics M&A will continue to exhibit robust transaction volume in the near term. If you are a plastics company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of August 31, 2022

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

Notable M&A Activity

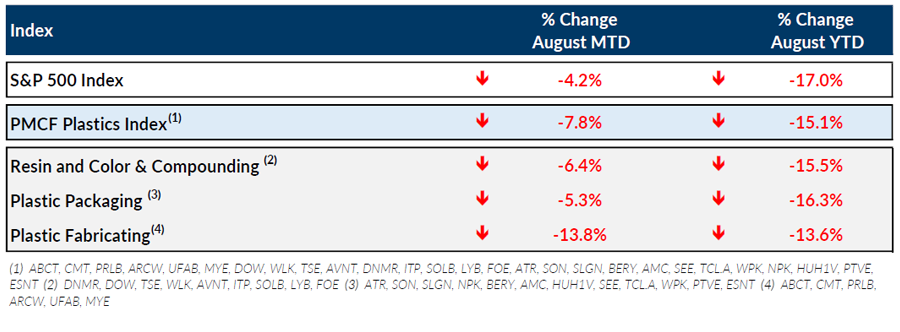

Public Entity Performance

Major News

- Job Market Stronger Than Previously Reported, Data Show (Wall Street Journal)

https://www.wsj.com/articles/job-market-stronger-than-previously-reported-data-show-11661364957?mod=Searchresults_pos17&page=4 - California Lawmakers Kill Plan to Cut Plastic Packaging in Online Shopping (Plastics News)

https://www.plasticsnews.com/public-policy/california-bill-plastic-packaging-e-commerce-shopping-killed - Supply Chain Problems Continue to Hit US Chemical Sector (Plastics News)

https://www.plasticsnews.com/news/supply-chain-problems-continue-hit-us-chemical-sector - US GDP Fell Less Than Previously Thought in Second Quarter (Wall Street Journal)

https://www.wsj.com/articles/u-s-jobless-claims-eased-last-week-in-tight-labor-market-11661432194?mod=Searchresults_pos19&page=3 - More Volatility for North American PS, ABS resin prices (Plastics News)

https://www.plasticsnews.com/resin-pricing/polystyrene-resin-prices-abs-resin-prices-chaos-over-feedstocks

Download Plastics M&A Update – August 2022