Plastics Industry M&A Activity Tracking

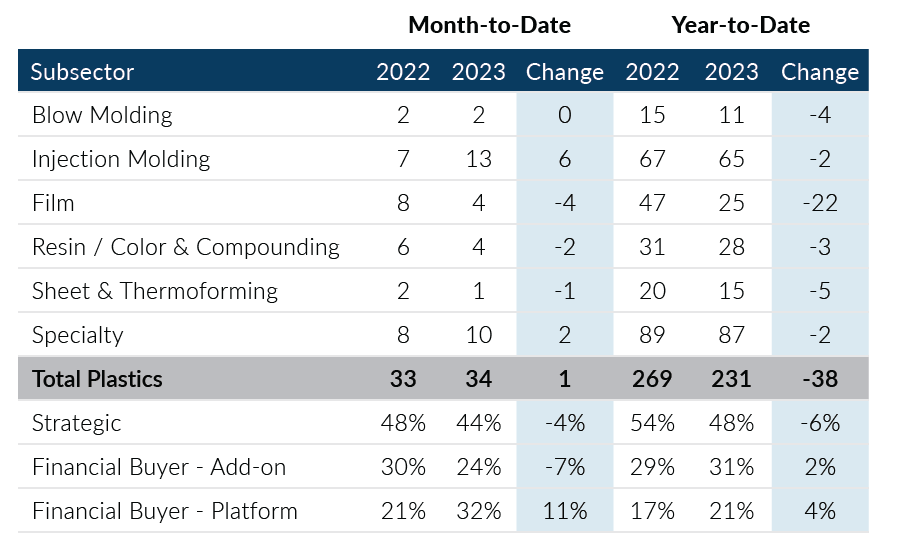

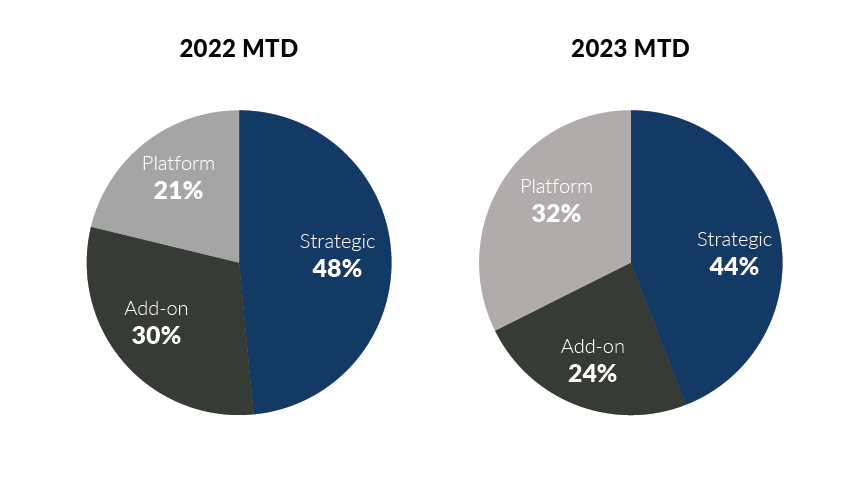

Global Plastics M&A recorded 34 deals in August, up eight from July levels. Strategic buyers surged in the month, climbing back above their average monthly deal volume after a weak July. Over the past two months, financial buyers have recorded a noticeable uptick in platform deals, which accounted for over 30% of the deal volume, and August represented the most active month since 2021. Overall, August was the second-highest month of 2023 from a Plastics deal volume standpoint, with levels being supported by activity across all buyer types.

- Strategic buyers recorded 15 deals in August, which is slightly above the monthly average of 14. Despite higher volumes, strategic buyers only accounted for 44% of monthly deal volume due to the strong month from financial buyers

- Financial buyers accounted for over 50% of deal volumes for the second straight month. Private equity transaction volume was driven by platform acquisitions, which rose by three deals over July levels and remained resilient in the face of challenging credit markets

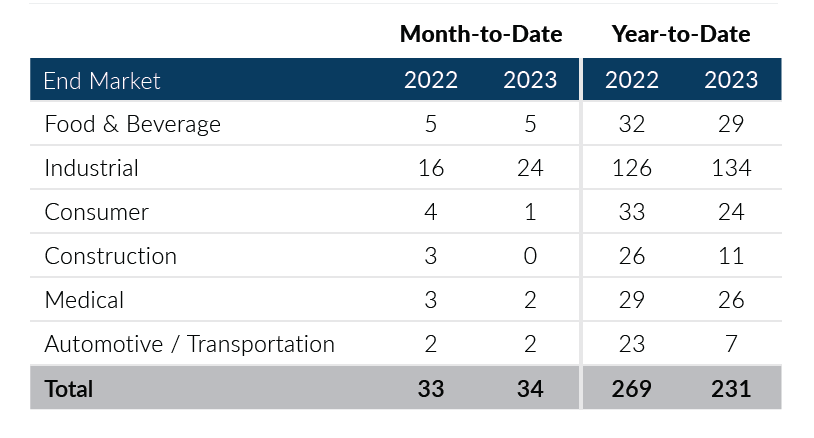

- Industrial transactions recorded 24 deals in August, accounting for 71% of the deal volume. Notably, August was the Industrial end market’s most acquisitive month since December 2021

- The Resin / Color & Compounding subsector recorded four deals in August, up two from July levels. Through August, the subsector has recorded 28 deals, which is slightly below the 2022 year-to date activity levels

Global Plastics M&A exhibited a balanced mix of transaction activity across all buyer types in August, which was an encouraging shift from July when strategic buyers posted below-average volumes. The recent uptick in platform private equity deals, despite higher interest rates, has further resulted in increased M&A activity and a more positive outlook for the balance of 2023. If you are a Plastics company considering a merger, acquisition, sale, or recapitalization in the short or longer term please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of August 31, 2023

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

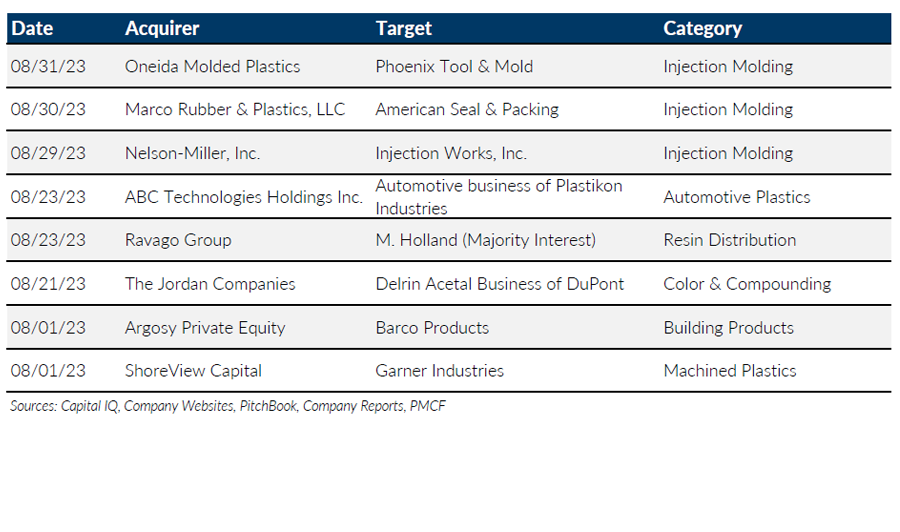

Notable M&A Activity

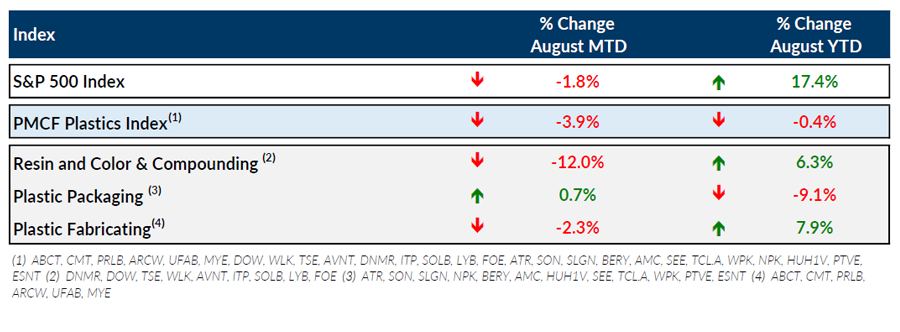

Public Entity Performance

Major News

- U.S. Machinery Shipment Value Dropped in Second Quarter (Plastics News)

https://www.plasticsnews.com/news/plastics-machinery-shipment-value-dropped-second-quarter - Numbers That Matter: Plastics Feeling a Pinch but May Avoid Recession (Plastics News)

https://www.plasticsnews.com/news/plastics-feeling-pinch-may-avoid-recession - U.S. Seeks Middle Ground in Deeply Divided Plastics Treaty Talks (Plastics News)

https://www.plasticsnews.com/news/us-seeks-middle-ground-plastics-treaty-talks - Recession Fears Have Been ‘Blown Out of the Water,’ Long-Serving Fed President Says (The Wall Street Journal)

https://www.wsj.com/economy/central-banking/recession-fears-have-been-blown-out-of-the-water-long-serving-fed-president-says-da0b5461?mod=central-banking_more_article_pos19 - Job Market Cools but Is Far From Freezing (The Wall Street Journal)

https://www.wsj.com/economy/jobs/job-market-cools-but-is-far-from-freezing-b9fb7f7f?mod=jobs_more_article_pos2

Download Plastics M&A Update – August 2023