Plastics Industry M&A Activity Tracking

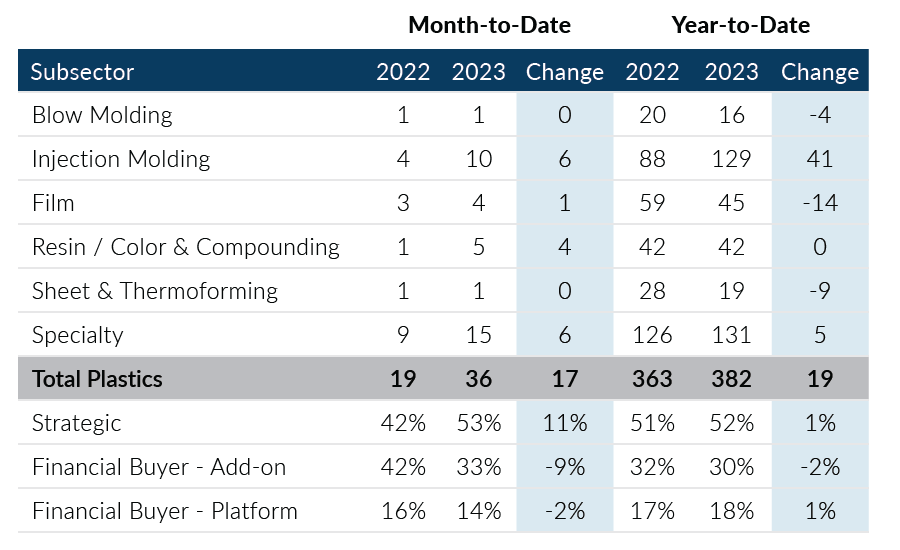

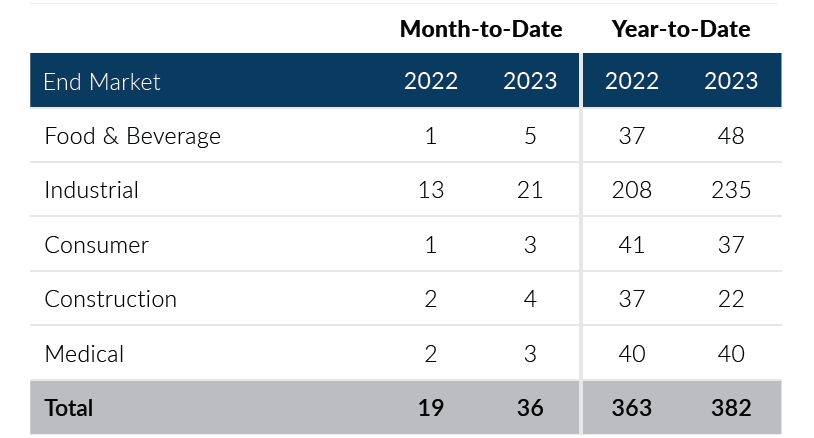

Global Plastics M&A recorded 36 deals in December, representing above-average deal volume and a continuation of October and November trends. December was tied for the third most active month of the year and concluded a strong second half of 2023. All three months in the fourth quarter recorded over 35 deals, boasting 115 deals total, or 30% of annual activity. Sustained demand in December resulted in 382 deals for 2023, representing the second-highest annual volume level since 2016 and outpacing 2022 volumes by 19 transactions.

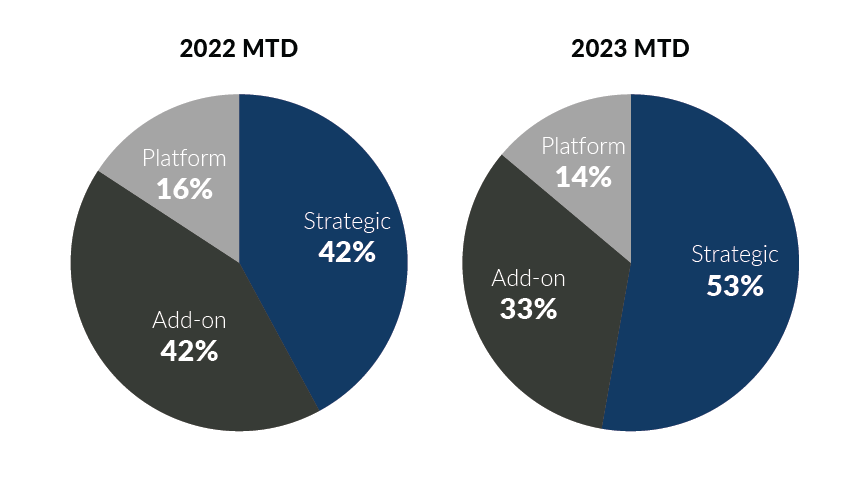

- In December, 19 deals were attributable to strategic buyers. Activity from this buyer group has slowed after posting 26 deals in October and 22 in November. Despite the decline, December was still the third most active month for strategic buyers from a deal volume standpoint

- Private equity buyers recorded 17 deals in the month, down one from November levels. Add-on acquisitions represented 71% of deals for financial buyers. Despite falling below yearly averages, platform activity matched November levels with five deals

- Deals involving two Foreign parties accounted for 20 deals, or 56% of deal volume in December. Foreign M&A activity increased significantly from 2022 levels, posting its second-highest year since 2016 with 184 deals

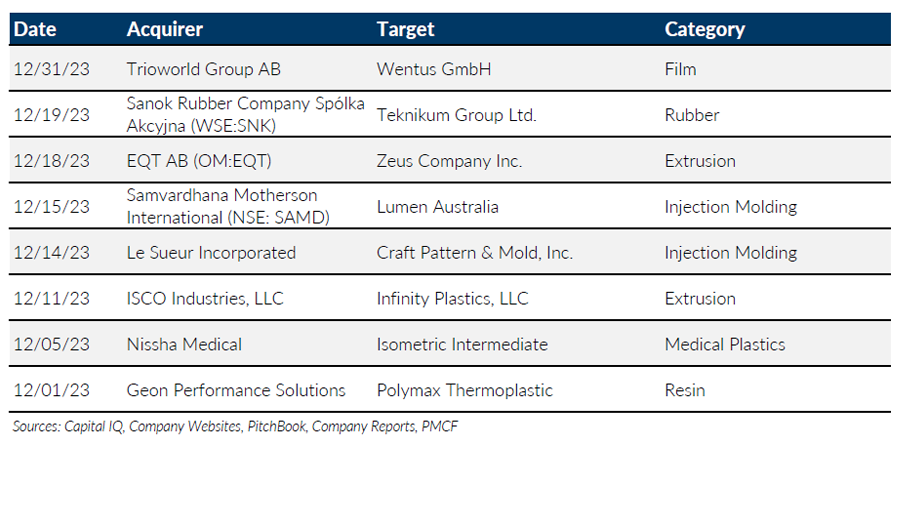

- The Injection Molding subsector maintained elevated levels in December. The month capped off the most active year for this subsector since PMCF began tracking Plastics M&A

Global Plastics M&A rounded out 2023 with a significant uptick in the second half compared to a sluggish first half. One of the key drivers of the increased activity in 2023 was foreign buyer participation, which reported a substantial increase of over 30% relative to 2022 levels. Plastics M&A appears to have strong momentum heading into 2024 with buyers reporting an uptick in new deals launched in Q4. If you are a plastics company considering a merger, acquisition, sale, or recapitalization in the short or longer term please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of December 31, 2023

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

Notable M&A Activity

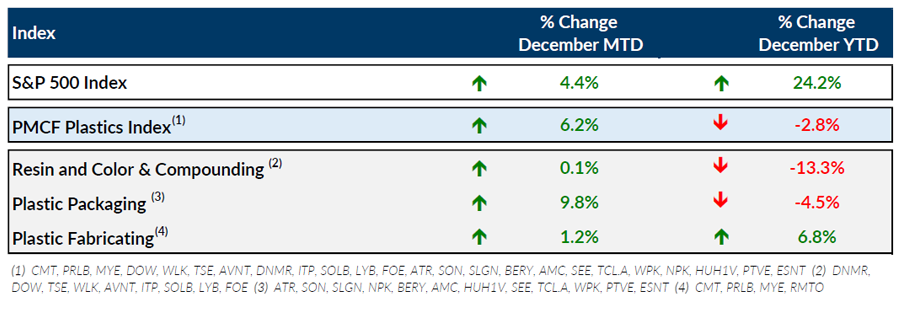

Public Entity Performance

Major News

- No Single Approach Will Solve Plastics Problems (Plastics News)

https://www.plasticsnews.com/news/seaholm-no-single-approach-will-solve-plastics-problems - PET Bottle Recycling Holds Steady (Plastics News)

https://www.plasticsnews.com/news/pet-bottle-recycling-held-steady-2022 - Backers See Chance For Boost to Bottle Bills (Plastics News)

https://www.plasticsnews.com/news/beverage-makers-shifting-position-bottle-bill-backers-see-chance-states - World Central Banks Signal Victory Over Inflation Is in Sight (The Wall Street Journal)

https://www.wsj.com/economy/central-banking/ecb-boe-rate-decision-december-b69625fb - U.S. Jobs Market Cools Again, Conference Board Employment Trends Index Shows (The Wall Street Journal)

https://www.wsj.com/economy/jobs/u-s-jobs-market-cools-again-conference-board-employment-trends-index-shows-855a4dd8?mod=jobs_more_article_pos8

Download Plastics M&A Update – December 2023