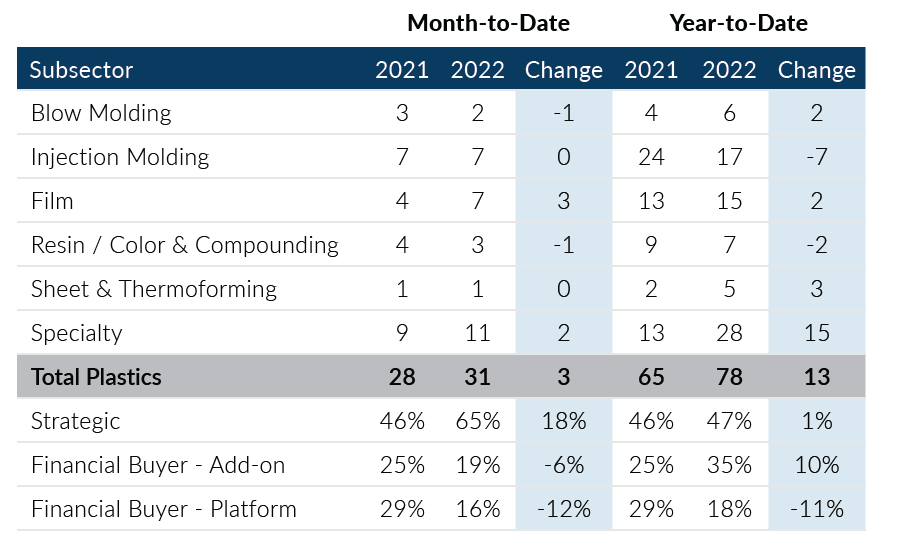

Plastics Industry M&A Activity Tracking

Global Plastics continued to post strong M&A activity down in February 2022 after a record start to the year in January. 31 deals were recorded in the month, which was lower than 47 transactions in January, but higher than February 2021. Deals in the month were driven by active strategic participation while private equity buyer activity slowed compared to high levels in January 2022. February transaction volume represented an increase of 3 deals year-over-year and a continuation of elevated M&A activity experienced throughout 2021.

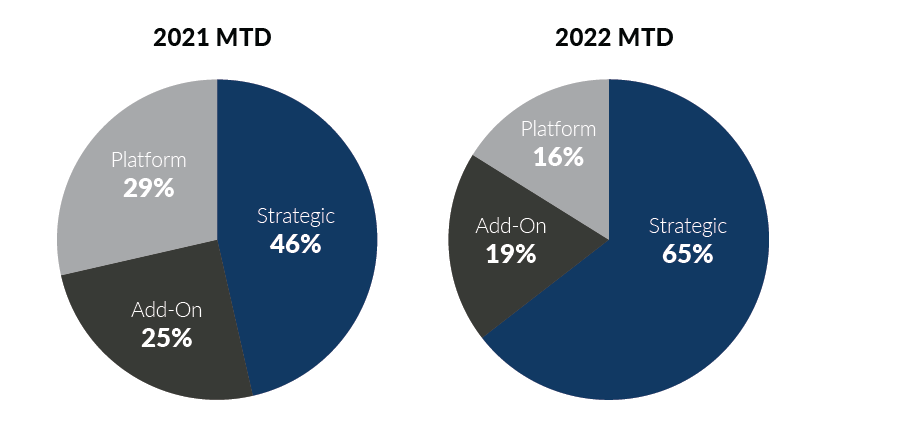

- Strategic buyers were highly acquisitive in the month, accounting for 20 transactions or 65% of the total deal volume in the month

- Much of the decline in transaction levels month-over-month can be attributed to private equity transactions which decreased from 30 deals in January to 11 deals in February

- Film and Injection Molding transactions accounted for 45% of the deal volume in the month; both subsectors have had a strong start to the year contributing 32 of the 78 year-to-date transactions

- Specialty transactions have accounted for 36% of the year-to-date deal volume, which is up from 20% through this same time last year

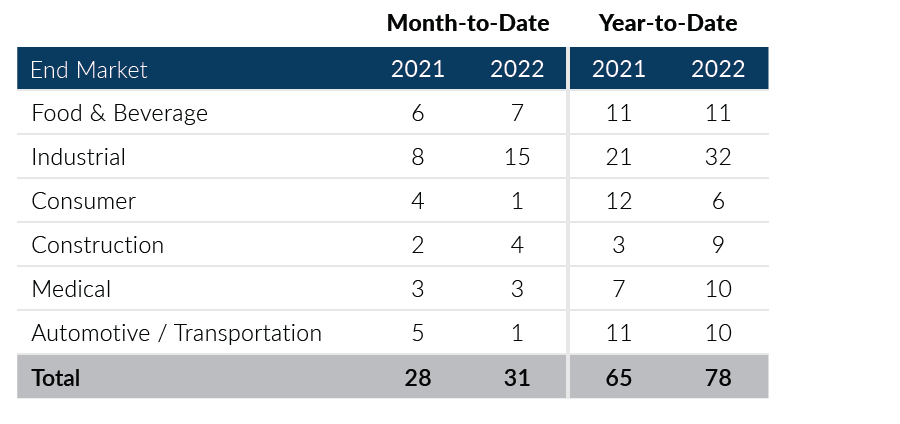

- Food & Beverage transactions increased by 3 deals month-over-month, totaling 7 deals in February and 11 deals through the beginning of the year

The Global Plastics M&A market has started off the year strong, building on an unprecedented environment experienced in 2021. If February is any indication, transaction volumes seem to be continuing at elevated levels, however, it is early in the year and 2021 would be tough to replicate given unique circumstances. If you are a plastics company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

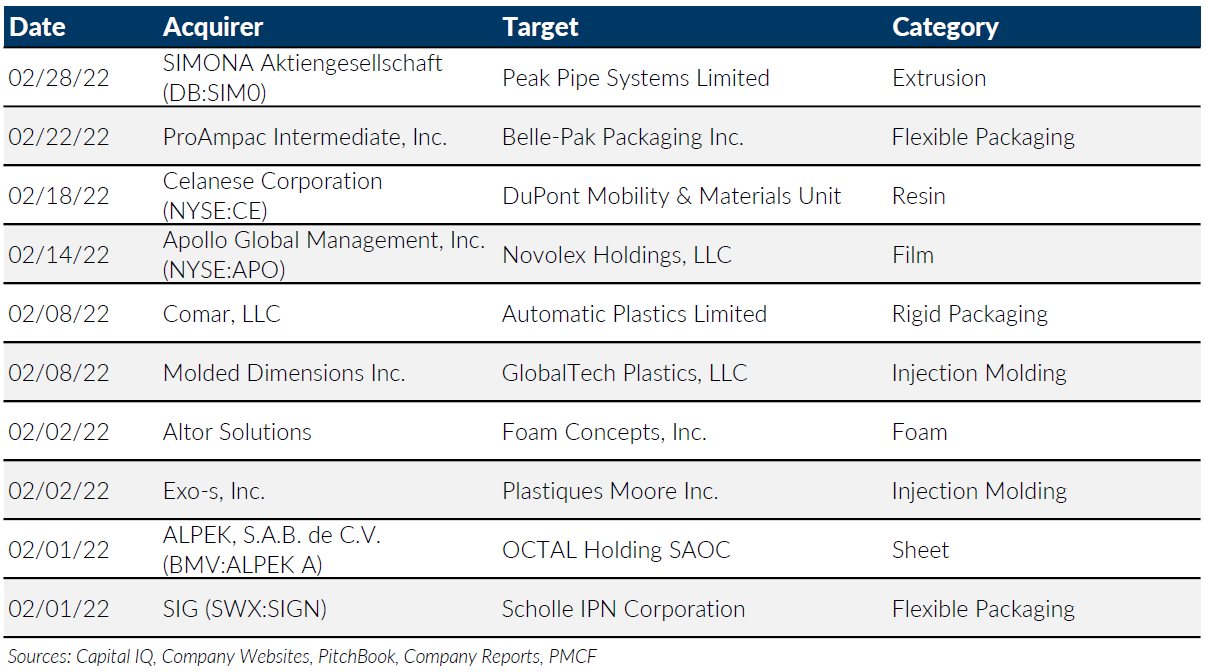

Notable M&A Activity

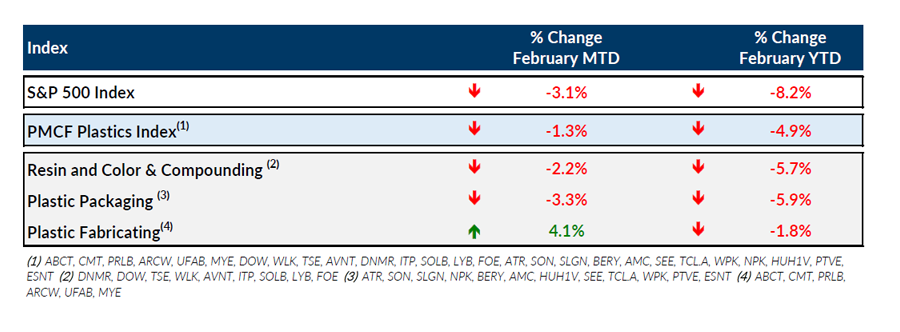

Public Entity Performance

Major News

- Economy Gained Momentum in February Despite Inflation Worries (Wall Street Journal)

https://www.wsj.com/articles/economy-gained-momentum-in-february-despite-inflation-worries-11645551346 - Supplies Recovered For Some Materials to Start 2022 Others Remain Turbulent (Plastics News)

https://www.plasticsnews.com/news/supplies-recovered-some-materials-start-2022-others-remain-turbulent - Fed Seeks Sweet Spot Between Slowing Inflation, Aiding Growth (Plastics News)

https://www.plasticsnews.com/news/fed-seeks-sweet-spot-between-slowing-inflation-aiding-growth - Ukraine Crisis Could Mean Higher Resin Prices (Plastics News)

https://www.plasticsnews.com/news/ukraine-invasion-could-mean-higher-resin-prices - U.S. Job Openings, Quits Remained Elevated at End of Last Year (Wall Street Journal)

https://www.wsj.com/articles/job-openings-us-growth-labor-market-turnover-02-01-2022-11643670099