Plastics Industry M&A Activity Tracking

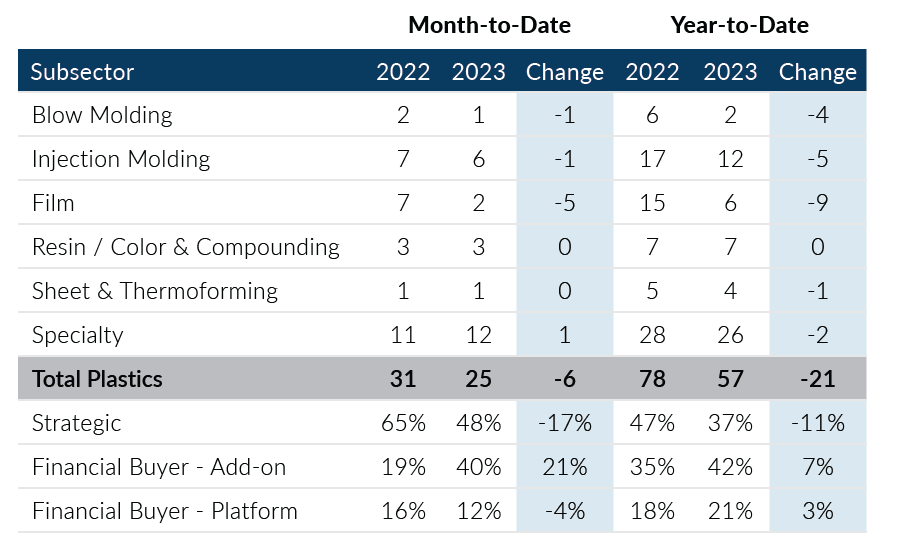

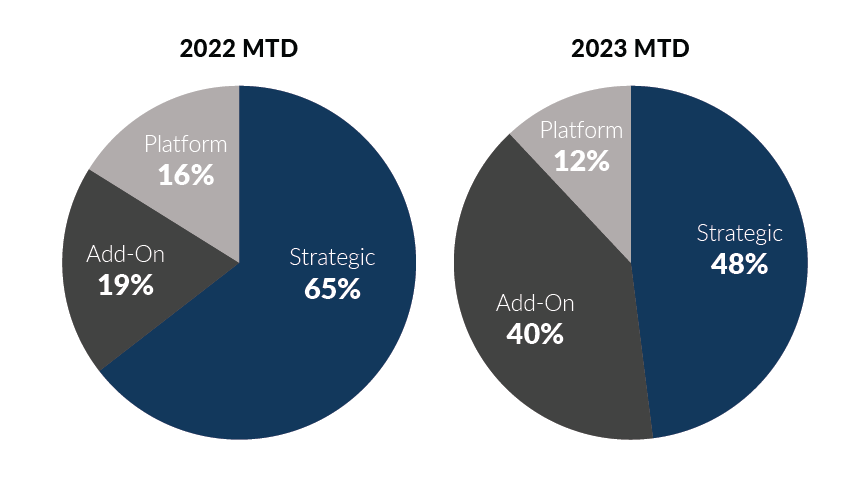

Global Plastics M&A recorded 25 deals in February, down from 31 last year and below the strong start recorded in January. Deals in the month were driven by active strategic buyers, which reported a notable increase from last month. Private equity add-on deals continued to report elevated levels of activity due, in part, to the high level of investment by private equity in the plastics industry over the last few years. New private equity platform activity, however, reverted to lower levels experienced in the 2nd half of 2022, after a strong start in January.

- Strategic buyers were highly acquisitive in the month, accounting for 12 transactions, or 48% of the total deal volume in the month, and up from nine transactions recorded in January

- The majority of the decline in transaction volume levels from last month can be attributed to lower private equity platform transactions, which decreased from 9 deals in January to 3 deals in February

- Injection molding transactions recorded 6 deals for the second consecutive month, which is slightly below the trailing 12-month average of 7 deals

- Specialty Plastic transactions which include foam, extrusion, distribution, and other sectors, recorded 12 deals in February, up from 11 deals last year

- Color & Compounding transactions are off to a strong start in 2023, matching last year’s transaction activity and 50% higher than the trailing 12-month average of 2 deals

Despite continued challenges with acquisition financing and macroeconomic uncertainty, the Global Plastics M&A market has shown resilience so far in 2023. Transaction volumes have rebounded from subpar fourth quarter activity levels and appear to be on track to continue at higher levels in the near term. If you are a plastics company considering a merger, acquisition, sale, or recapitalization in the short or long term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of February 28, 2023

Plastics M&A By Subsector

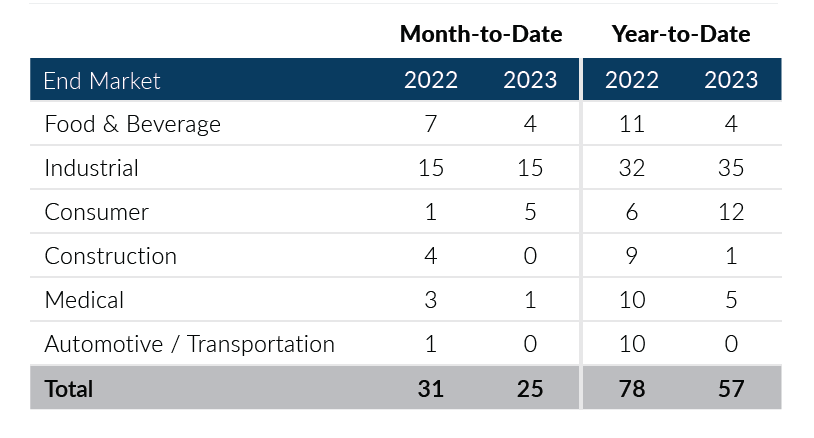

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

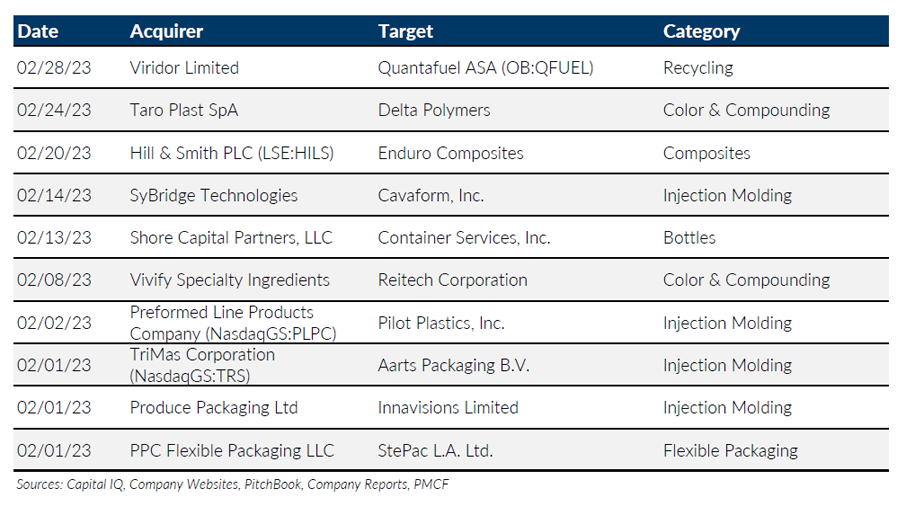

Notable M&A Activity

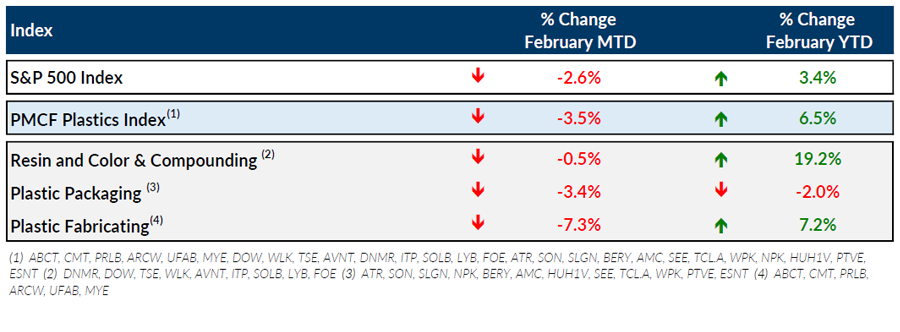

Public Entity Performance

Major News

- Commodity Resin Prices on the Rise at the Start of 2023 (Plastics News)

https://www.plasticsnews.com/resin-pricing/higher-resin-prices-start-2023 - Economic Data is Full of Drama. What Does that Mean for Plastics (Plastics News)

https://www.plasticsnews.com/news/economy-data-full-drama-what-does-mean-plastics - Efforts Underway to Expand PET Thermoforming Recycling (Plastics News)

https://www.plasticsnews.com/news/efforts-underway-expand-pet-thermoform-recycling - Economy Showing Strength in Early 2023 After Last Quarter’s GDP Gain Revised Modestly Lower (The Wall Street Journal)

https://www.wsj.com/articles/economy-showing-strength-in-early-2023-after-last-quarters-gdp-gain-revised-modestly-lower-5b068ade?mod=Searchresults_pos12&page=1 - Fed’s Barkin Supports Measured Pace of Interest-Rate Increases (The Wall Street Journal)

https://www.wsj.com/articles/feds-barkin-supports-measured-pace-of-interest-rate-increases-1ca6425b?mod=Searchresults_pos2&page=7

Download Plastics M&A Update – February 2023