Plastics Industry M&A Activity Tracking

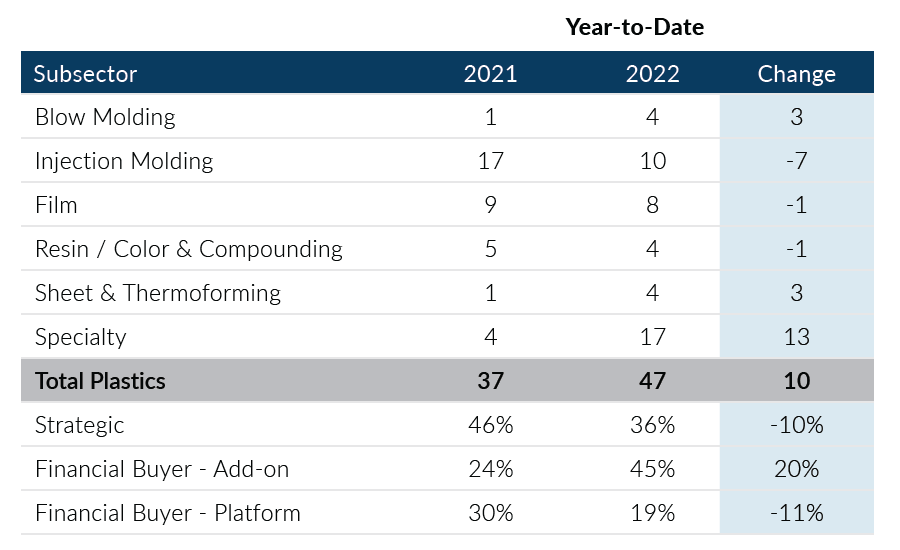

January 2022 ushered in a strong beginning to the new year for the Global Plastics M&A market. Transactions in the month totaled 47 deals which continued the trend of elevated deal activity witnessed in 2021. January transaction levels grew by 10 deals year-over-year. While these transaction levels are promising, some of this activity can likely be attributed to carryover transactions from the end of 2021. Overall, while the global environment has led to uncertainty in economic markets, plastic M&A deal volumes have remained robust to start the year.

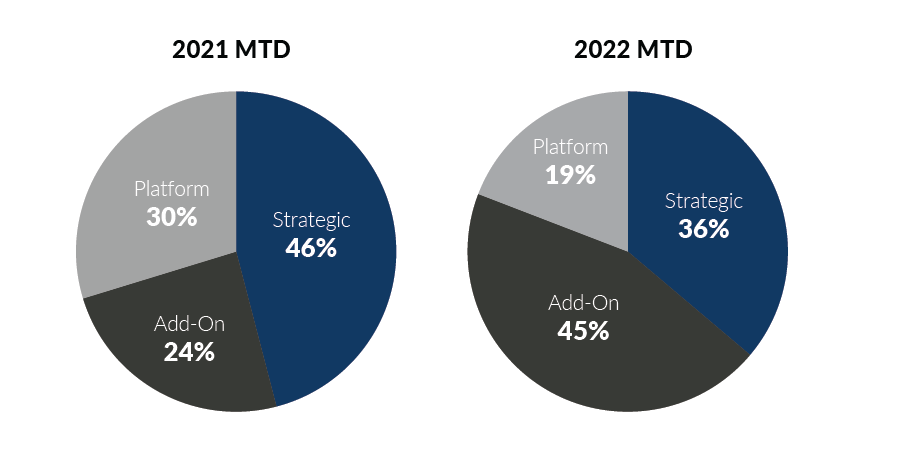

- Private equity firms were extremely active in the first month of the new year, totaling 30 transactions, or 64% of total transaction volume

- Injection Molding and Specialty led all plastic subsectors, combining for 27 total transactions in January; both subsectors were extremely active in 2021 as well, accounting for 51% of transaction volume in the year

- Blow Molding and Sheet & Thermoforming subsectors both increased by 3 transactions over January 2021 levels

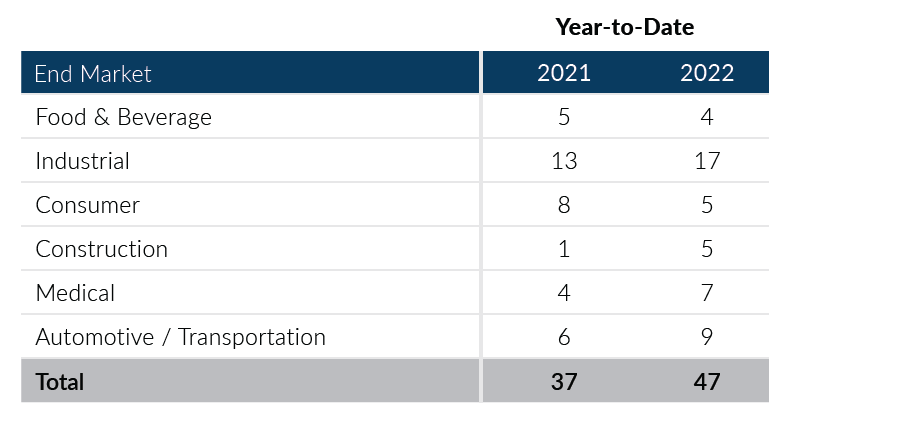

- Industrial end market once again led all end markets in the month, recording 17 transactions in January; the Industrial end market has contributed the largest amount of plastics M&A for the past 5 years

- Automotive and Construction end markets combined for 14 deals in January 2022 and increased significantly from a volume mix standpoint relative to levels posted in 2021

The Global Plastics M&A market began the year in encouraging fashion, continuing the pace of transaction activity set in 2021. January 2022 marked the highest level of activity in the first month of the new year that PMCF has seen since it began tracking the sector. As the new year continues, it remains to be seen whether transaction volumes in the plastics sector will continue to be as robust as they were in January and 2021 which report record M&A activity. If you are a plastics company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

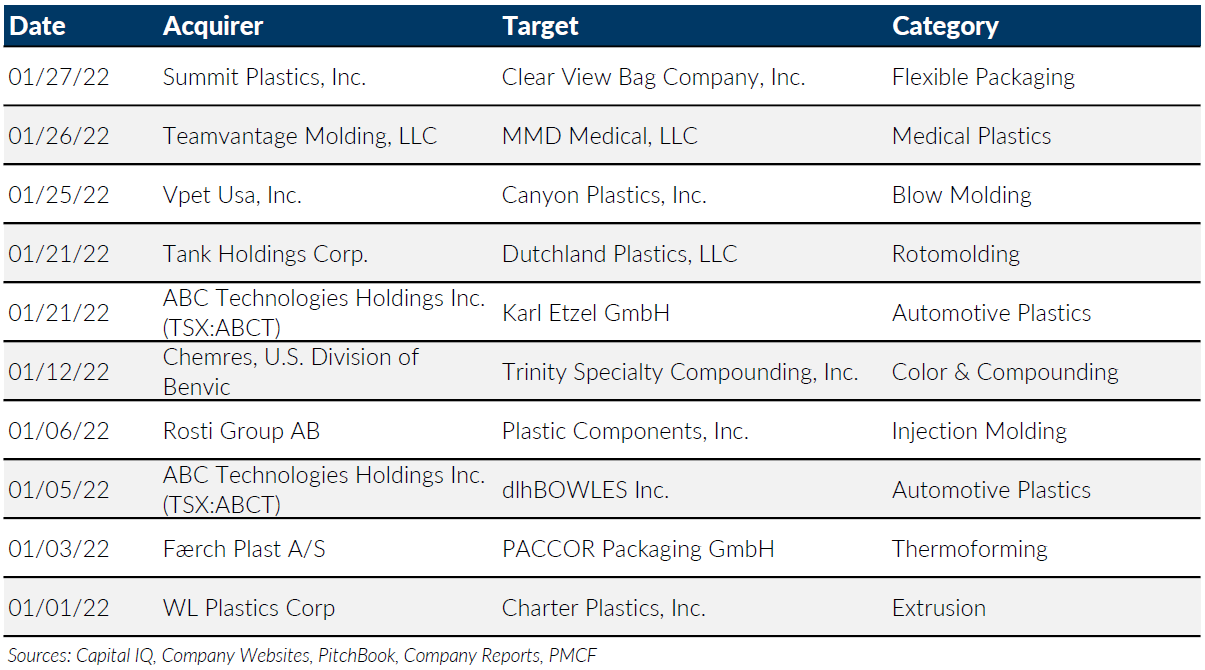

Notable M&A Activity

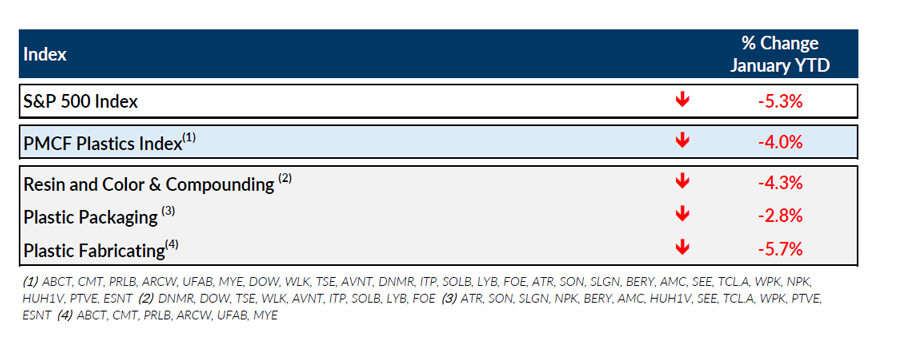

Public Entity Performance

Major News

- Big Deals, Big Money in 2021 M&A Final Numbers (Plastics News)

https://www.plasticsnews.com/news/big-deals-big-money-2021-ma-final-numbers - A Surprising Jump in Prices For One Resin While Others Dip (Plastics News)

https://www.plasticsnews.com/news/pet-resin-prices-took-surprising-jump-january - A Strong Year For Materials Firms in 2021 (Plastics News)

https://www.plasticsnews.com/news/lyondellbasell-eastman-celanese-post-strong-numbers-2021 - Inflation, Supply Chain, Omicron Expected to Take a Bigger Toll on Global Growth (Wall Street Journal)

https://www.wsj.com/articles/inflation-supply-chain-omicron-expected-to-take-a-bigger-toll-on-global-growth-11643119381