Plastics Industry M&A Activity Tracking

January 2023 ushered in a strong beginning to the new year for the Global Plastics M&A market. Transactions in the month totaled 32 deals, which represents the first time the Global Plastics M&A market has recorded over 30 deals since August 2022. Furthermore, when compared to the average monthly volume from H2 2022, January recorded an additional six transactions. Overall, Global Plastics M&A activity displayed its resilience, and buyers continue to be acquisitive in the face of macroeconomic uncertainty and challenging credit markets.

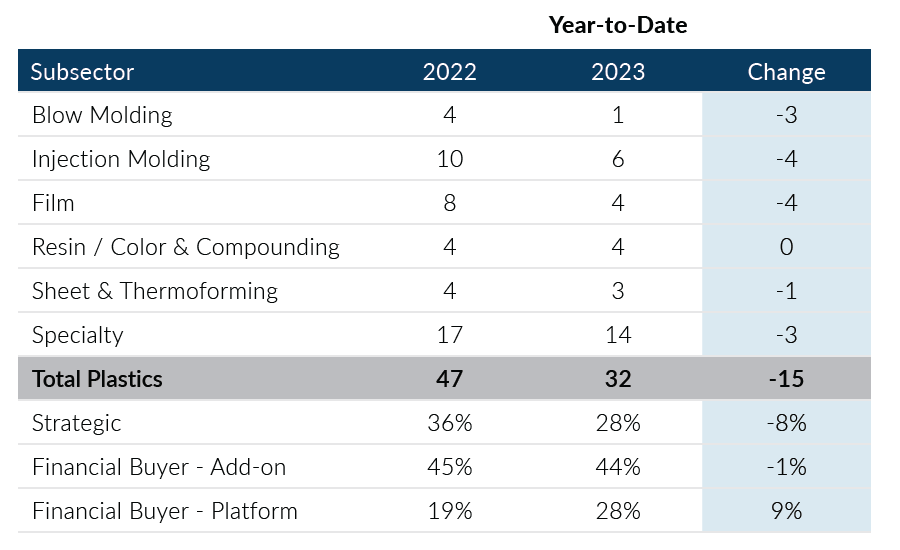

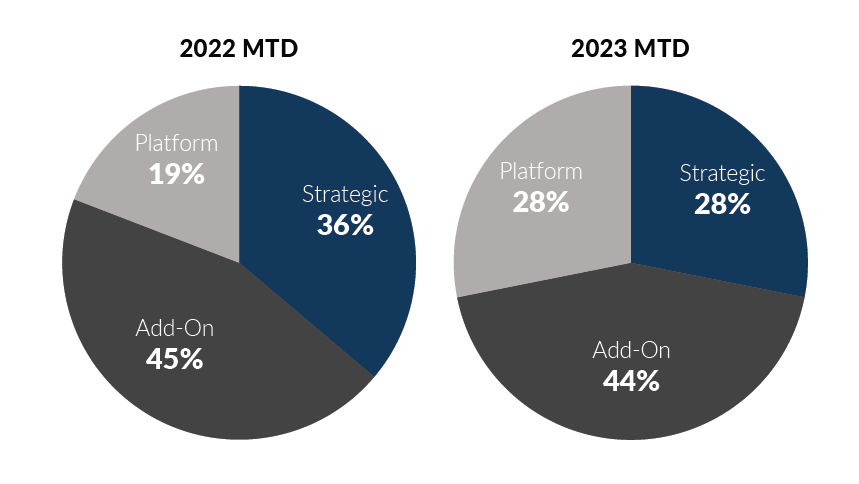

- Private equity firms were particularly active in the first month of the new year, totaling 23 transactions, or 72% of the total transaction volume. January represents the most acquisitive month for platform private equity since May 2022

- Strategic buyers remained on the sidelines in January, recording nine deals which is well below the 2022 monthly average of 16

- Specialty transaction activity remained strong in January, recording 14 deals which matched the subsector’s most active month of 2022

- Color & Compounding transactions started the year strong, recording four transactions in January which is double the average monthly volume levels for the subsector in 2022

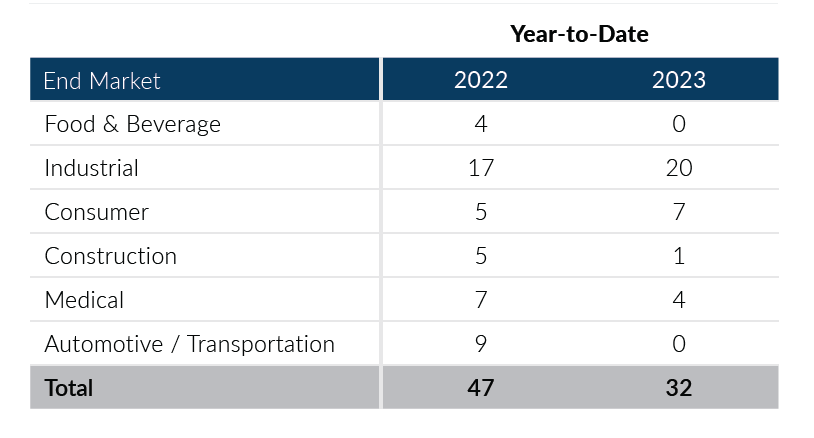

- The Industrial end market accounted for 20 deals, or 63% of transaction volume, in January. When compared to January 2022, the end market recorded an additional three deals

The Global Plastics M&A market began the year with an uptick in activity, rebounding from the lower activity levels witnessed in the latter half of 2022. It’s too early to tell whether January levels will continue in the first half of 2023, but the trends in the month were encouraging from an M&A perspective. If you are a plastics company considering a merger, acquisition, sale, or recapitalization in the short or long term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of January 31, 2023

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

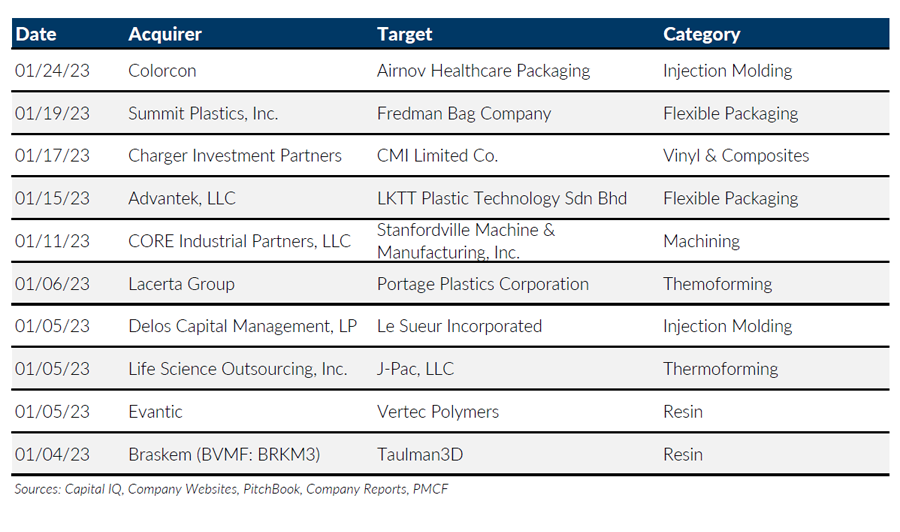

Notable M&A Activity

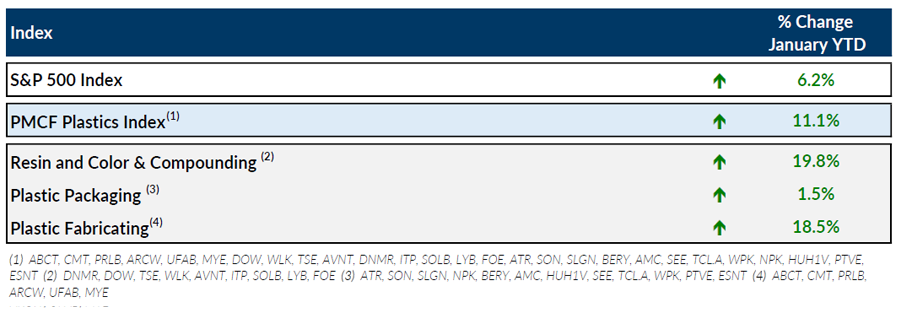

Public Entity Performance

Major News

- U.S. Nears Debt Ceiling, Begins Extraordinary Measures to Avoid Default (Wall Street Journal)

https://www.wsj.com/articles/treasury-to-begin-extraordinary-measures-to-pay-bills-amid-debt-ceiling-debate-11674091179?mod=Searchresults_pos1&page=1 - U.S. GDP Rose 2.9% in the Fourth Quarter After a Year of High Inflation (Wall Street Journal)

https://www.wsj.com/articles/us-gdp-economic-growth-fourth-quarter-2022-11674683034?mod=Searchresults_pos14&page=2 - Plastics M&A Market Cools; Higher Interest Rates Blamed (Plastics News)

https://www.plasticsnews.com/mergers-acquisitions/plastics-ma-market-cools-higher-interest-rates-take-blame - World Economy is Getting Less Circular (Plastics News)

https://www.plasticsnews.com/news/news-davos-circularity-gap-report-2023-shows-downward-circularity-trend - Microplastics Take Outsized Role as Senate Democrats Seek Action (Plastics News)

https://www.plasticsnews.com/public-policy/microplastics-take-macro-role-hearing-democrats-urge-action

Download Plastics M&A Update – January 2023