Plastics Industry M&A Activity Tracking

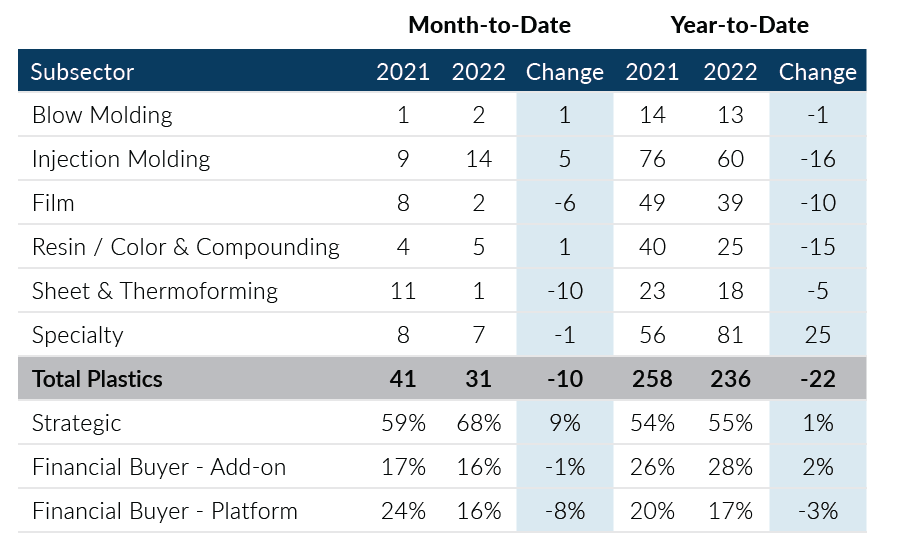

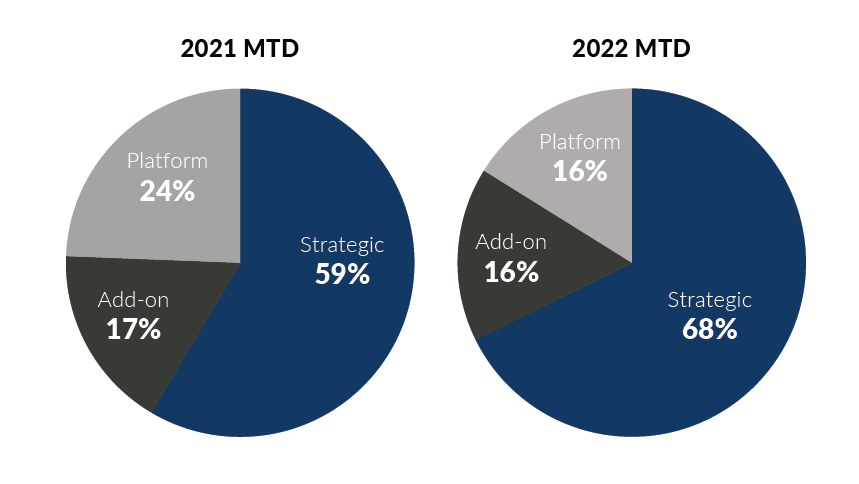

Global Plastics M&A activity totaled 31 transactions in the month of July, down 3 deals from June levels. While volume fell month-over-month, July marked the third consecutive month with over 30 transactions announced. Transaction levels were driven by an active strategic buyer base, which accounted for 68% of the total deal volume. Overall, Plastics M&A continues to exhibit strong activity levels when compared to monthly volumes seen prior to the pandemic, and is on track to have another strong year from an M&A volume standpoint.

- After a strong month in June, private equity activity pulled back slightly as fewer financial buyers pursued platform acquisitions of plastics companies. Notably, July has been a slower month for private equity activity historically

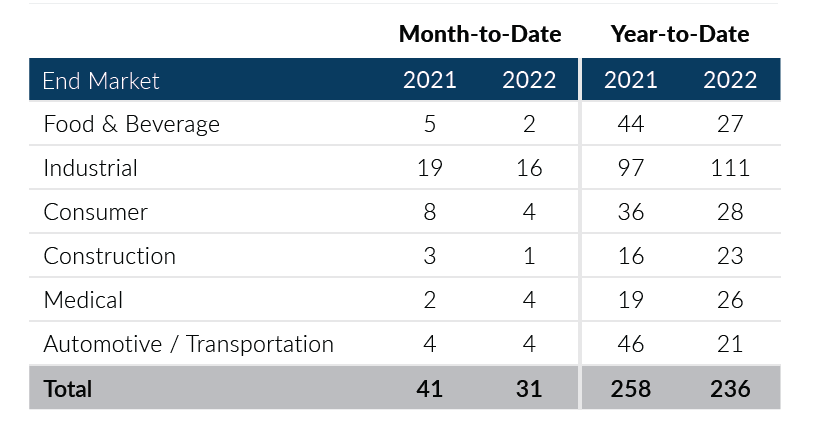

- U.S. buyers continue to be active in 2022, averaging 17 transactions per month and recording 15 in the month of July. Through July of last year, U.S. buyers had accounted for 43% of the total deal volume while they have accounted for 51% of the deal volume in 2022

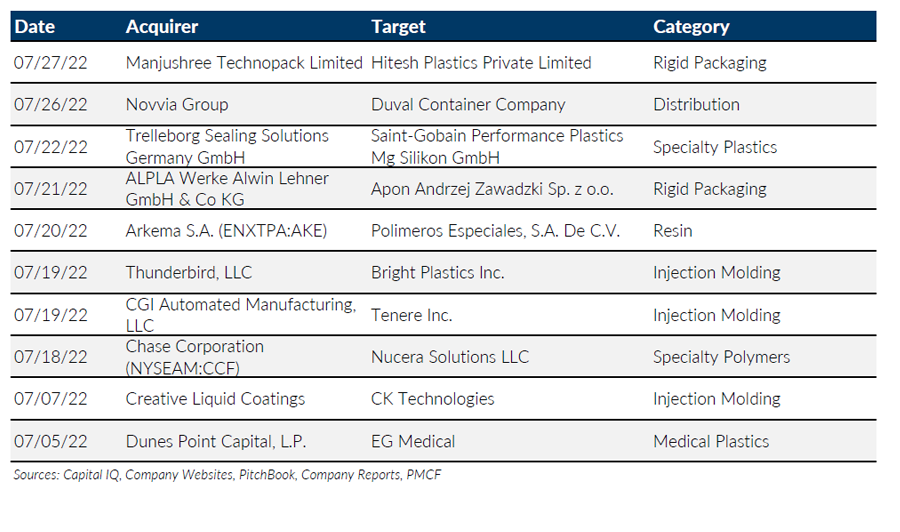

- The Injection Molding subsector posted its highest level of transaction activity of the year in the month of July, accounting for 14 deals which was up from 7 transactions in June

- Resin and Color & Compounding deals accounted for 5 deals in July which was up from 2 deals in June. In the year, this subsector has accounted for 11% of the total volume

Through July 2022, Global Plastics M&A has reported strong deal volumes after a slower Q2. Total deal activity sits at 236 transactions in the year-to-date which is below 2021 volumes, but significantly higher than activity seen through the same year-to-date period in 2017 – 2020. Amidst uncertainty in the macroeconomy, plastics transaction levels and valuation multiples continue to be strong. If you are a plastics company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of July 31, 2022

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

Notable M&A Activity

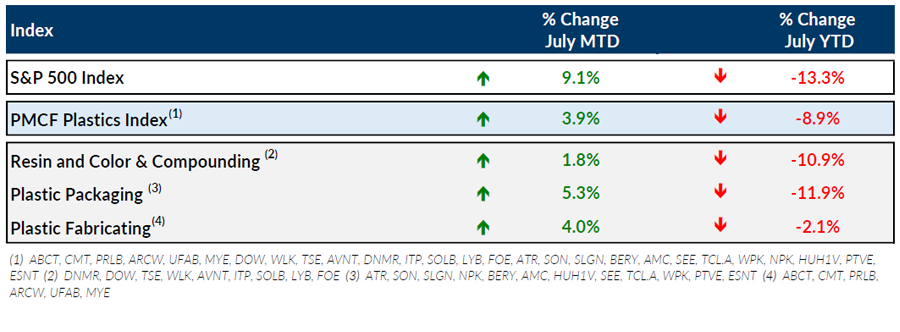

Public Entity Performance

Major News

- Sales up, Profits Mixed for Materials Firms in the Second Quarter (Plastics News)

https://www.plasticsnews.com/news/sales-profits-mixed-materials-firms-second-quarter - There Are Signs Inflation May Have Peaked, but Can It Come Down Fast Enough? (Wall Street Journal)

https://www.wsj.com/articles/there-are-signs-inflation-may-have-peaked-but-can-it-come-down-fast-enough-11658568604 - Packaging Suppliers Face Winding Pathway on the Road to Sustainability (Plastics News)

https://www.plasticsnews.com/news/packaging-suppliers-face-winding-pathway-road-sustainability - Polystyrene, Polypropylene and PET Dominate Resin News (Plastics News)

https://www.plasticsnews.com/news/polystyrene-polypropylene-and-pet-dominate-resin-news - July Jobs Report: U.S. Added 528,000 New Jobs as Unemployment Rate Fell to 3.5% (Wall Street Journal)

https://www.wsj.com/articles/july-jobs-report-unemployment-rate-economy-growth-2022-11659646690

Download Plastics M&A Update – July 2022