Plastics Industry M&A Activity Tracking

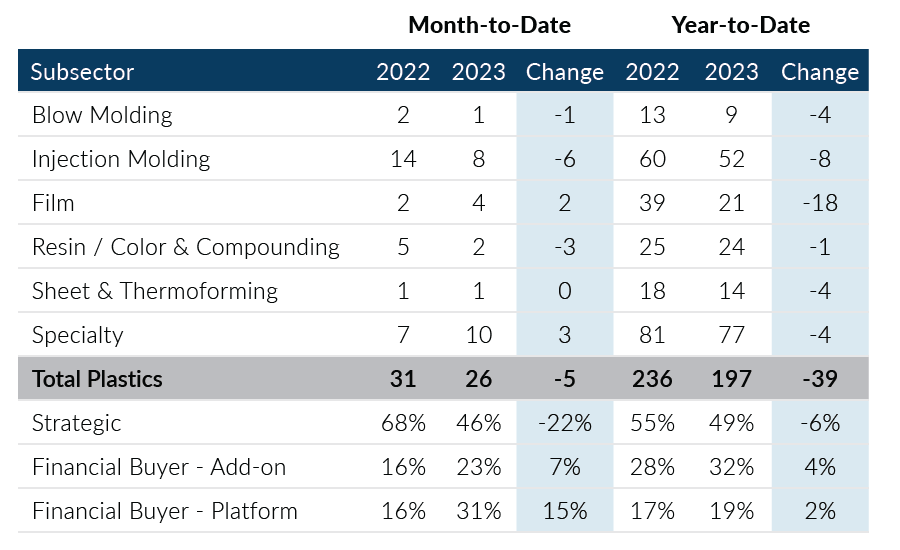

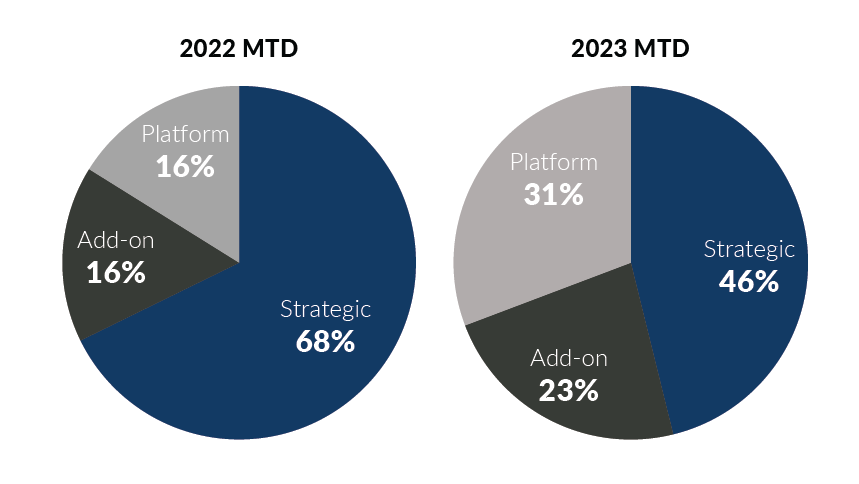

Global Plastics M&A recorded 26 deals in July, down one from June levels. Strategic buyers accounted for 12 deals in the month, which represented a decrease of five transactions month-over-month. An increase in platform private equity transactions and consistent add-on activity helped to balance out the lack of strategic activity in the month. Overall, the resilience of private equity buyers signals that investors remain confident in the space and continue to get deals done even in challenging credit markets.

- Strategic buyer activity levels in July marked the third-lowest month of 2023 from a volume standpoint and a notable shift from Q2 levels when strategic buyers averaged 17 deals per month

- Financial buyers accounted for over 50% of the deal volume for the first time since March. Private equity transaction volume was driven by platform acquisitions, which accounted for eight deals and were responsible for 31% of the monthly deal activity

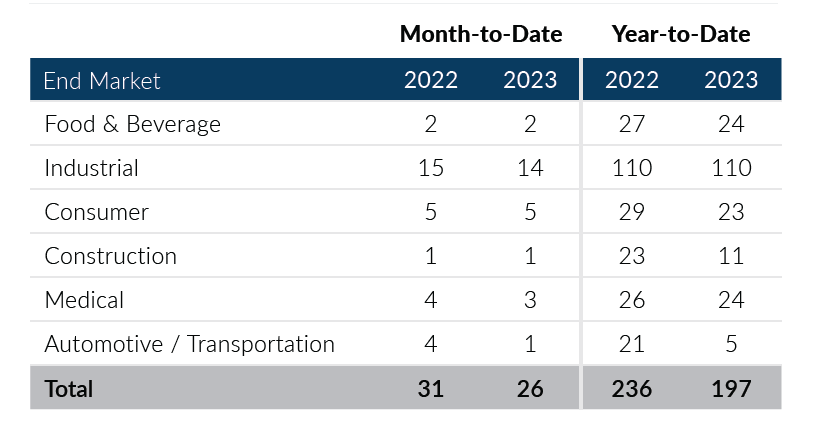

- Industrial transactions continue to drive deal volumes and accounted for over 50% of Global Plastics M&A activity for the sixth time this year

- The Injection Molding subsector recorded eight deals in the month, slightly above its year-to-date monthly average. Furthermore, the subsector is tracking near 2022 activity levels

Global Plastics M&A posted a strong Q2 and started the third quarter positively due to elevated financial buyer activity. Although strategic buyer activity decreased month-over-month, year-to-date activity remains strong. PMCF will continue to monitor buyer trends as they evolve throughout the remainder of the year. If you are a plastics company considering a merger, acquisition, sale, or recapitalization in the short or longer term please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of July 31, 2023

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

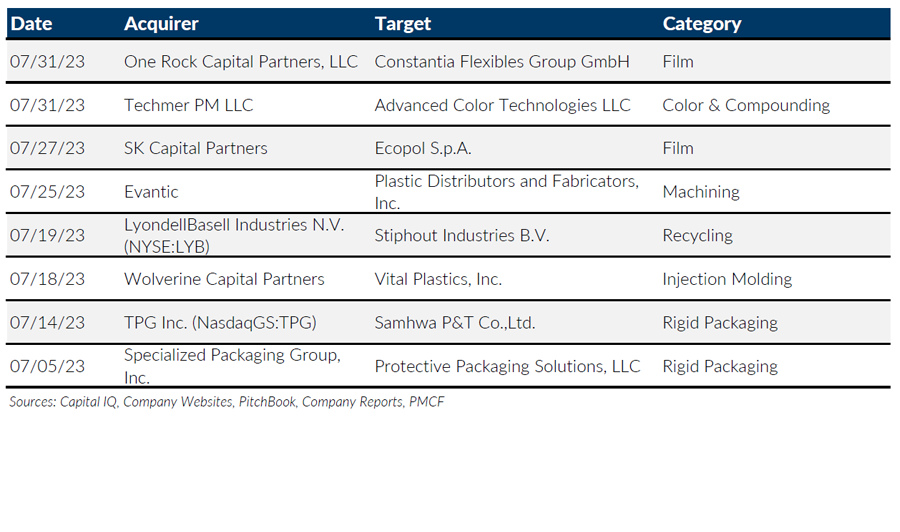

Notable M&A Activity

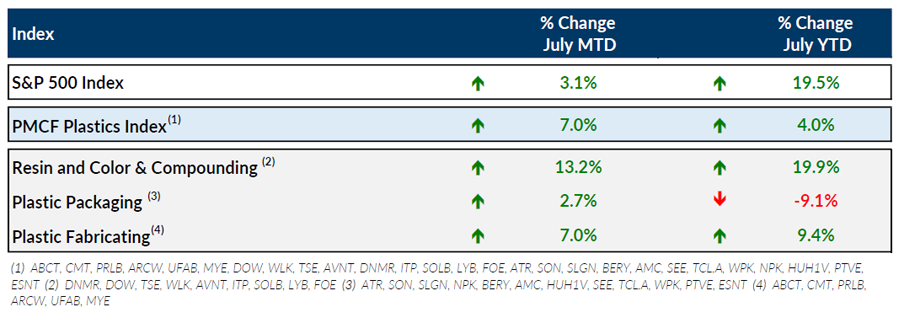

Public Entity Performance

Major News

- House Republican EPA Budget Backs Chemical Recycling, Bioplastics, Reuse (Plastics News)

https://www.plasticsnews.com/public-policy/house-republican-epa-budget-backs-chemical-recycling-bioplastics-reuse - Polystyrene, Nylon, Polycarbonate and ABS See Price Decreases (Plastics News)

https://www.plasticsnews.com/resin-pricing/latest-resin-prices-polystyrene-nylon-polycarbonate-and-abs - EPA Proposal to Cut Plastics, Chemical Plant Emissions Draws Intense Interest (Plastics News)

https://www.plasticsnews.com/public-policy/epa-proposal-cut-plastics-chemical-plant-emissions-draws-intense-interest - How the U.S. Economy Is Sticking the Soft Landing (The Wall Street Journal)

https://www.wsj.com/articles/how-the-u-s-economy-is-sticking-the-soft-landing-cf140c04?mod=economy_more_pos2 - U.S. Economic Growth Accelerates, Defying Slowdown Expectations (The Wall Street Journal)

https://www.wsj.com/articles/us-gdp-report-economic-growth-92482437?mod=economy_more_pos5

Download Plastics M&A Update – July 2023