Plastics Industry M&A Activity Tracking

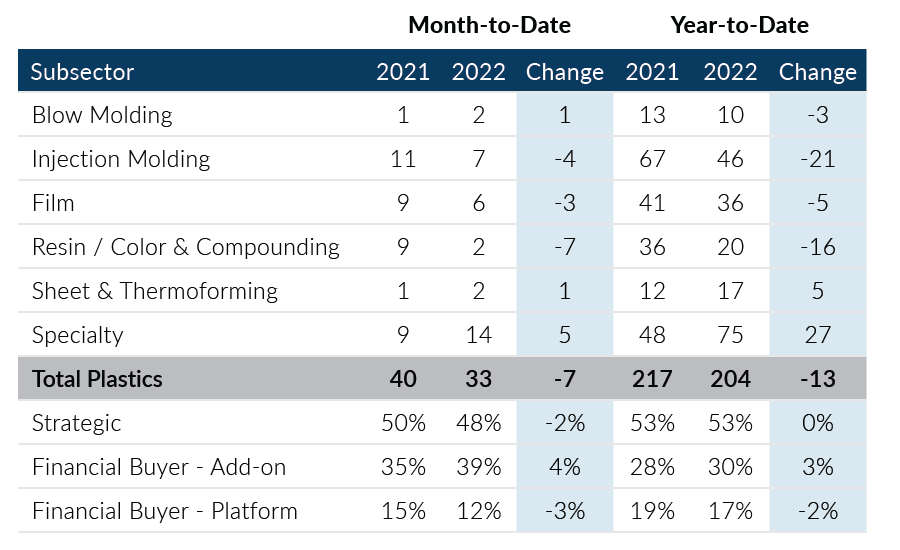

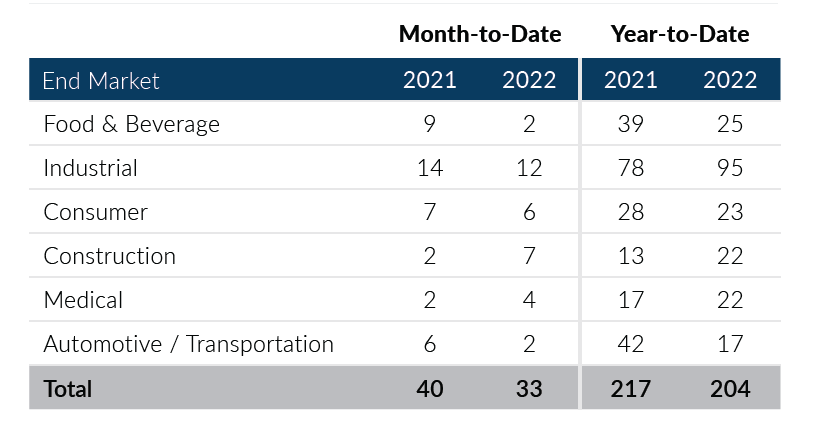

Global Plastics M&A increased for the second consecutive month in June, however, month-to-date and year-to-date activity are still below elevated levels seen in 2021. 33 transactions were recorded in the month, which is up 2 transactions from May levels. Looking back at the first half of the year, Q2 volumes were lower than Q1 levels by 24 transactions as Q1 likely benefited from 2021 carryover transactions. Despite a dip in Q2 activity, 2022 transaction volumes remain strong as even annualized Q2 activity would still surpass 2018 and 2019 levels.

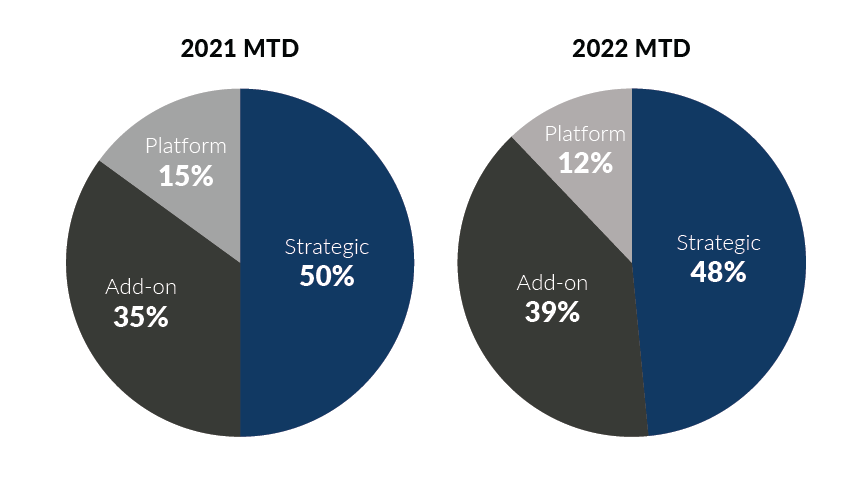

- Strategic deal activity made up 53% of the total transaction volume in H1 2022, which is on par with H1 2021. Additionally, private equity add-on transactions increased to 30% of total deal activity, up 3% over the same period in 2021

- Private equity add-on activity rebounded in June, accounting for 13 deals in the month, which is up 10 deals over May. Platform transactions slightly decreased in the month; platform private equity deals accounted for 4 deals in June, down from 9 in May

- Film transactions picked back up in June, accounting for 6 deals, or 18% of the deal volume, after only recording 3 deals in May

- The Blow Molding subsector recorded 2 transactions equaling its activity from the past 3 months and doubling May levels; transaction volumes in this subsector are slightly below 2021 levels through the first half of the year

Through H1 2022, Global Plastics M&A remains on pace to have a very strong year in 2022. Year-to-date volume sits at 204 transactions which is 13 less deals than H1 2021, but 35 more deals than H1 2019. Importantly, domestic deal activity remains robust with year-to-date volume levels exceeding even 2021 levels. If you are a plastics company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

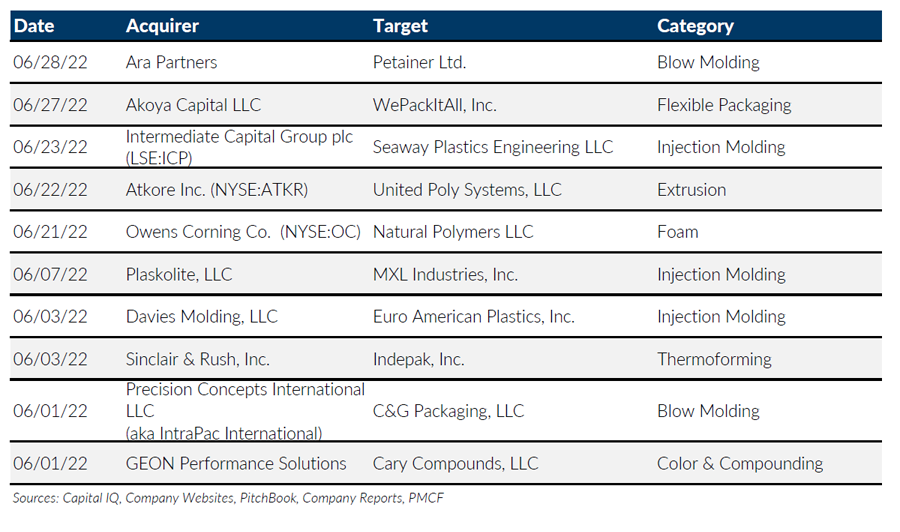

Notable M&A Activity

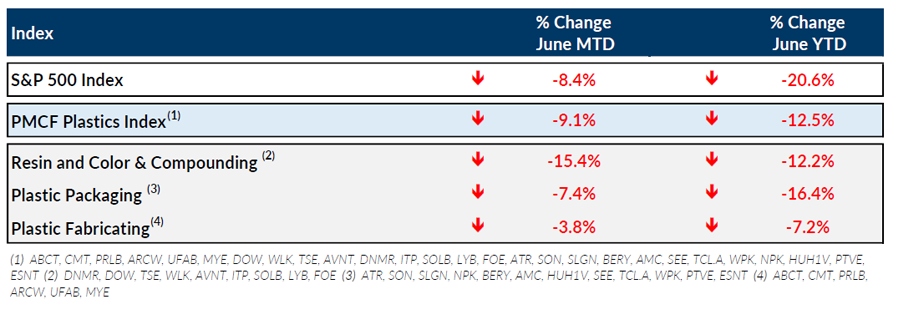

Public Entity Performance

Major News

- Supply Chain ‘Scramble’ Likely to Continue into 2023 (Plastics News)

https://www.plasticsnews.com/news/supply-chain-scramble-likely-continue-2023 - Fed Raises Rates By 0.75 Percentage Point, Largest Increase Since 1994 (Wall Street Journal)

https://www.wsj.com/articles/fed-raises-rates-by-0-75-percentage-point-largest-increase-since-1994-11655316170 - California Passes Strictest Plastics Law in US, with ERP & Recycling Targets (Plastics News)

https://www.plasticsnews.com/news/california-passes-toughest-plastics-law-us-epr-and-recycling-targets - U.S. Added 372,000 Jobs in June (WSJ)

https://www.wsj.com/articles/june-jobs-report-unemployment-rate-economy-growth-2022-11657237512 - U.S. Plastics Industry Will See Above-average Growth in 2022 (Plastics News)

https://www.plasticsnews.com/news/despite-inflation-worries-us-plastics-industry-will-see-above-average-growth-2022

Download Plastics M&A Update – June 2022