Plastics Industry M&A Activity Tracking

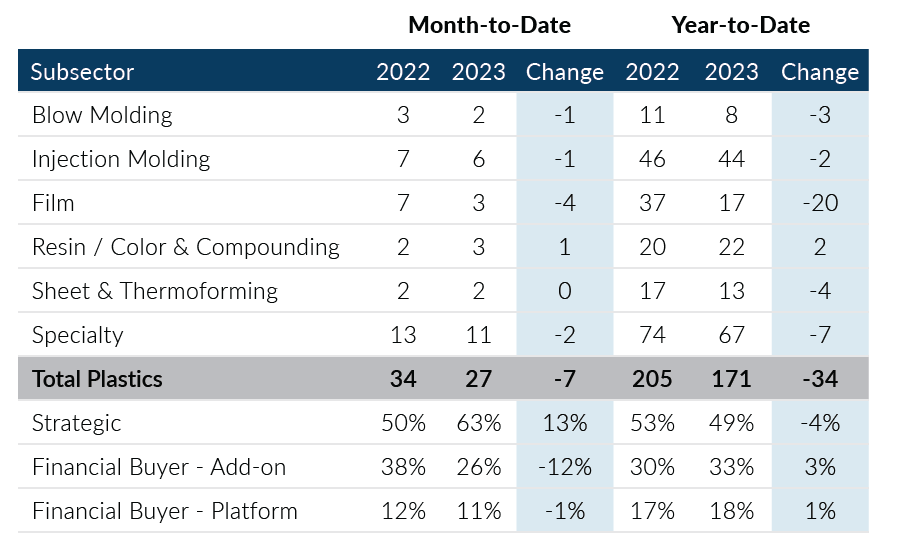

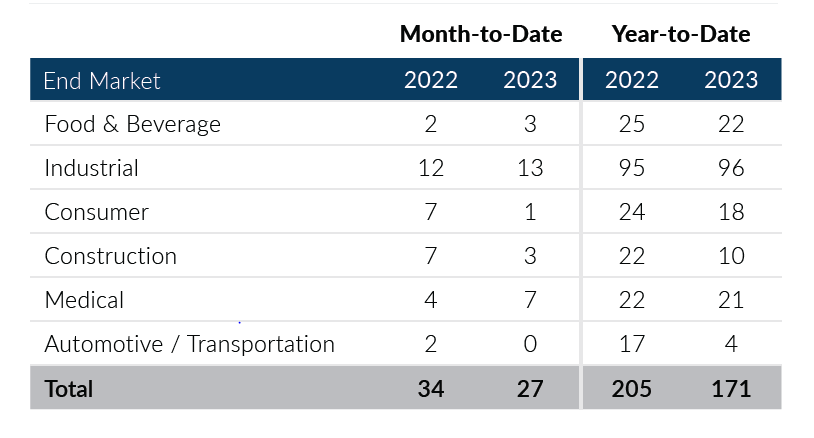

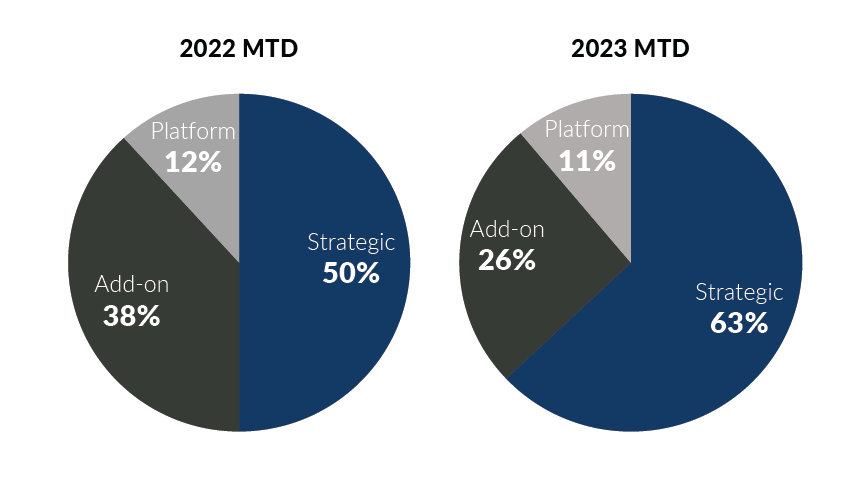

Global Plastics M&A recorded 27 deals in June, down eight from May levels, but in line with the monthly average for H1 2023. June transaction activity was driven by strategic buyers which accounted for 65% of the deal volume in the month. The first half of 2023 recorded 171 deals, which was 34 deals lower than an elevated H1 2022, but 13 deals higher than H2 2022 activity levels. Through June, it is apparent that Global Plastics M&A has slowed after strong years in 2021 and 2022, however, current levels remain in line with pre-pandemic volumes.

- In the second quarter of 2023, strategic buyers displayed an uptick in M&A activity. Overall, these buyers accounted for 84 transactions in H1 2023, 52 of which were announced in Q2 2023

- Private equity transactions pulled back in June after a strong May, recording 10 deals. While both platform and add-on acquisitions decreased month-over-month, private equity activity has been strong through the first six months of the year, recording 87 deals through June

- Industrial transactions recorded a strong first half of 2023, accounting for 56% of all deal activity. The end market averaged 16 deals per month, which is two deals higher than the average monthly volume from H2 2022 of 14

- The Color & Compounding subsector is on pace to have its most acquisitive year since PMCF began tracking Global Plastics M&A. Through June of 2023, the subsector has accounted for 17 deals, which is six higher than H1 2022

Global Plastics M&A deal volumes have experienced an uptick in each of the last two quarters as both strategic and financial buyers have become more active in pursuing M&A transactions. This rebound in M&A activity can, in part, be attributed to easing macroeconomic instability which depressed deal volumes in the second half of 2022 and the beginning of 2023. If you are a plastics company considering a merger, acquisition, sale, or recapitalization in the short or longer term please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of June 30, 2023

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

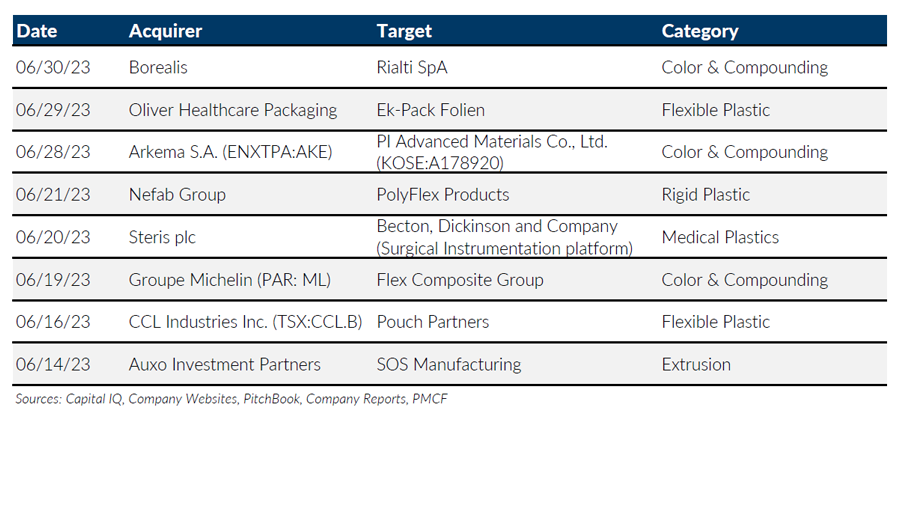

Notable M&A Activity

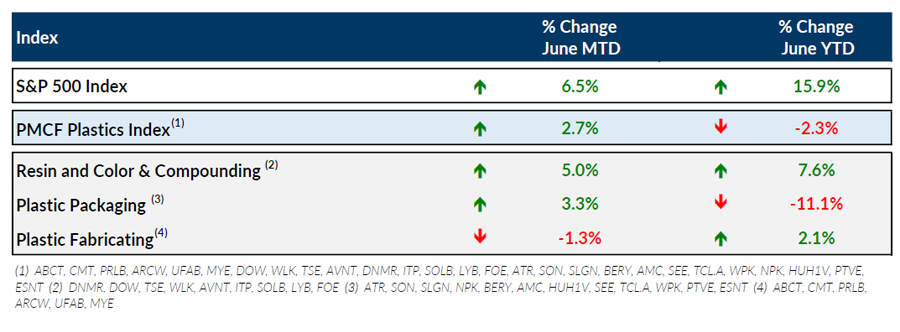

Public Entity Performance

Major News

- Recyclers See Plastics Treaty As ‘Huge’ Chance for Change (Plastics News)

https://www.plasticsnews.com/news/global-plastics-treaty-huge-chance-change-association-plastic-recyclers-say - PN Pricing Chart Sees June Drops, Nonmarket Corrections (Plastics News)

https://www.plasticsnews.com/resin-pricing/resin-prices-june-2023-see-drop-nonmarket-corrections - Plastics M&A slumps in Uncertain Economy (Plastics News)

https://www.plasticsnews.com/mergers-acquisitions/plastics-ma-slumps-uncertain-economy - Inflation Eased to 3% in June, Slowest Pace in More Than Two Years (The Wall Street Journal)

https://www.wsj.com/articles/consumer-price-index-report-june-inflation-ede7f4b1?mod=economy_more_pos14 - U.S. Economy Shows Surprising Vigor in First Half of 2023 (The Wall Street Journal)

https://www.wsj.com/articles/u-s-economy-shows-surprising-vigor-in-first-half-of-2023-1a8a32eb?mod=economy_more_pos31

Download Plastics M&A Update – June 2023