Plastics Industry M&A Activity Tracking

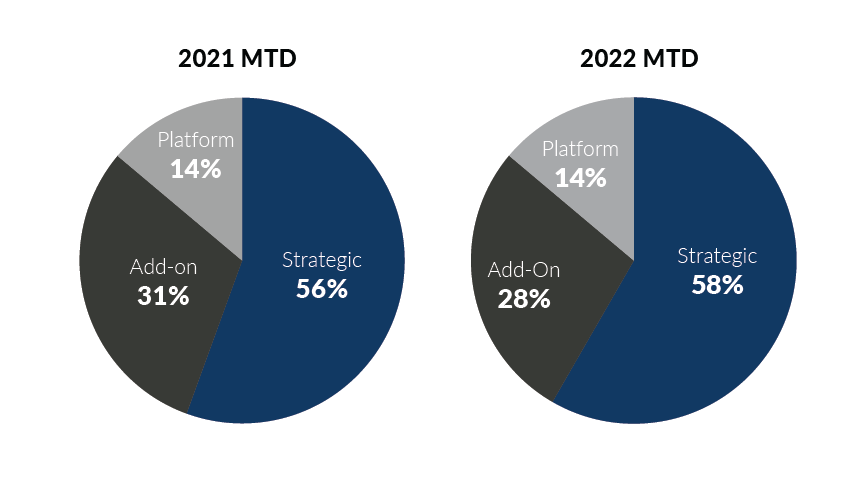

Global Plastics M&A continued its strong start to the year, recording 36 deals in March which was up from 31 transactions recorded in February. Transaction activity through the first quarter has been driven by active strategic buyers which have accounted for 51% of the deal volume through the first three months of the year. Overall, plastics M&A has matched the elevated level of activity seen in the first quarter of 2021 despite some uncertainty in the market.

- For the second month in a row, strategic buyers exceeded 20 transactions with public companies accounting for 7 deals in the month

- Private equity transactions increased by 4 deals month-over-month as financial buyers returned to the market in March after a slow month in February

- Specialty transactions including machinery, distribution, foam, and profile extrusion deals posted 11 deals in the month and have recorded 39 deals through the beginning of the year

- Resin and Color & Compounding deals accounted for 14% of the transaction volume in March and have matched 2021 levels on a year-to-date basis

- Medical transactions have accounted for 15 deals through the first quarter of the year which is an increase of 4 deals year-over-year

Global Plastics M&A concluded the first quarter of 2022 by notching over 30 transactions in each of the first three months. Elevated transaction volumes confirm the favorable M&A market conditions experienced throughout 2021 in plastics. The transaction activity for the full year 2021 will be tough to replicate, but 2022 is currently on track. If you are a plastics company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

Notable M&A Activity

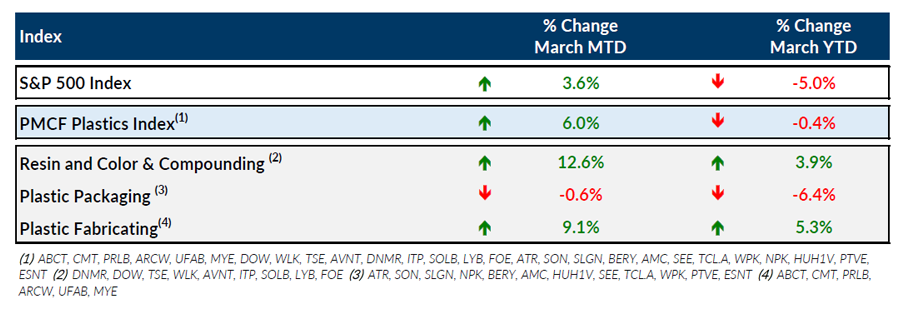

Public Entity Performance

Major News

- Resin Prices on the Rise (Plastics News)

https://www.plasticsnews.com/news/resin-prices-rise-supply-chain-ukraine-and-production-all-blame - Numbers That Matter: Interest Rates, Energy Costs, Uncertainty All on the Rise (Plastics News)

https://www.plasticsnews.com/news/interest-rates-energy-costs-uncertainty-all-rise - U.S. March Jobs Report Shows Strong Hiring Momentum (Wall Street Journal)

https://www.wsj.com/articles/march-jobs-report-unemployment-rate-2022-11648766857 - Some Plastics Firms Leave Russia Over Ukraine Crisis (Plastics News)

https://www.wsj.com/articles/sec-to-float-mandatory-disclosure-of-climate-change-risks-emissions-11647874814 - SEC Floats Mandatory Disclosure of Climate-Change Risks, Emissions (Wall Street Journal)

https://www.wsj.com/articles/sec-to-float-mandatory-disclosure-of-climate-change-risks-emissions-11647874814

Download Plastics M&A Update – March 2022