Plastics Industry M&A Activity Tracking

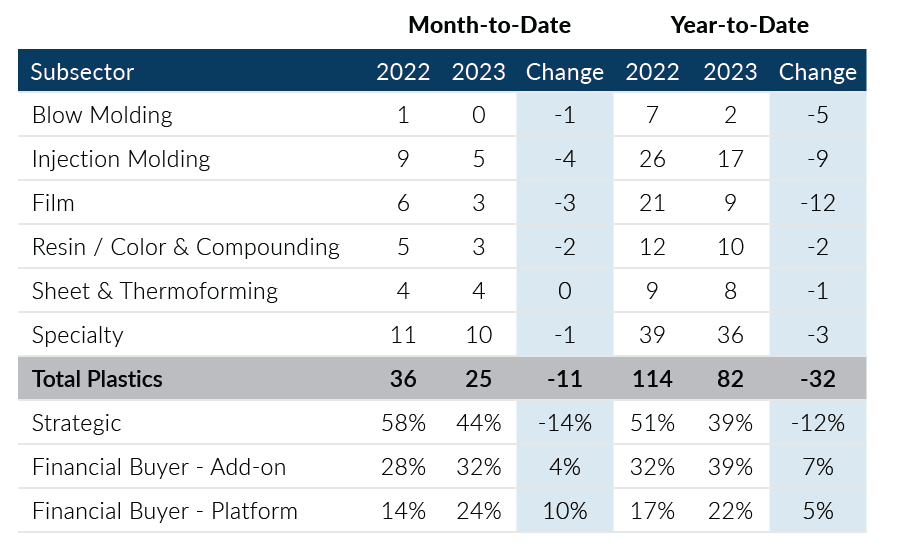

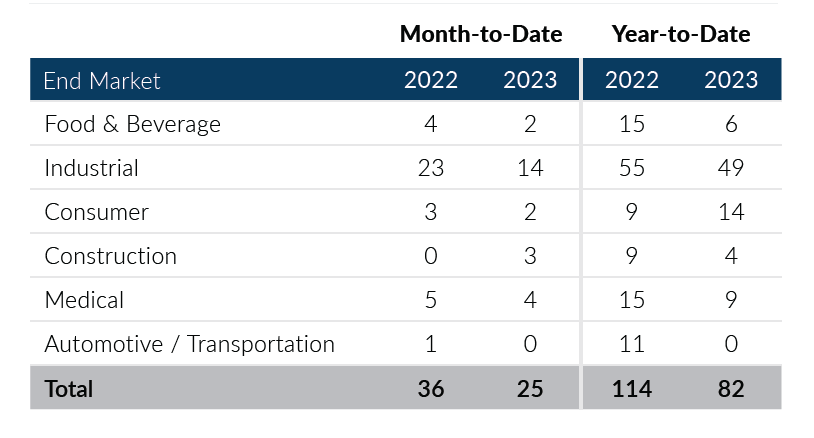

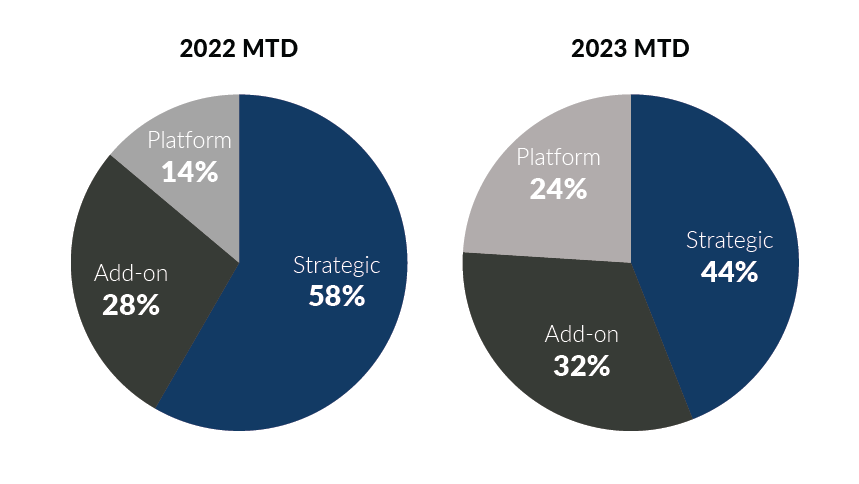

Global Plastics M&A had a slow finish to the quarter in March, recording 25 deals in the month which was consistent with February volume levels. Deal activity through the first quarter of 2023 was driven primarily by private equity add-on acquisitions, which accounted for 39% of the total volume compared to 32% last year. The 82 deals recorded in Q1 2023 were in line with Q1 levels prior to the pandemic but remain below the elevated Q1 2021 and 2022 levels.

- Platform acquisitions rebounded from the low activity levels witnessed in Q4 2022. In Q1 2023, platform buyers recorded 18 deals and accounted for 22% of deal activity, up from 11% in Q4 2022 and 17% in Q1 2022

- Strategic buyer transactions have reported lower activity in Q1 2023, accounting for 39% of deal volume compared to 51% last year

- Specialty transactions, including machinery, distribution, foam, and profile extrusion deals, recorded a slight decline in transaction volume in March but was the best-performing subsector in Q1 2023

- Foreign transactions accounted for 16 deals, or 64% of deal activity, in March 2023, representing the first time since July of 2022 that foreign transactions have produced more deal flow than domestic transactions

Global Plastics M&A concluded the first quarter of the year averaging over 27 transactions in each month and tracking toward pre-pandemic activity levels experienced in 2018 and 2019. Although uncertainty in the economy and difficulties with acquisition financing have created some challenges for deal-making, buyers and sellers remain motivated to get plastics deals done. If you are a plastics company considering a merger, acquisition, sale, or recapitalization in the short or longer term please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of March 31, 2023

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

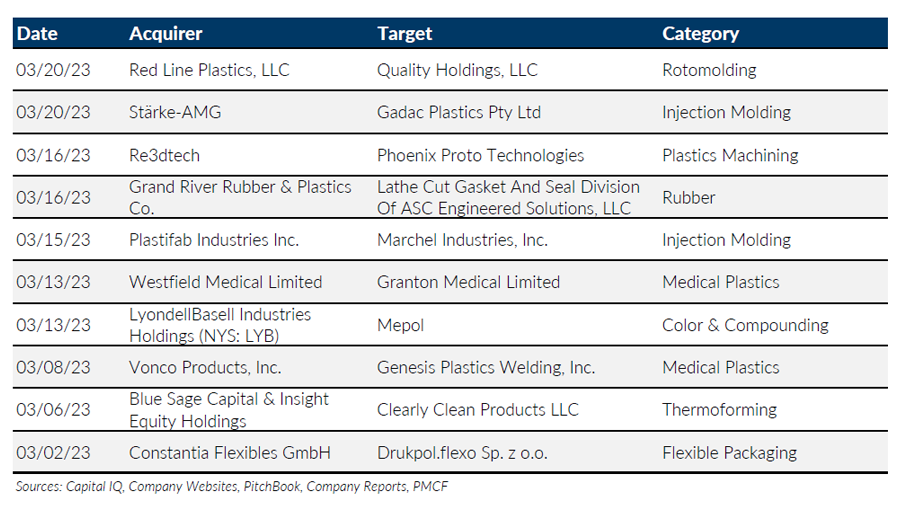

Notable M&A Activity

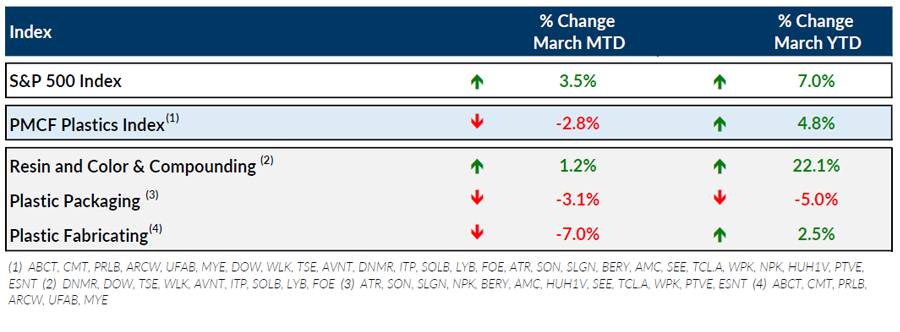

Public Entity Performance

Major News

- U.S. Plastics Machinery Shipments Pick Up at End of 2022 (Plastics News)

https://www.plasticsnews.com/news/us-plastics-machinery-shipments-pick-end-2022 - Industry Sees Biden Bioplastics Goal as Serious Signal (Plastics News)

https://www.plasticsnews.com/news/industry-response-bidens-bioplastics-goal-important-signal - Commodity Prices Rise; Engineering Resins Drop (Plastics News)

https://www.plasticsnews.com/resin-pricing/commodity-resin-prices-rise-engineering-resin-prices-drop - U.S. Bank Failures Pose Risk to Global Growth (The Wall Street Journal)

https://www.wsj.com/articles/u-s-bank-failures-pose-risk-to-global-growth-1baafd89?mod=Searchresults_pos14&page=1 - March Jobs Report Shows Hiring Gradually Cooling (The Wall Street Journal)

https://www.wsj.com/articles/march-jobs-report-unemployment-rate-economy-growth-2023-3338931f?mod=economy_more_pos2

Download Plastics M&A Update – March 2023