Plastics Industry M&A Activity Tracking

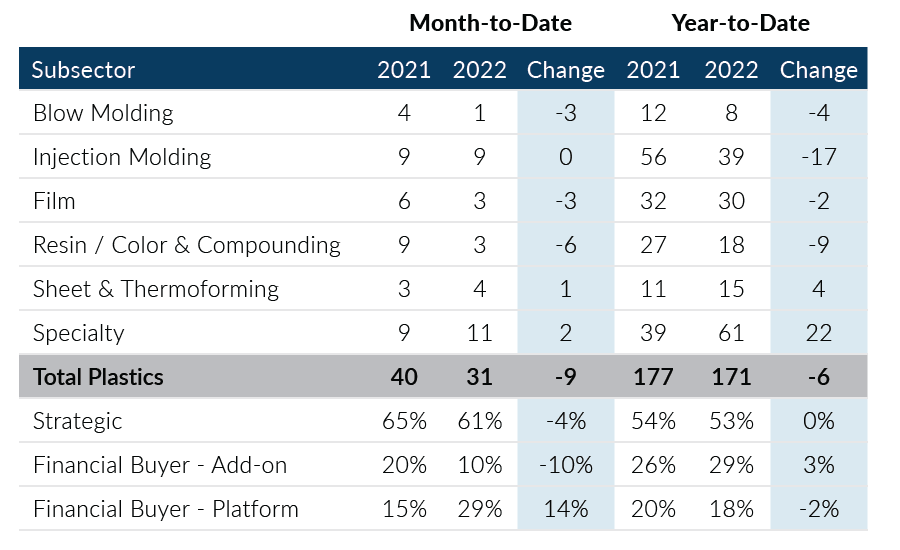

Global Plastics M&A recorded the second straight month lower than last year after a very strong first quarter 2022. We recorded 31 transactions for the month, which is up 5 transactions from April levels. PMCF is monitoring the current macroeconomic environment for any potential impact on Plastics M&A in the short-term. Currently, the M&A market in plastics remains strong, but annual volume is trending to be lower than the elevated levels experienced in 2021.

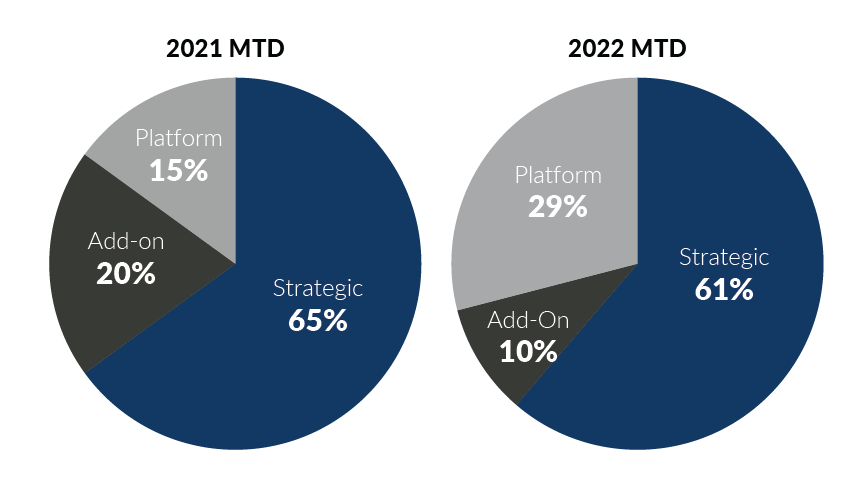

- Private equity add-on activity dipped in May, however, platform transaction volume rose in the month; platform private equity deals accounted for 9 deals in the month, which is up from 3 in April

- Public strategic buyers accounted for 12 deals in the month; this is the second month in a row that public buyers accounted for 10 or more deals as strategic buyer activity as percent of total volume increased month-over-month

- Sheet & Thermoforming transactions bounced back in May, accounting for 4 deals, or 13% of the deal volume, after only recording 2 deals in April

- 9 Injection Molding deals were recorded in May 2022 which was equal to May 2021 levels and an increase of 5 transactions month-over-month

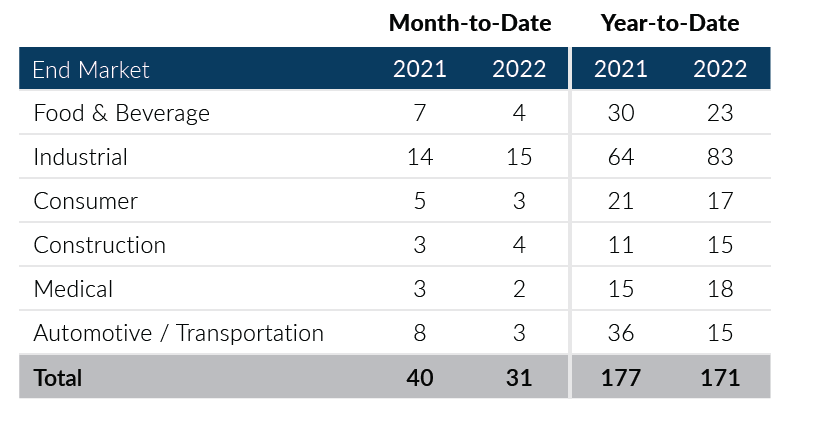

- Automotive deal activity which has been slow through the year-to-date increased in May, accounting for 10% of the deal volume after accounting for only 4% in April

Global Plastics M&A transaction volume has cooled down relative to the elevated activity of 2021, but continues to outpace pre-pandemic levels. Given recent activity, Plastics M&A volume in the second half of 2022 will likely be lower than 2021. With that being said, if the current levels continue, 2022 should still be a strong year overall. If you are a plastics company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

Notable M&A Activity

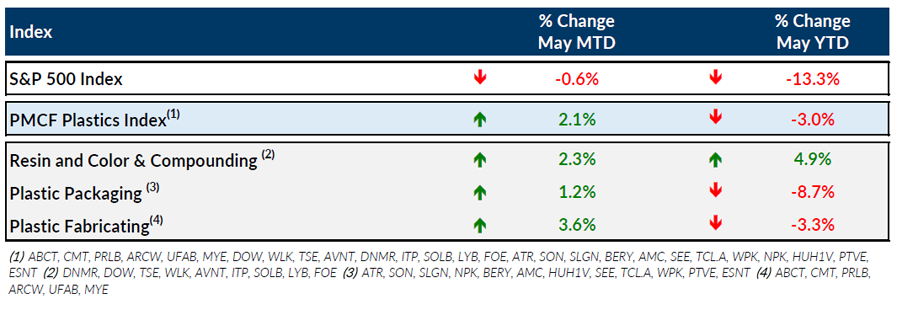

Public Entity Performance

Major News

- Some Materials Stocks Outperforming Market

https://www.plasticsnews.com/one-good-resin/some-materials-stocks-outperforming-market - Global Supply Chain Pressure Index: May 2022 Update (Liberty Street Economics)

https://libertystreeteconomics.newyorkfed.org/2022/05/global-supply-chain-pressure-index-may-2022-update - Feedstock Costs Prompt Rising Resin Prices in Europe

https://www.plasticsnews.com/resin-pricing/polymer-resin-prices-europe-rise-amid-feedstock-costs - Reshoring Institute Executive: Expect Supply Chain ‘Chaos’ to Prompt Domestic Spending (Plastics News)

https://www.plasticsnews.com/news/domestic-spending-should-get-boost-supply-chain-chaos-continues - Rapid Pace of U.S. Job Growth Stretched Into April (Wall Street Journal)

https://www.wsj.com/articles/april-jobs-report-unemployment-rate-2022-11651789328

Download Plastics M&A Update – May 2022