Plastics Industry M&A Activity Tracking

Global Plastics M&A recorded 35 deals in May, making it the most active month from a deal volume standpoint since March of last year. Both strategic and financial buyers contributed to the higher levels of M&A activity, accounting for a near-equal split of the overall deal volume. Over the past three months, deal volumes have trended in a positive direction as buyers have increased their activity in the space. Overall, 2023 activity has been more stable in comparison to Q4 2022, and increasing volumes signify an improvement in the Plastics M&A market.

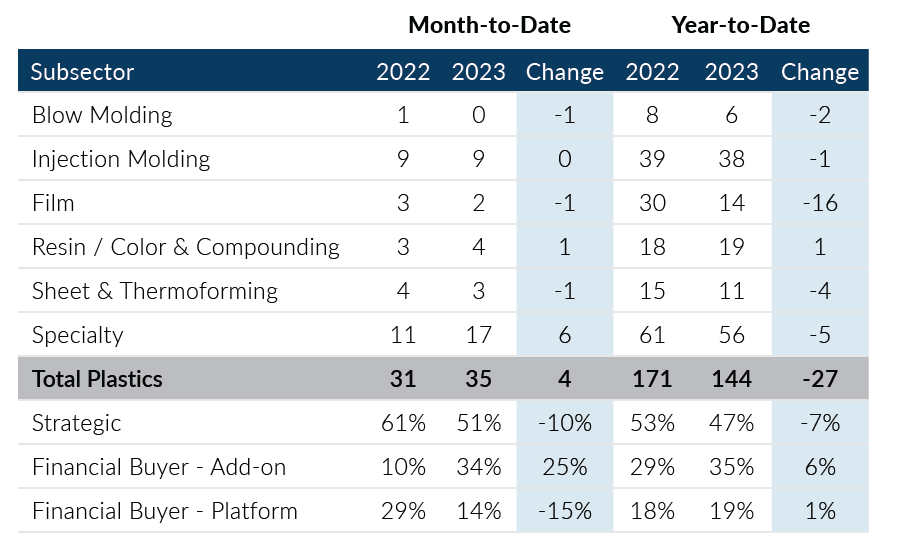

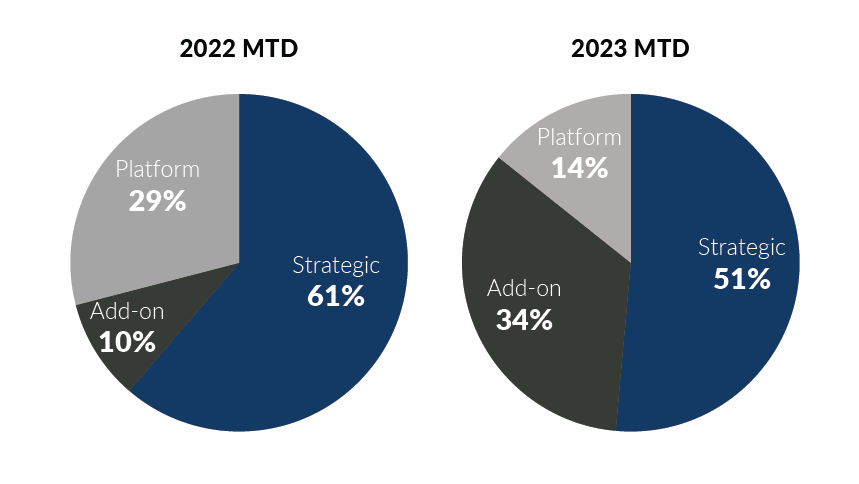

- Strategic buyer activity through May of 2023 has been lower than historical levels, however, this buyer group accounted for over 50% of deal volume for the second month in a row which was an encouraging sign for the Plastics M&A market

- Private equity add-on transactions rebounded after a soft April by doubling last month’s volume. Notably, this group of buyers posted their most active month since January of this year, and continues to generate activity above historical levels

- Much of the elevated activity in May was due to a large increase in Specialty deals with a significant amount of composites and machinery deals being announced in the month; 17 of the 35 deals announced in the month could be attributed to Specialty transactions

- The Injection Molding subsector continues to experience high levels of deal volume in 2023, with activity through May of 2023 nearly matching the elevated levels seen in 2022

Global Plastics M&A has shown positive momentum through May of 2023 after a lower second half of 2022. Volumes are below the elevated activity experienced in the first half of 2022, but are on pace to exceed pre-COVID M&A levels if current trends continue. From a buyer standpoint, strategics have been less active likely due to macroeconomic challenges while private equity add-ons have increased activity. If you are a plastics company considering a merger, acquisition, sale, or recapitalization in the short or longer term please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of May 31, 2023

Plastics M&A By Subsector

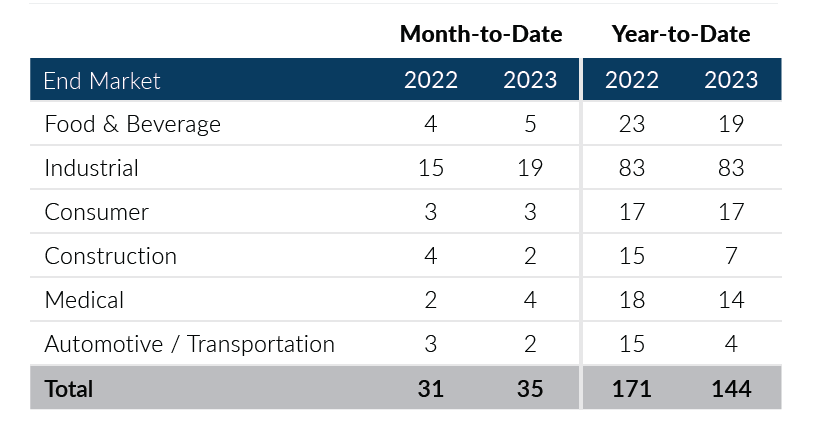

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

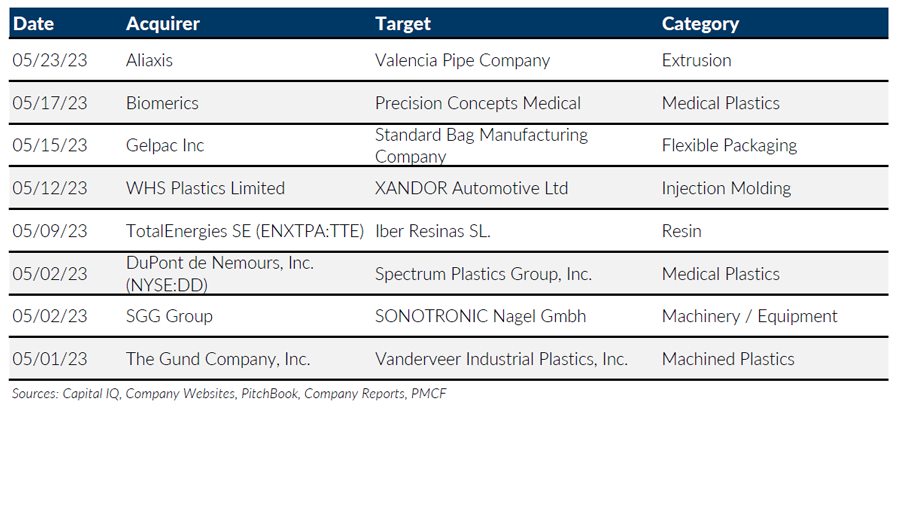

Notable M&A Activity

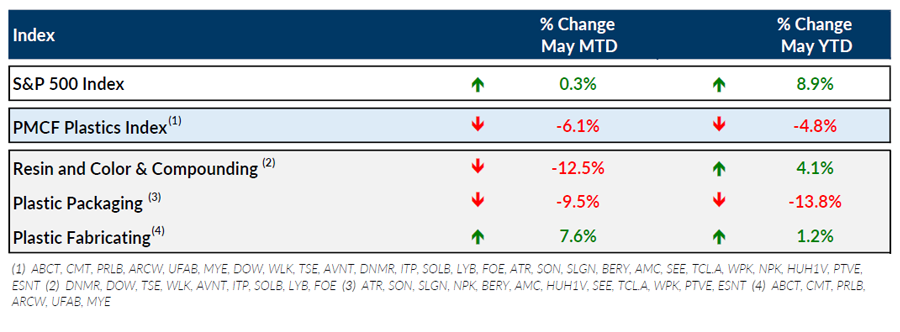

Public Entity Performance

Major News

- Global Plastics Recycling Market to Grow 50% by 2030, Report Says (Plastics News)

https://www.plasticsnews.com/news/global-plastics-recycling-grow-50-2030-report-says - PVC, PS Prices Take Opposite Paths in May (Plastics News)

https://www.plasticsnews.com/resin-pricing/pvc-prices-drop-ps-rises-may - Value of Plastics Machinery Shipments Up From Start of 2022 (Plastics News)

https://www.plasticsnews.com/news/plastics-machinery-numbers-edge-2022 - Inflation Eased in April but Remains Stubbornly High (The Wall Street Journal)

https://www.wsj.com/articles/us-inflation-april-2023-consumer-price-index-48f0eac5?mod=Searchresults_pos2&page=1 - Robust Hiring in April Shows U.S. Job Market Remains Hot in Cooling Economy (The Wall Street Journal)

https://www.wsj.com/articles/april-jobs-report-unemployment-rate-economy-growth-2023-a500d302?mod=Searchresults_pos14&page=1

Download Plastics M&A Update – May 2023