Plastics Industry M&A Activity Tracking

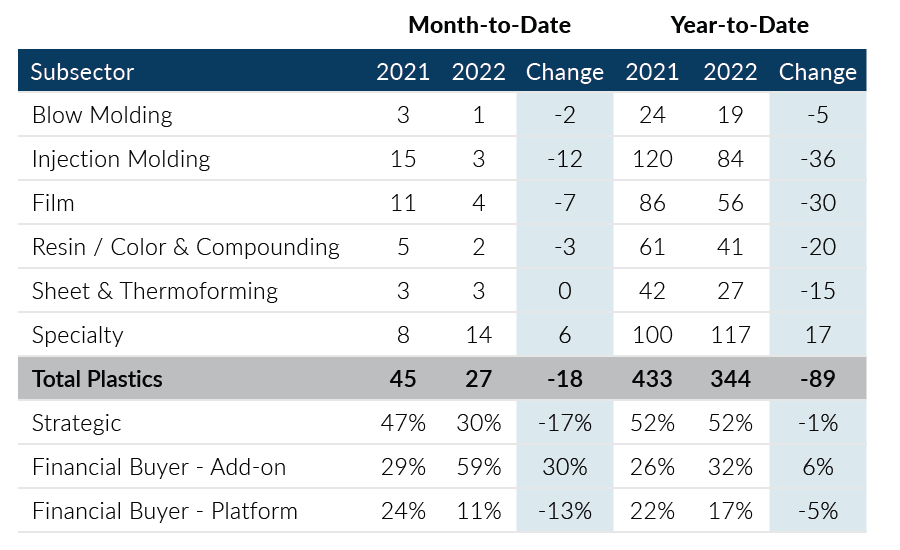

Global Plastics M&A activity rebounded in November, recording 27 transactions, which was an increase of seven deals over October levels. Despite the strong month-over-month performance, November marks the third consecutive month with less than 30 transactions recorded and still falls well below last year’s activity levels. In the last few months, Plastics M&A activity has slowed down as buyers and sellers deal with uncertainty in the macroeconomy and challenges with acquisition debt financing.

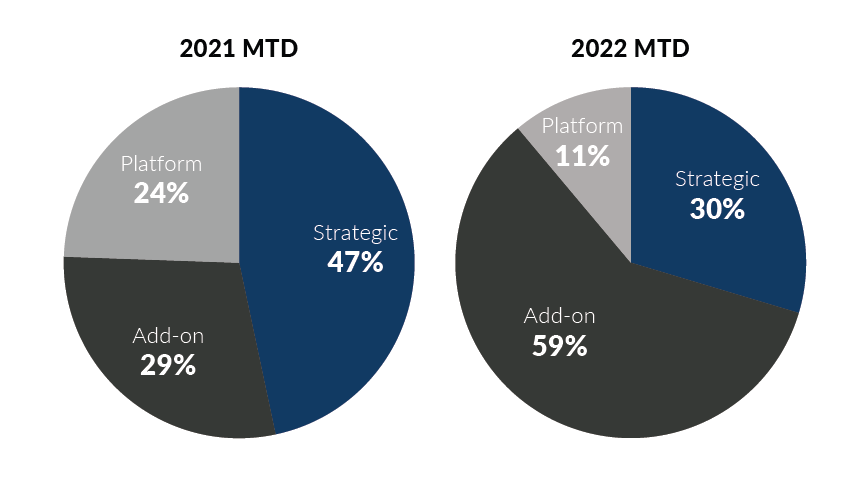

- Private equity add-on transactions surged in the month, making November the second most active month of the year for add-on acquisitions. Private equity platform transactions continue to be suppressed but did show some improvement over last month

- Strategic buyers’ activity was lower for the second consecutive month in November. Current levels are 50% lower than the average monthly transaction volume in 2022

- The Injection Molding subsector regressed in the month, recording the lowest monthly transaction volume for the year

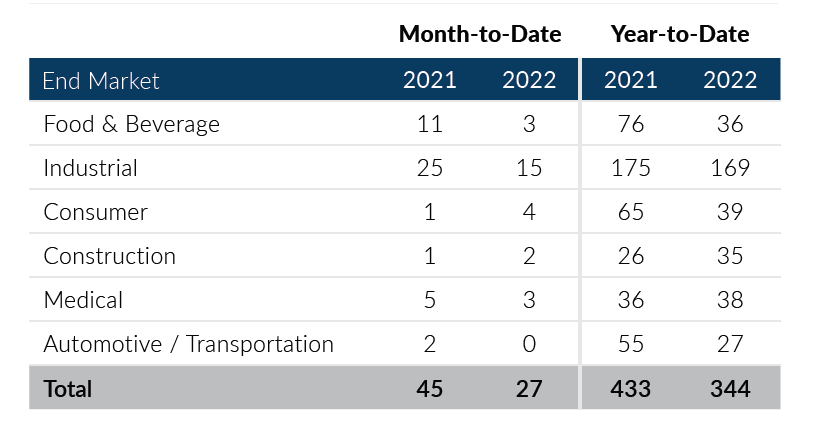

- The Industrial end market led all end markets in transaction activity for the 14th consecutive month, recording 15 deals

- The Consumer end market accounted for 15% of the deal activity for the month which is noticeably higher than the 12% levels reported on a year-to-date basis

Global Plastics M&A activity continues to be lower overall, but an increase in private equity add-on acquisitions was a positive trend for the month of November. Financing challenges continue to suppress private equity platform transactions and, in many cases, have constrained larger transactions. The fourth quarter of 2022 is turning out to be much different than the M&A frenzy experienced last year. If you are a plastics company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of November 30, 2022

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

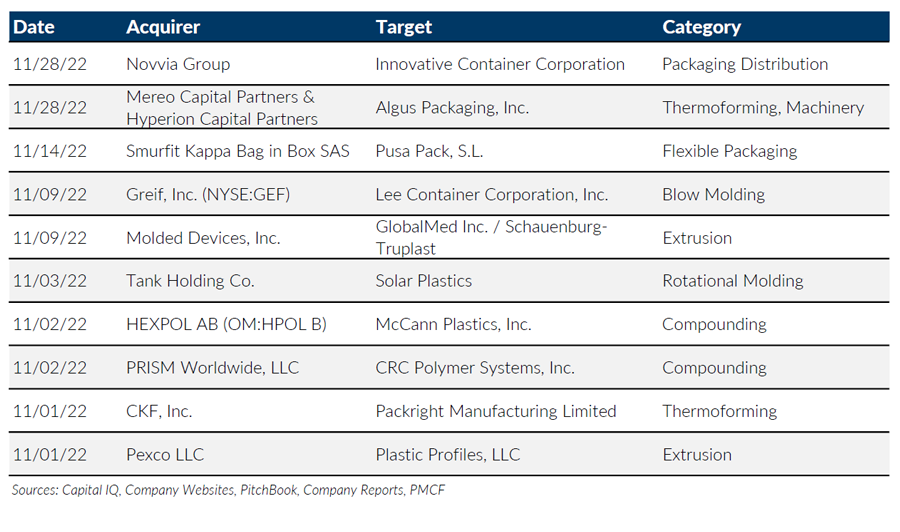

Notable M&A Activity

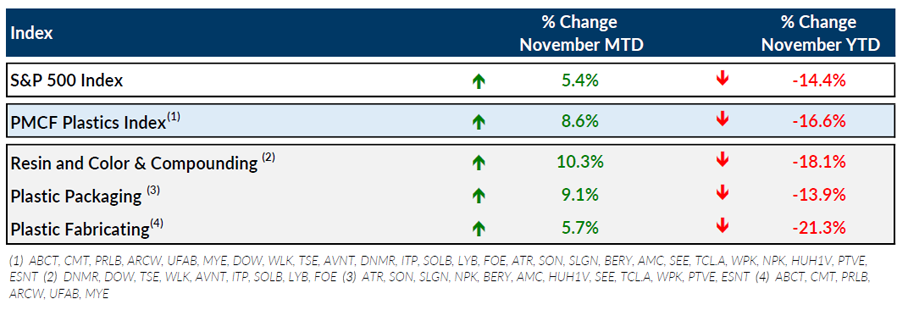

Public Entity Performance

Major News

- Plastics with a Positive Perspective (Plastics News)

https://www.plasticsnews.com/news/plastics-positive-perspective - Production Cutbacks Leading to Better Market Balance (Plastics News)

https://www.plasticsnews.com/resin-pricing/europe-resin-prices-getting-better-market-balance-production-cutbacks - Fed Minutes Show Most Officials Favored Slowing Rate Rises Soon (Wall Street Journal)

https://www.wsj.com/articles/fed-minutes-show-most-officials-favored-slowing-rate-rises-soon-11669230432 - Most Commodity Prices Drop, but PE Stays Flat (Plastics News)

https://www.plasticsnews.com/resin-pricing/most-commodity-prices-drop-pe-stays-flat - Third-Quarter US Growth Was Stronger Than Previously Thought (Wall Street Journal)

https://www.wsj.com/articles/job-openings-hiring-economy-october-2022-11669755543

Download Plastics M&A Update – November 2022