Plastics Industry M&A Activity Tracking

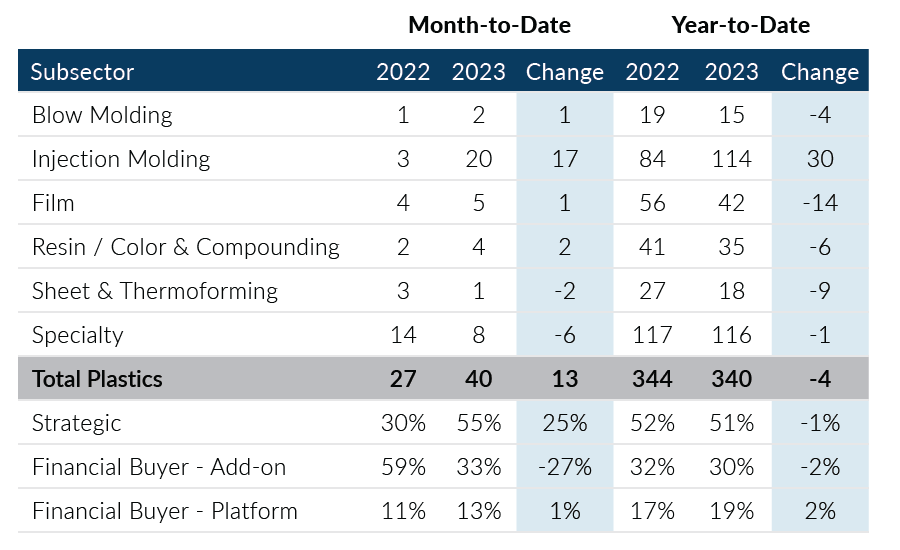

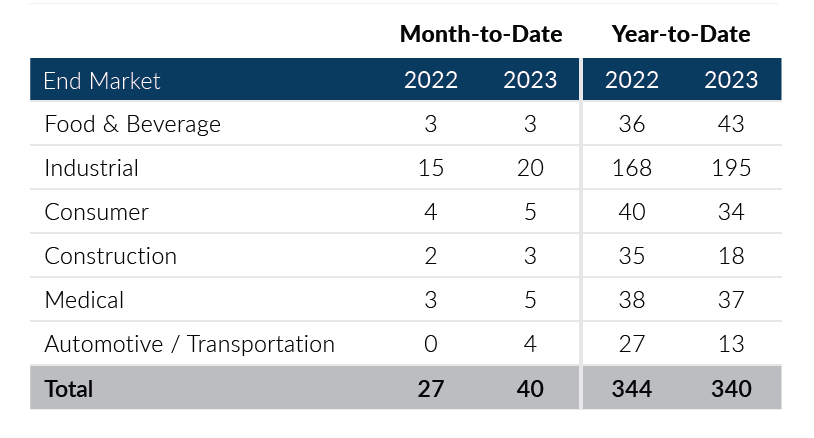

Global Plastics M&A recorded 40 deals in November, which marked the highest level of monthly deal activity in 2023. Both financial and strategic buyers exhibited strong demand and were dually responsible for the robust monthly deal activity. Strategic buyers posted over 20 deals for a second consecutive month. Meanwhile, elevated add-on acquisition activity drove financial buyer deal volumes. In November, foreign deals were significantly higher than domestic transactions which deviated from activity trends exhibited in the first three quarters.

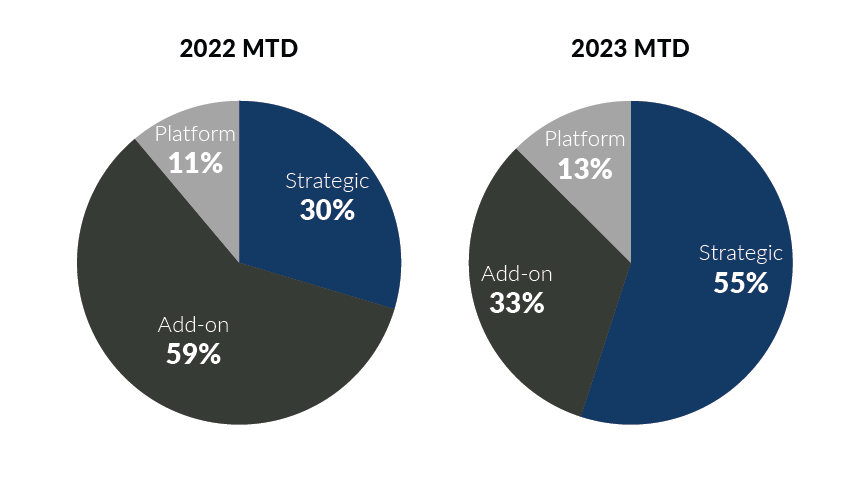

- Strategic buyers recorded 22 deals in November, which resulted in the second most active month of the year for this group. October and November marked the only months of the year in which strategic buyers have recorded 20 or more deals

- Private equity buyers recorded 18 deals in the month, up five from the prior month. A majority of financial deal activity was driven by add-on acquisitions, which recorded 13 of the 18 transactions, marking the second most active month of the year for add-on transactions

- Part of the recent uptick in deal activity is being driven by increased foreign M&A activity, which accounted for 60% of the total monthly transaction volume

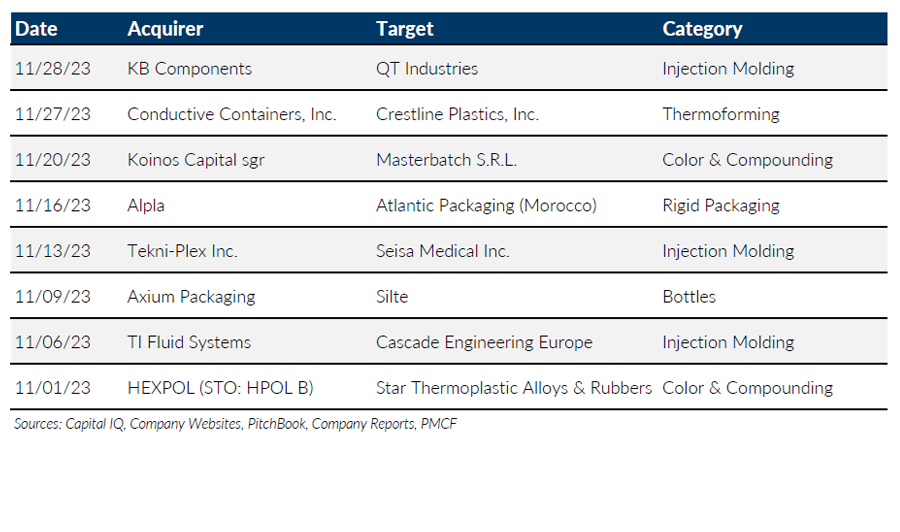

- The Injection Molding subsector posted double-digit transactions for the fourth consecutive month and accounted for 50% of total deal activity. The subsector is on pace to record its second most active year on record

Global Plastics M&A continued its four-month run of elevated deal activity in November. Improving macroeconomic conditions and outlook have helped fuel higher transaction activity. Consecutive months of strong deal activity are a reason for optimism as 2023 looks to surpass 2022 deal volumes, and pent-up demand appears to be a driving higher levels of deals to the market. If you are a plastics company considering a merger, acquisition, sale, or recapitalization in the short or longer term please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of November 30, 2023

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

Notable M&A Activity

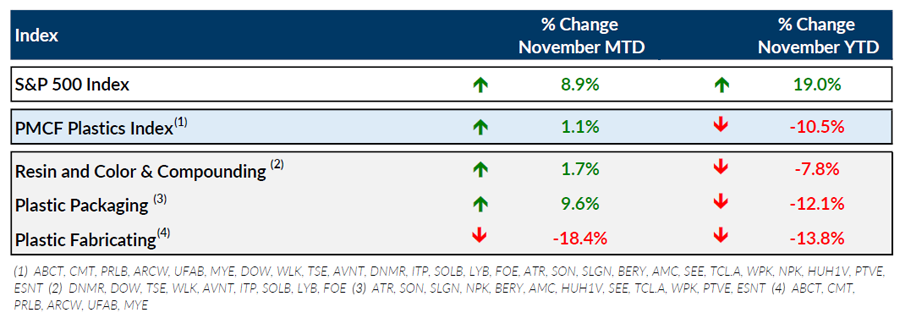

Public Entity Performance

Major News

- What’s Next After ‘Disappointing’ Plastics Treaty Talks? (Plastics News)

https://www.plasticsnews.com/public-policy/plastics-treaty-talks-were-disappointing-so-whats-next - Canada’s Listing of Plastics as Toxic Ruled ‘Unreasonable and Unconstitutional’ by Court (Plastics News)

https://www.plasticsnews.com/public-policy/toxic-plastic-products-canadian-declaration-ruled-unreasonable-and-unconstitutional - Inflation’s Cooldown Gives the Fed Leeway (The Wall Street Journal)

https://www.wsj.com/economy/central-banking/inflations-cooldown-gives-the-fed-leeway-ae6f6e84 - Reusable Packaging Can Compete on Price with Single-Use, MacArthur Foundation Says (Plastics News)

https://www.plasticsnews.com/news/reusable-packaging-can-compete-price-single-use-macarthur-foundation-says - Economy’s Soft Landing Comes Into View as Job Growth Slowly Descends (The Wall Street Journal)

https://www.wsj.com/economy/jobs/jobs-report-november-2023-us-economy-59125cde?mod=jobs_news_article_pos5

Download Plastics M&A Update – November 2023