Plastics Industry M&A Activity Tracking

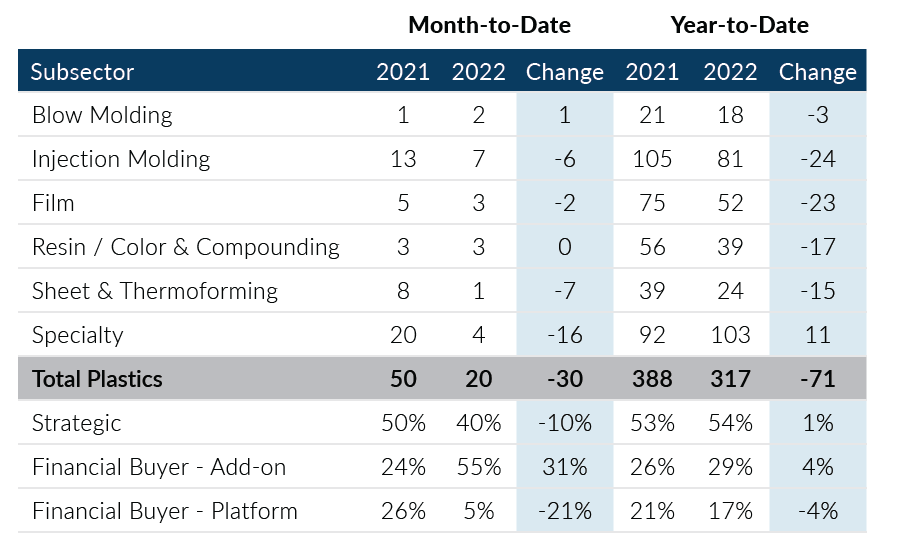

Global Plastics M&A activity had its lowest month of the year from a deal volume standpoint, totaling 20 transactions in the month. October marks the second consecutive month that transaction volumes fell below 30. Weaker activity in the month was driven by a steep decline in private equity platform investments and strategic acquisitions. While Plastics M&A activity levels were strong through the first three quarters of the year, challenging capital markets and uncertainty in the macroeconomy appear to be affecting Plastics M&A transaction volumes.

- Strategic buyers recorded eight transactions in October, down nine deals from September levels. October volumes were the lowest monthly total since May 2020

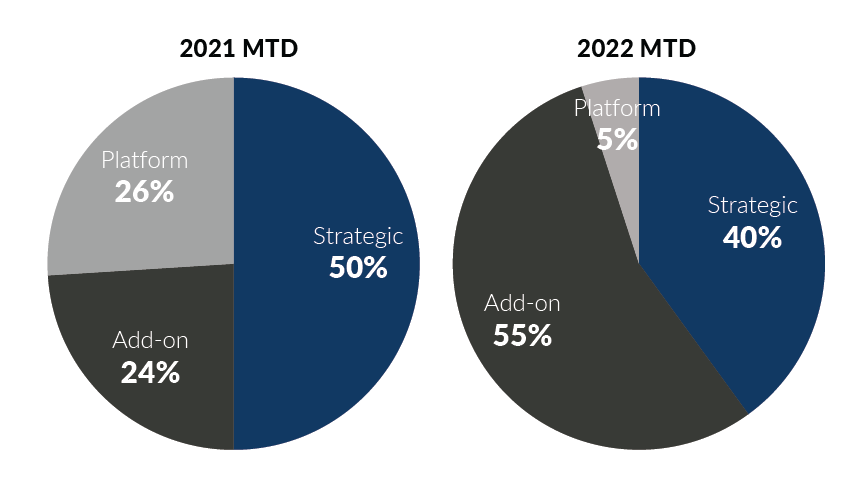

- Only one private equity platform deal was completed in October, marking the worst month on the year for platform transaction activity. Private equity add-on investments, however, had their third-best month of the year from a volume standpoint recording 11 transactions in October

- The Injection Molding subsector posted seven transactions for a third consecutive month in October. Furthermore, the Injection Molding subsector recorded more deals than any other subsector for the second time this year

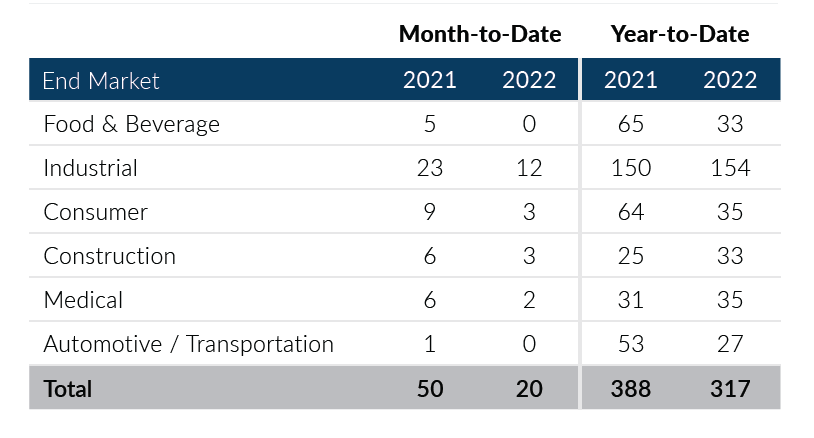

- The Industrial end market accounted for over 50% of deal volume for the third time this year, recording 12 transactions in October. Nevertheless, the end market recorded three deals less than its average monthly transaction volume for the year

Global Plastics M&A has seen a decline in activity for the second consecutive month which is consistent with the broader M&A market that has been impacted in part by a pullback in financing for M&A transactions. Plastics deals are still getting done at attractive multiples but the mix is in favor of private equity add-ons or strategic transactions where capital markets are not as much of a factor. If you are a plastics company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of October 31, 2022

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

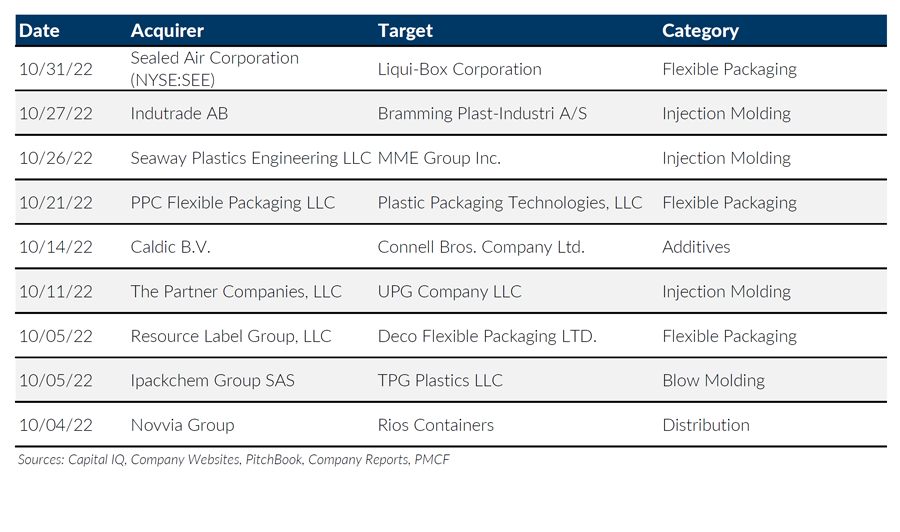

Notable M&A Activity

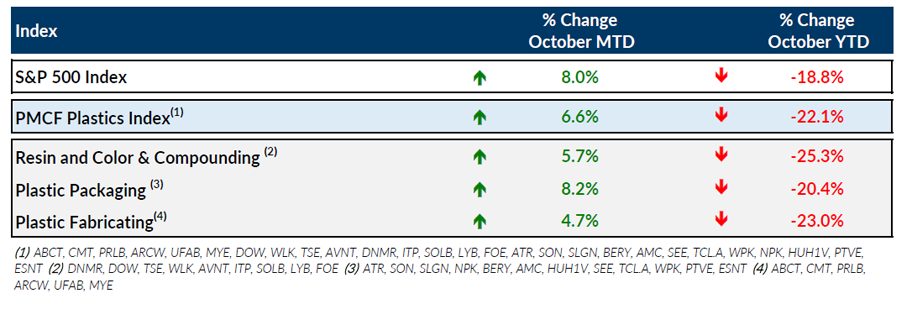

Public Entity Performance

Major News

- Strong US Dollar Impacting Global Plastic Sectors (Plastics News)

https://www.plasticsnews.com/news/strong-us-dollar-impacting-global-plastics-sectors - U.S. Economy Grew 2.6% in Third Quarter, GDP Report Shows (Wall Street Journal)

https://www.wsj.com/articles/us-gdp-economic-growth-third-quarter-2022-11666830253 - Reshoring a Bright Spot for US Plastics Industry (Plastics News)

https://www.plasticsnews.com/materials/reshoring-bright-spot-us-plastics-industry - Groups Seek to Banish Plastic from Infrastructure Projects (Plastics News)

https://www.plasticsnews.com/news/groups-seek-banish-plastics-infrastructure-projects - Why the October Jobs Report is so Strong Despite Tech Layoffs (Wall Street Journal)

https://www.wsj.com/articles/why-the-october-jobs-report-is-so-strong-despite-tech-layoffs-11667591383

Download Plastics M&A Update – October 2022