Plastics Industry M&A Activity Tracking

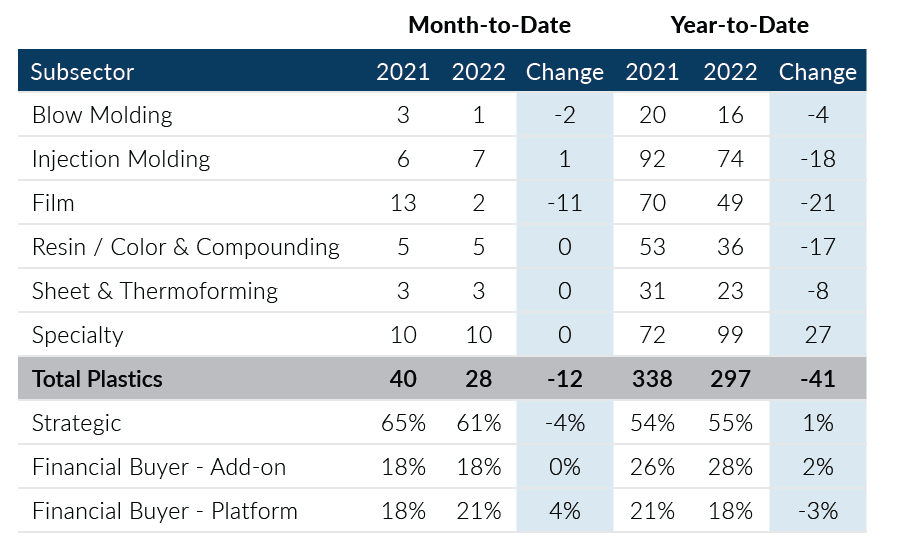

Global Plastics M&A activity slowed in September with 28 transactions, which was five transactions lower than a strong August and the second lowest month of this year. Despite the lower volumes in September, the 3rd quarter finished at deal volume levels that were comparable to the 1st and 2nd quarters. Plastics company transaction multiples appear to be continuing at attractive levels but activity seems to be trending downward as companies navigate higher interest rates and slowing demand in some sectors.

- Q3 2022 was marked by robust strategic buyer activity; strategic buyers accounted for 59% of the deal volume in the quarter, up from 55% in Q2 2022

- Specialty transactions which include distribution, extrusion, and foam deals led all plastics subsectors in the month with 10 deals. In Q3, Specialty transactions accounted for 27% of the deal volume

- After posting eight deals in August, the Film subsector had a slow month in September as only two deals were recorded. Overall, the subsector has accounted for 13% of the deal volume in Q3

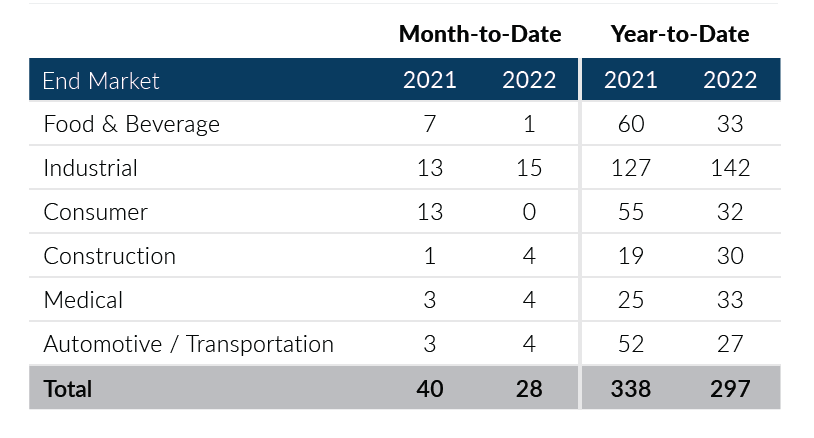

- The Automotive and Construction end markets accounted for four deals each and 29% of the deal volume in the month; both end markets had a strong Q3

Global Plastics M&A fell slightly in September, but has exhibited strong activity through all three quarters of 2022. Average monthly deal volume for each quarter has remained above 30 transactions. Q4 typically brings higher levels of plastics M&A activity as buyers and sellers move to close deals by year-end but this year could be different depending on the impacts of rising interest rates and a slowing economy. If you are a plastics company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Sources: Capital IQ, PitchBook, Thomson Reuters, Company Reports, PMCF. Data as of September 30, 2022

Plastics M&A By Subsector

Total Plastics M&A By End Market

Plastics Transactions By Buyer Type

Notable M&A Activity

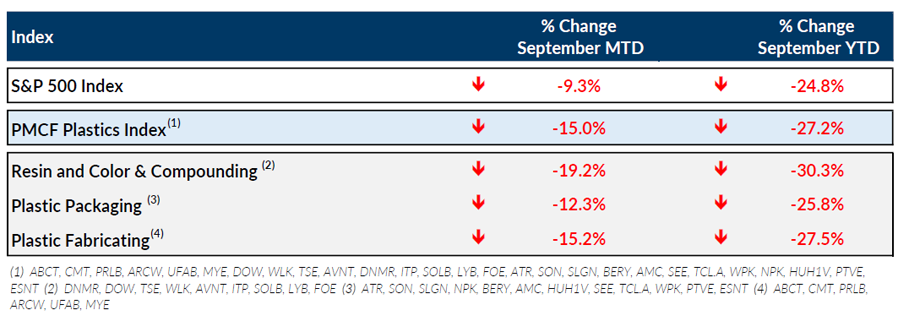

Public Entity Performance

Major News

- Economic Good News: Inflation and Supply Chain Issues Easing (Plastics News)

https://www.plasticsnews.com/news/economic-good-news-inflation-and-supply-chain-issues-easing - A “Robust” plastics Treaty Push by Governments, Businesses at UN Meeting (Plastics News)

https://www.plasticsnews.com/public-policy/robust-plastics-treaty-push-governments-business-un-meeting - U.S. Jobless Claim Hit Lowest Level in Five Months (Wall Street Journal)

https://www.wsj.com/articles/u-s-jobless-claims-hit-lowest-level-in-five-months-11664455866?mod=Searchresults_pos7&page=1 - Newsom Vetoes California’s Thermoform Recycled-Content Bill (Plastics News)

https://www.plasticsnews.com/public-policy/newsom-vetoes-californias-thermoform-recycled-content-bill - “Cautious” Purchasing Decisions Lead to Lower Resin Prices in September (Plastics News)

https://www.plasticsnews.com/resin-pricing/resin-prices-september-continue-downward-trend

Download Plastics M&A Update – September 2022