PMCF’s View on the M&A Market

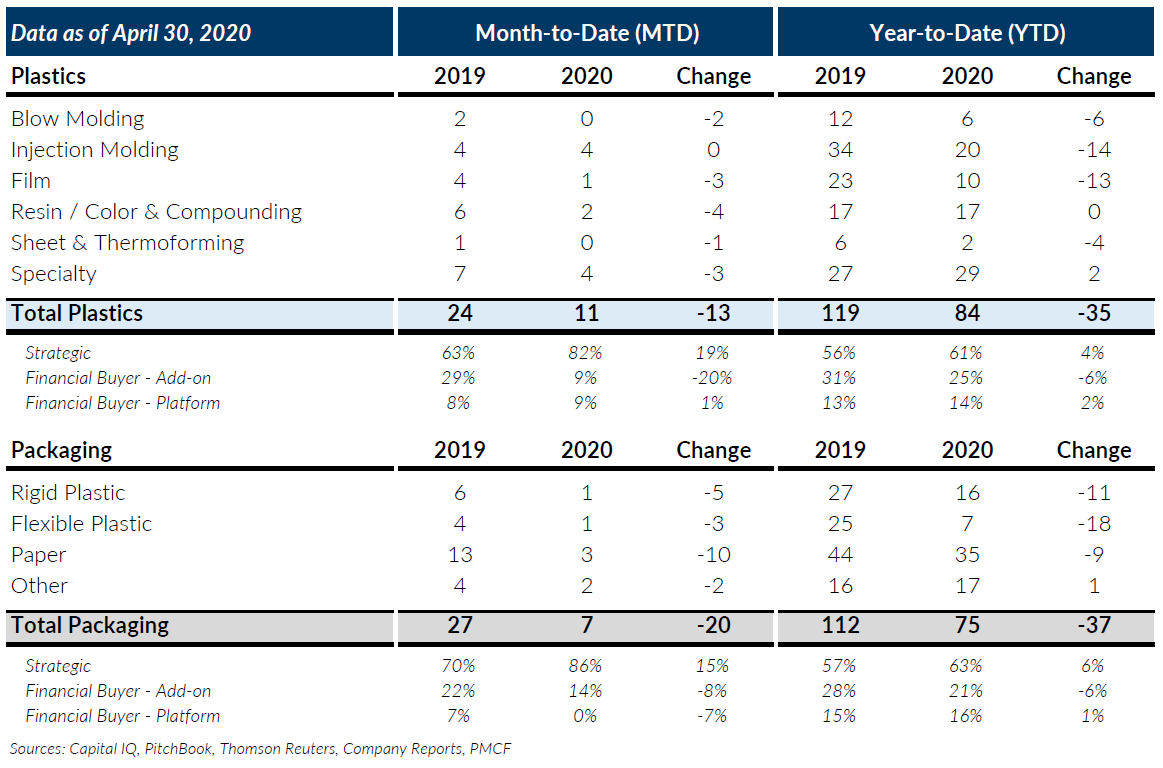

Global M&A volume in plastics and packaging continued its downward trend in April 2020 with surprisingly low levels of transaction activity reported for the month. COVID-19 started to impact transaction activity in both sectors last month, particularly in the second half of March as many states implemented stay-at-home orders. In April 2020, transaction activity continued to be impacted by COVID-19 by a much greater level, with plastics M&A activity reporting a decline of 54% over last year, and packaging only recording 7 transactions for the month, a 74% decline.

Within Plastics, Injection Molding was the one bright spot for the month with the same number of deals as last year, but the subsector is still lagging last year on year-to-date basis. Resin, Color & Compounding and Specialty subsectors were both lower for the month but are still at or above last year’s transaction activity for the first four months. The mix of buyers changed dramatically in April with publicly traded strategic buyers and private equity buyers reporting large declines while privately held strategic acquirers completed the same number of transactions as last year.

Packaging M&A activity in April 2020 experienced a larger decline than Plastics and is now showing a larger overall decrease on a year-to-date basis (~33%). We find this correlation to be unusual given the lower cyclicality of packaging companies compared to plastics and the reported positive impacts of COVID-19 on several packaging subsectors including e-commerce and food. We think this is likely due to a combination of packaging buyers being more cautious and internally focused, and packaging sellers willing to be more patient to wait out any negative valuation impacts from COVID-19. This is a trend we will be watching over the next couple of months.

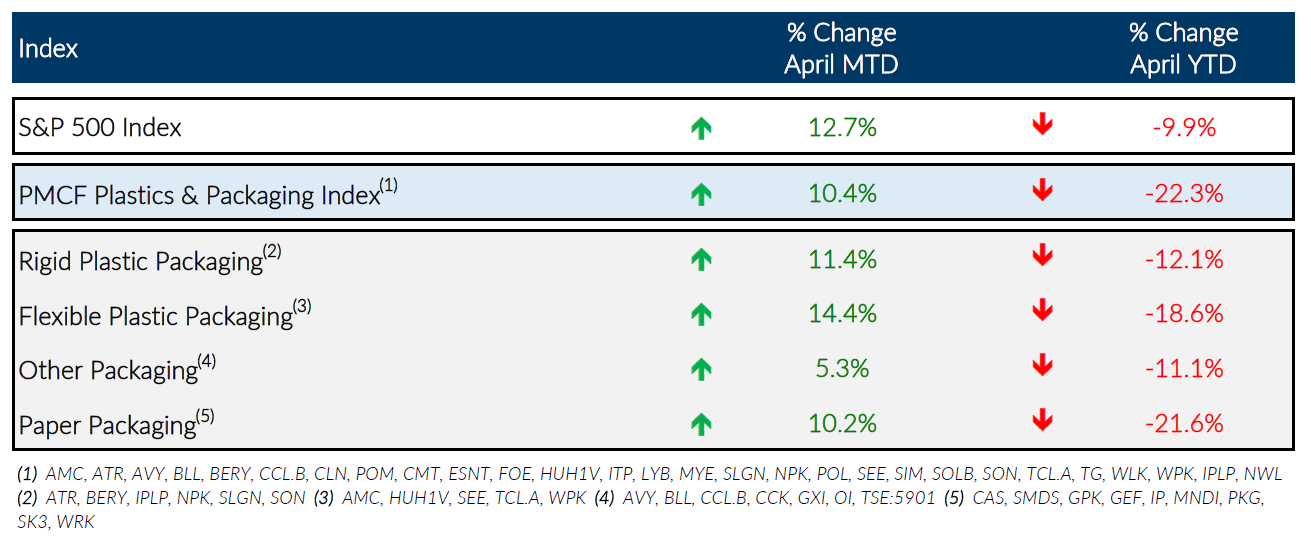

On a positive note, the stock market experienced a nice rebound in April with the S&P 500 finishing up 12.7% for the month. PMCF’s Plastics & Packaging Index increased by 10.4% with all subsectors showing positive results. Flexible Plastic Packaging experienced the highest increase, posting a 14.4% change for the month. We also noticed lower stock market volatility in the month of April which is hopefully a positive leading indicator for the coming months.

There continues to be a great deal of uncertainty surrounding plastics and packaging M&A due to COVID-19. As a result, we expect to see lower plastics and packaging M&A activity in the short-term with a scarcity of high-quality businesses coming to market in the early stages of the recovery. We are not sure when M&A will return to pre-COVID-19 levels, but it appears that buyers will be ready before sellers given the large amounts of available capital and the number of solicitations we’ve been receiving over the last several weeks.

PMCF Industry M&A Activity Tracking

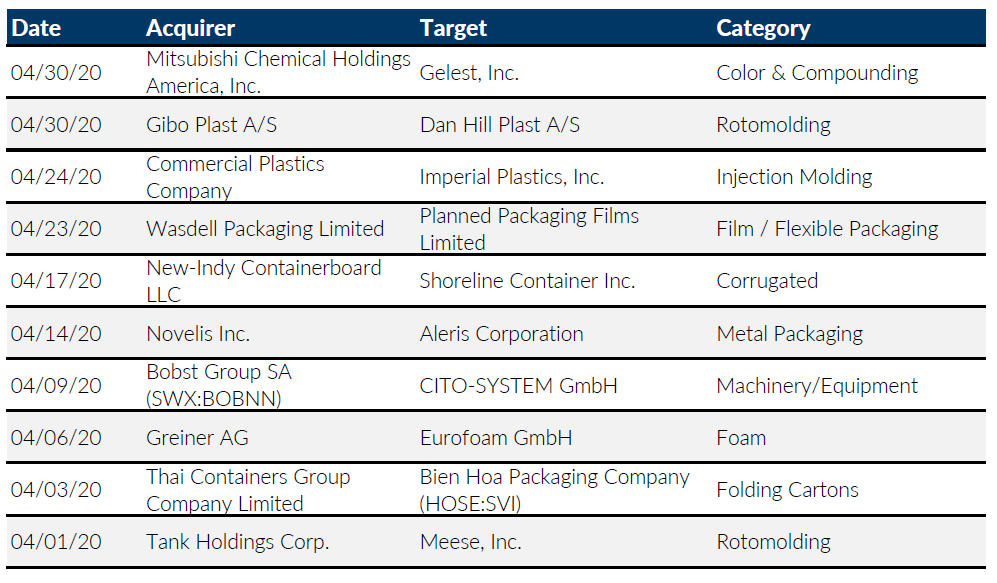

Notable M&A Activity

Major News in Plastics & Packaging

- Plastics News: Study expects medical plastics growth to top 17%

- Fastmarkets RISI: April US boxboard prices steady with recycled increases set for May; virus-related demand drives up shipments

- Packaging World: Opinion: COVID-19 Swings “Reusable” from Good to Bad

- Plastics News: Slowing economy drops the hammer on resin prices

Public Entity Performance