PMCF’s View on the M&A Market

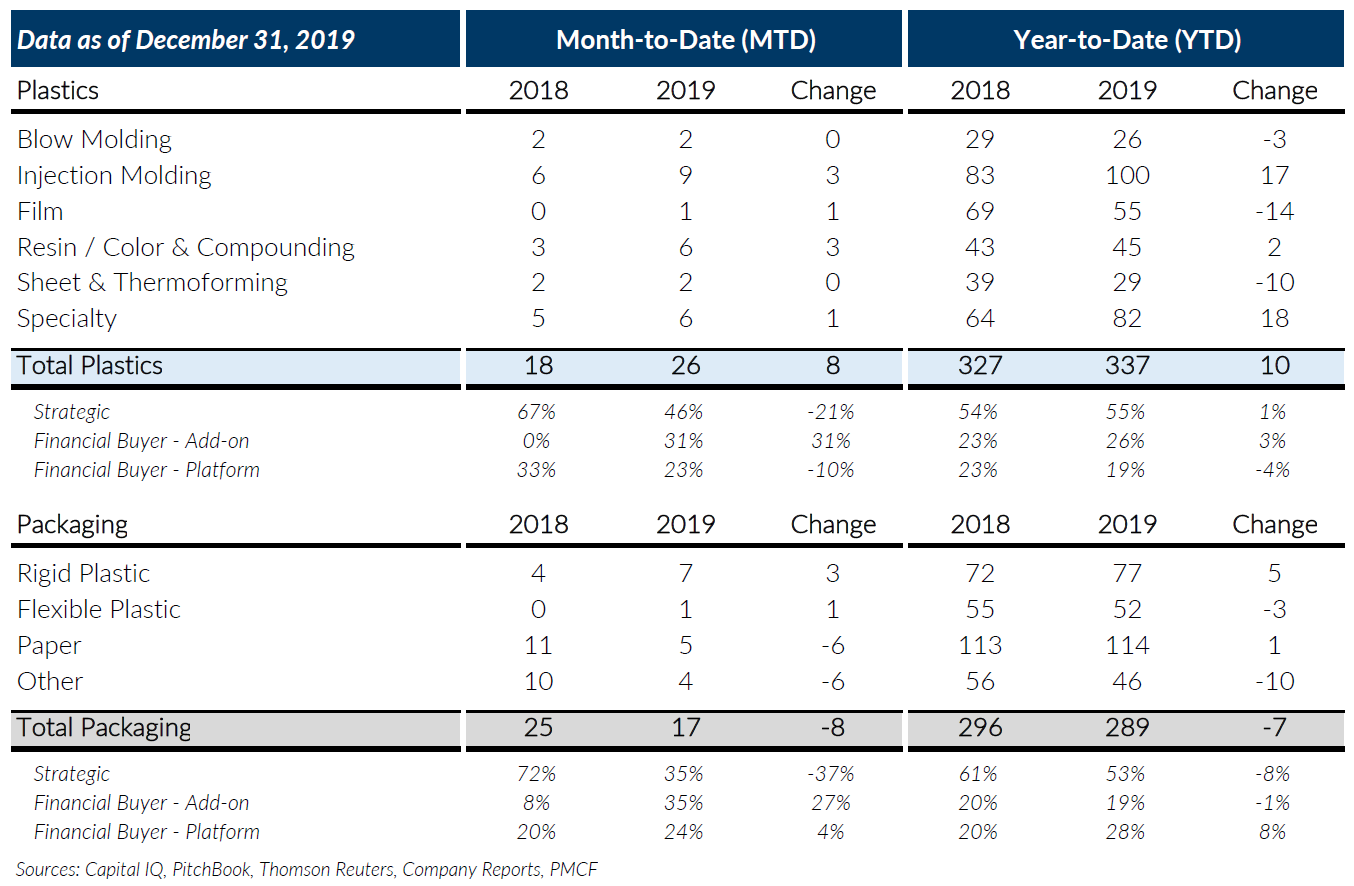

The Global Plastics & Packaging market had a strong finish to the decade with 26 announced deals in December. The monthly volume represents a 44% increase over last year and takes the total number of Plastic and Packaging deals in 2019 to 337, an increase of 3% over 2018 and yet another year of 300+ transactions. This growth has been driven by a large increase in private equity add-on activity which increased 19% to reach a record number of 88 deals in 2019. Despite a decline in December primarily driven by the Paper sub-segment, Packaging M&A posted another strong year with 289 total transactions. Despite the year-over-year decline, Packaging M&A volume is still well above historical averages and continues to be an attractive segment for most buyers.

Deal multiples remain strong across most sectors which should continue to motivate shareholders to explore transactions. Sellers appear to be favoring buyers that offer a strategic benefit (strategic buyer or private equity add-on) vs a platform private equity buyer. Part of this is likely due to strategic buyers or private equity backed strategic buyers paying higher valuation multiples due to potential synergies that are not available to a pure financial buyer. Based on the interest from strategic and financial buyers, the current economic environment, and pipeline of transaction activity already in process, PMCF expects 2020 to be another strong year for Plastics & Packaging M&A.

PMCF Industry M&A Activity Tracking

Notable M&A Activity

Major News in Plastics & Packaging

- Plastics News: As politicians parse plastics bans, it’s time for industry to get proactive

- Fastmarkets RISI: US boxboard prices end 2019 intact as sources cite ‘consolidation and discipline’ by producers

- Plastics News: Tariffs return on China-made injection molds

- Packaging Digest: Consumers want non-plastic packaging options

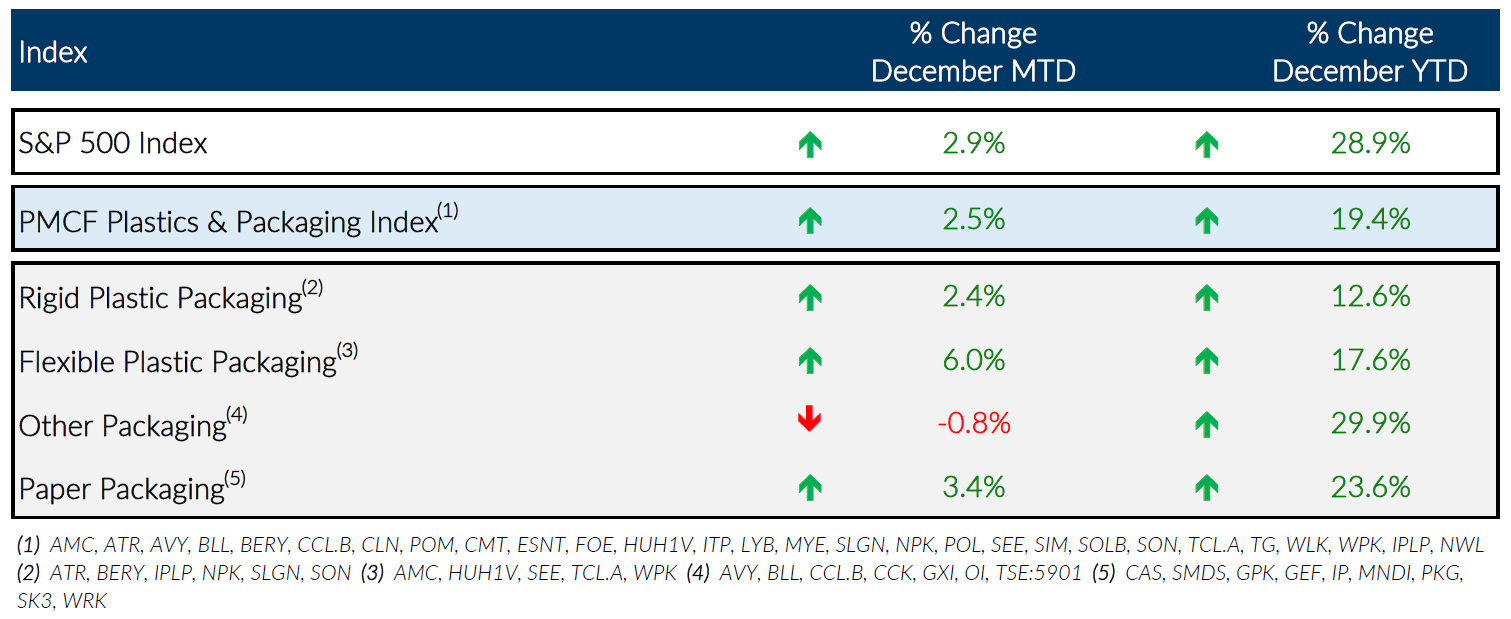

Public Entity Performance