PMCF’s View on the M&A Market

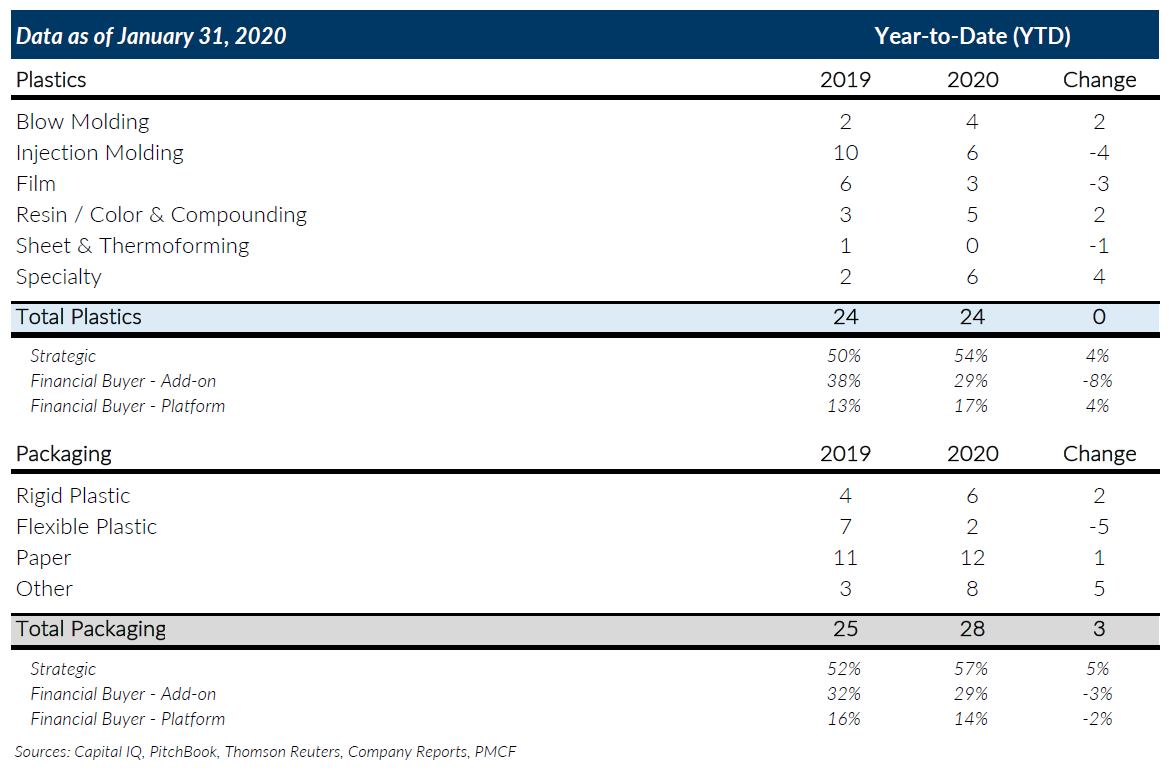

M&A volume for Global Plastics recorded 24 transactions in January 2020, which was the same level as last year and a continuation of strong activity levels. Private equity platform and strategic buyer transactions increased year-over-year as several marquee transactions were announced or closed.

Global Packaging M&A activity in January 2020 increased 12% over 2018 levels to 28 announced or closed transactions. The Other Packaging sub-sector, namely Machinery/Equipment and Distribution packaging companies, attributed most of the growth during the month with eight transactions. Strategic buyers increased share of total transactions at the expense of both private equity platform and add-on transactions.

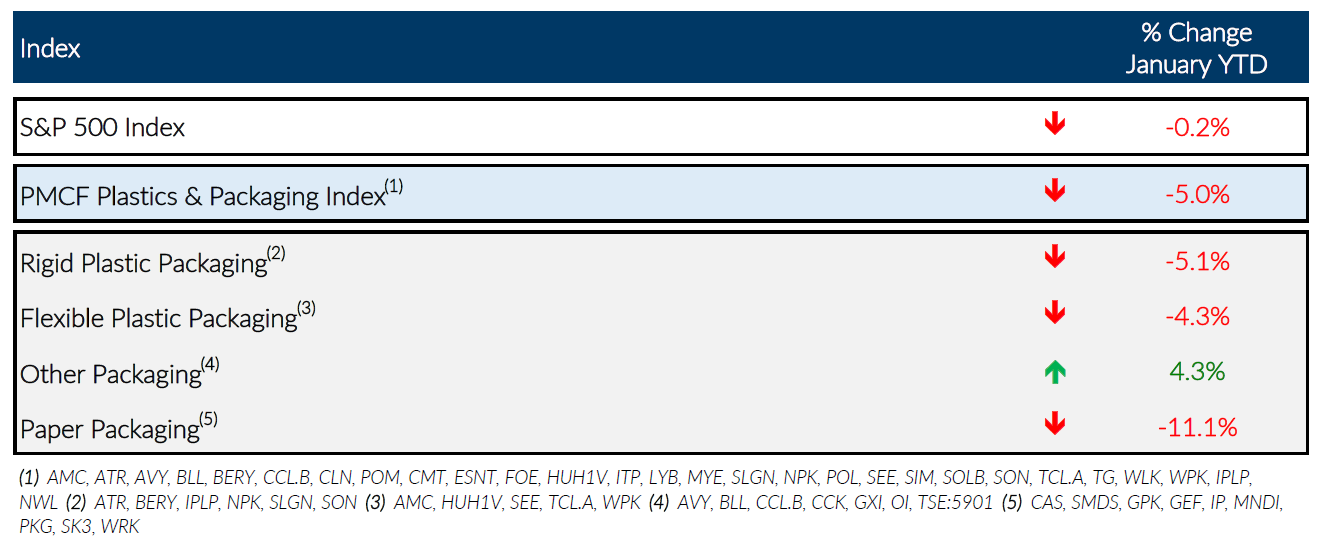

Global public markets retreated in January as fears of the Coronavirus led to plant shut-downs, overall decreases in global trade, and adjusted operating outlooks for 2020. PMCF’s Plastics & Packaging indices were all impacted with the exception of the Other Packaging index.

PMCF Industry M&A Activity Tracking

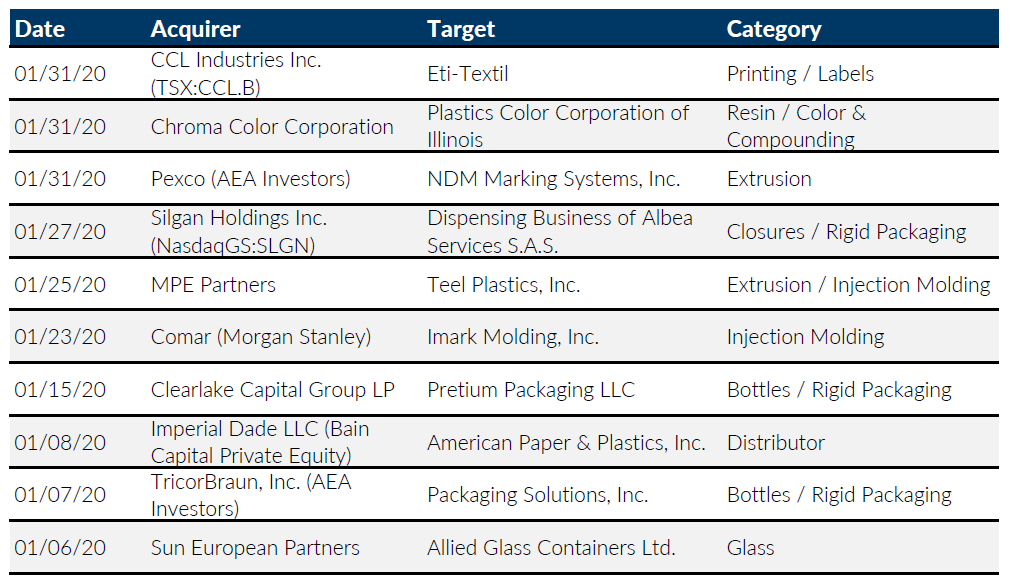

Notable M&A Activity

Major News in Plastics & Packaging

- Fastmarkets RISI: US economic activity in manufacturing sector expands in January for 129th consecutive month

- Wall Street Journal: Coronavirus Toll on Shipping Reaches $350 Million a Week

- Plastics News: Outlook for construction: Early signs for ’20 looking up

- Plastics News: A January surprise for polyethylene prices

Public Entity Performance