PMCF’s View on the M&A Market

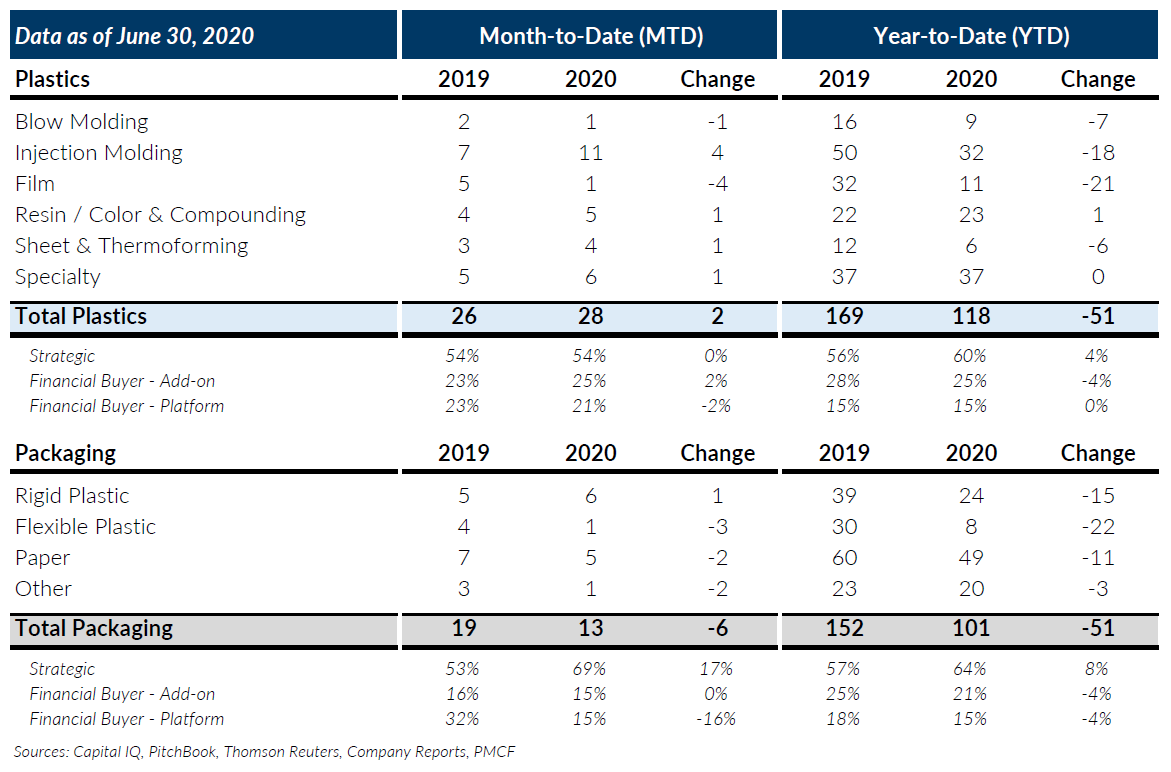

Global Plastics M&A activity came roaring back in June 2020 after being significantly down in April and May due to COVID-19. We recorded 28 transactions for the month which is a modest increase over last year but over 4 times the number of transactions recorded last month. The buyer makeup of these transactions was similar to last year with a slight up-tick in private equity add-on transactions, coming at the expense of private equity platform transactions. We were encouraged by the level of activity for the month but are not ready to declare that Plastics M&A is back to pre-COVID-19 levels. We estimate that several of the transactions that occurred in June were carryover transactions from the last two months that had been delayed due to COVID-19. However, we do think the increased level of activity is a positive sign that buyers are getting more comfortable with the outlook post COVID-19.

On the flip side, Global Packaging M&A continued to be suppressed with 13 transactions recorded for the month. This represents a ~30% decline compared to last year and the same level of activity recorded last month. Strategic buyers continue to represent the majority of the transactions with private equity posting declines in both add-ons and platform transactions. The Rigid Plastic Packaging subsector experienced a noticeable uptick over last year and the last two months, while Paper Packaging continues to be the most resilient subsector through the COVID-19 crisis. Conversely, the Flexible Plastic Packaging subsector reported only 2 transactions in the last 3 months and prior to COVID-19, was down ~70% through March 2020 compared to last year. While Packaging did not see a rebound in M&A activity similar to Plastics in June, we have noticed an increase in activity of both new deals and deals that had previously been put on hold due to COVID-19.

While these are challenging and unprecedented times for plastics and packaging M&A, there remains opportunities for both buyers and sellers to close successful transactions or best position themselves for a future transaction in the short or longer term.

For potential sellers of plastics and packaging companies, we encourage you to check out our recently published Post COVID-19 Succession Playbook for planning considerations here.

PMCF Industry M&A Activity Tracking

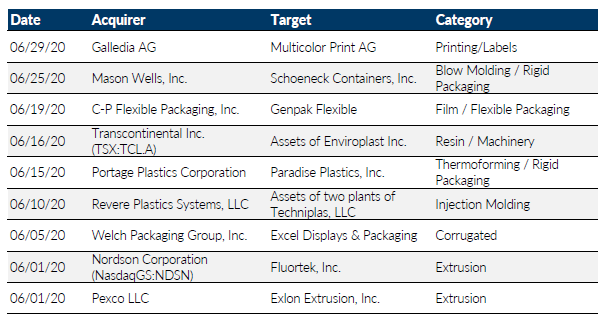

Notable M&A Activity

Major News in Plastics & Packaging

PE Professional

Despite Headwinds, Packaging Industry Faces Pockets of Growth

Packaging Digest

How Food and Beverage Packagers Can Navigate the New Normal

Plastics News

Flexible plastic recycling trial reports success, but notes ‘anemic’ markets

Plastics News

Demand, feedstocks take the wheel to drive resin price changes in June

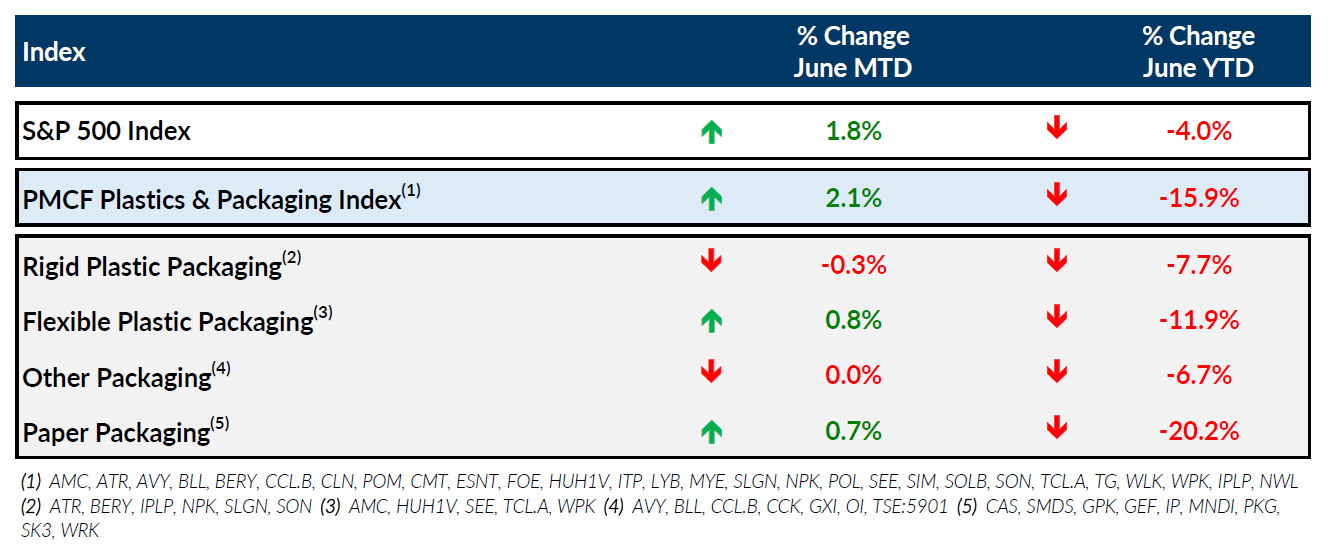

Public Entity Performance