PMCF’s View on the M&A Market

PMCF’s Plastics & Packaging Monthly M&A Update is meant to supplement our semi-annual M&A reports and provide our contacts with more frequent information on M&A activity in the dynamic plastics and packaging industries.

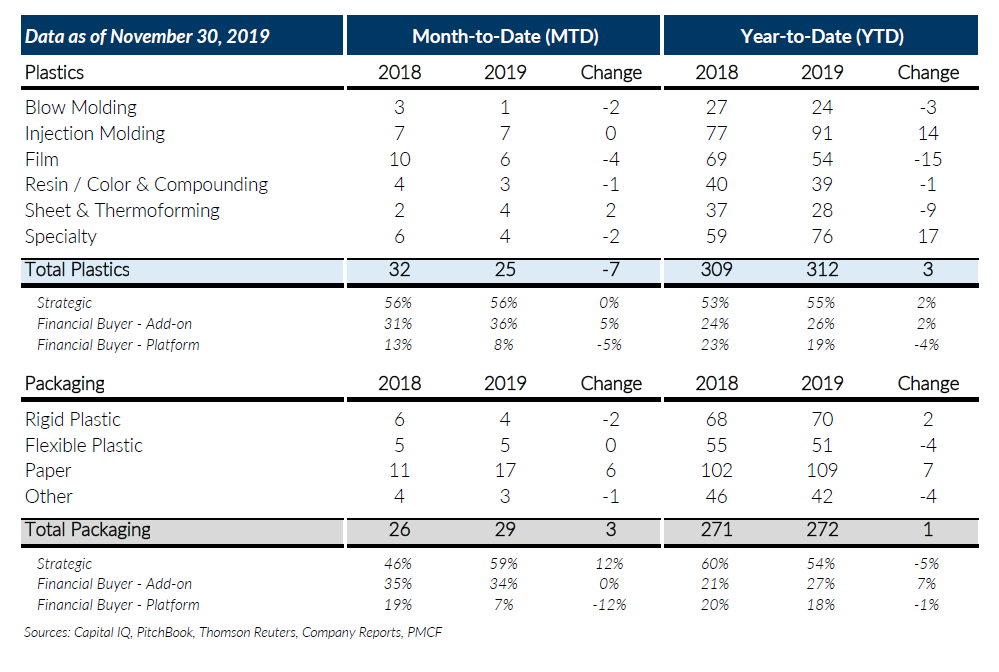

M&A activity for the month of November continued to be strong in packaging with reported deals increasing by 11.5% compared to last year. The Paper Packaging sub-segment drove a large part of this increase which we believe is due in part to increased attractiveness of paper in single-use packaging applications. Conversely, Global Plastics M&A reported another monthly decline in November which was partly attributable to lower activity in the Film sub-segment. Plastics M&A activity in total is still slightly ahead of last year so we are not drawing any conclusions from the decline over the last two months.

Strategic buyer activity picked up in both sectors compared to last month and add-on acquisitions continue to represent the majority of private equity transactions. Purchase price multiples and debt financing remain strong based on the deal activity that we’ve seen or that has been publicly disclosed. Total M&A activity for 2019 in both Plastics and Packaging sectors is tracking to finish at similar levels to 2018, which would represent another strong year of M&A.

PMCF Industry M&A Activity Tracking

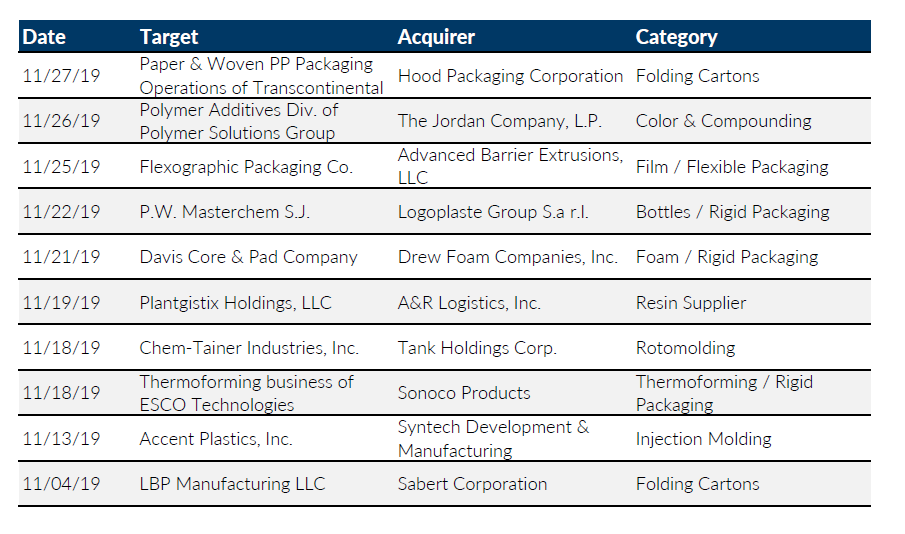

Notable M&A Activity

Major News in Plastics & Packaging

- Wall Street Journal: Private-Equity Cash Piles Up as Takeover Targets Get Pricier (Buyout activity in the U.S. is down sharply even as firms’ unspent cash allocated for North American deals hits record $771.5 billion)

- ETMM: K 2019 gives a clear signal for responsible handling of plastics

- Fastmarkets RISI: US economic activity in manufacturing sector expands in November for 127th consecutive month – ISM

- Fastmarkets RISI: US GPD rises by 2.1% in 3Q 2019

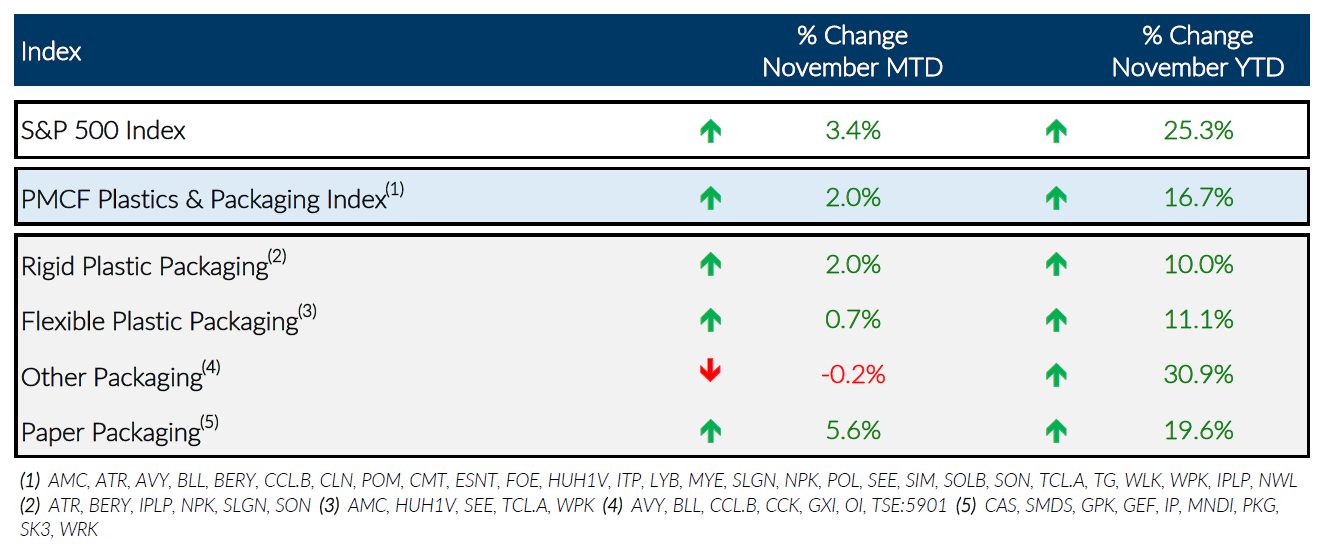

Public Entity Performance