PMCF’s View on the M&A Market

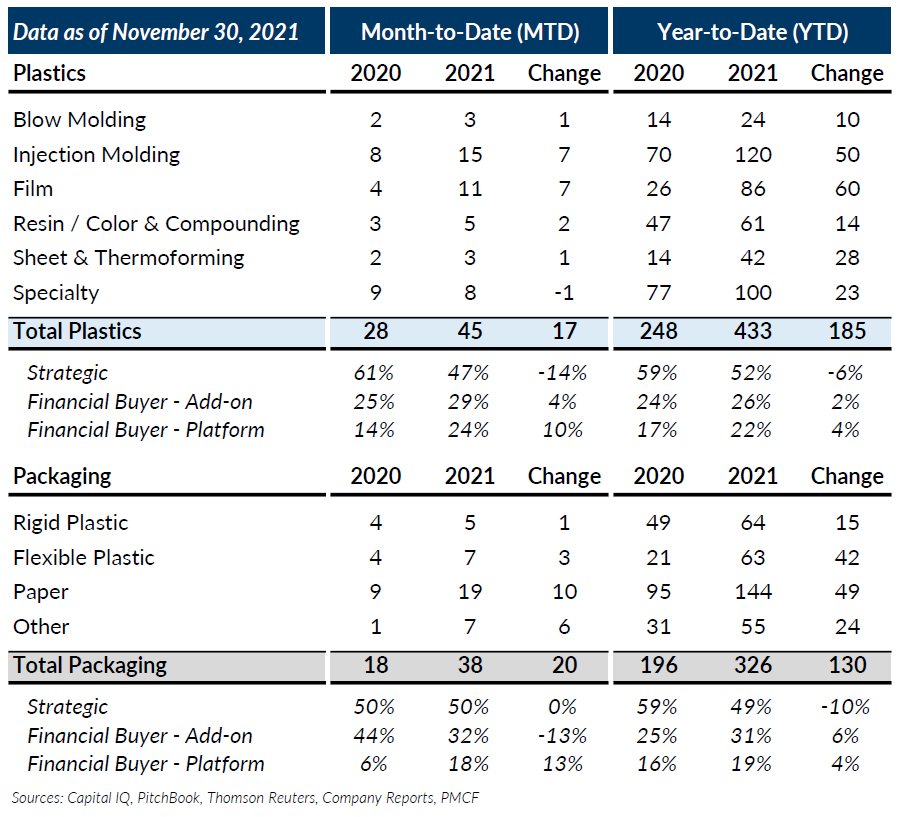

Global Plastics M&A saw another strong month in November 2021 from a deal volume standpoint. Deals on the month totaled 45 transactions with high participation from both strategic and financial buyers. Overall, the past eleven months have exhibited record levels of transactions following somewhat depressed levels last year due to COVID.

Plastics subsectors were all active in the month of November and were once again paced by Injection Molding transactions which totaled 15 transactions on the month. In 2021, Injection Molding has accounted for ~28% of deal volume with 120 deals. These numbers are more than double 2020 levels through this same time last year. Other than Injection Molding, Resin and Color & Compounding posted 5 transactions which was an increase of two transactions over November 2020. On the year, Plastics subsectors have increased dramatically over last year’s levels.

Global Packaging M&A posted a healthy level of transaction activity in November 2021 with 38 deals on the month. This level of transaction volume is the highest year-to-date. Deal volumes were driven by an active Paper subsector which saw 19 deals on the month. Corrugated transactions contributed ~42% of the paper deal volume up from ~23% in November 2020. Overall, Corrugated transactions have accounted for ~31% of Paper transactions on the year and have almost doubled last year’s levels. Flexible and Rigid Plastic Packaging transactions remained elevated and accounted for 12 Packaging deals on the month. Private Equity and Strategic buyers were active in both the Paper and Plastic Packaging M&A markets accounting for an equal split of the total deals.

The past month was strong from an M&A standpoint as both the Plastics and Packaging sectors saw high transaction volumes. Based on all the feedback we are hearing in the marketplace, December should bring similar levels of elevated transaction activity and cement 2021 as a record year from a transaction standpoint for both the Plastics and Packaging sectors. If you are a plastics or packaging company considering a merger, acquisition, sale or recapitalization in the short or longer term, please consider leveraging PMCF’s transaction planning and execution expertise to best position your company in a transaction.

Notable M&A Activity

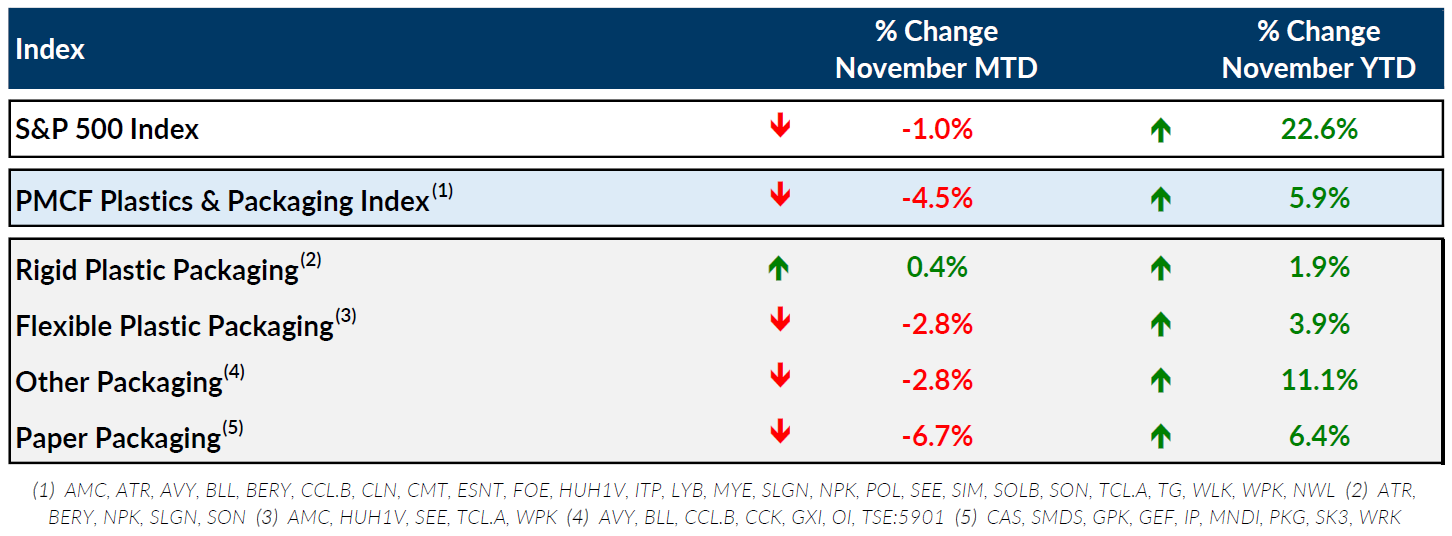

Public Entity Performance

Major News in Plastics & Packaging

- U.S. Economic Activity in Manufacturing Sector Grew in November (RISI Info)

https://www.risiinfo.com/ic/news/pulpandpaper/us-economic-activity-in-manufacturing-sector-grew-in-november-ism-212375.html - Importance of Plastics an Unexpected Impact of COVID-19 (Plastics News)

https://www.plasticsnews.com/news/importance-plastics-unexpected-impact-covid-19 - Supply Chain Issues ‘Continuing for the Foreseeable Future’ (Plastics News)

https://www.plasticsnews.com/news/caps-conference-were-not-out-woods-yet - U.S. Economy Could Enjoy Post-Holiday Glow, New Variant or No (Wall Street Journal)

https://www.wsj.com/articles/u-s-economy-could-enjoy-post-holiday-glow-11637928001