PMCF’s View on the M&A Market

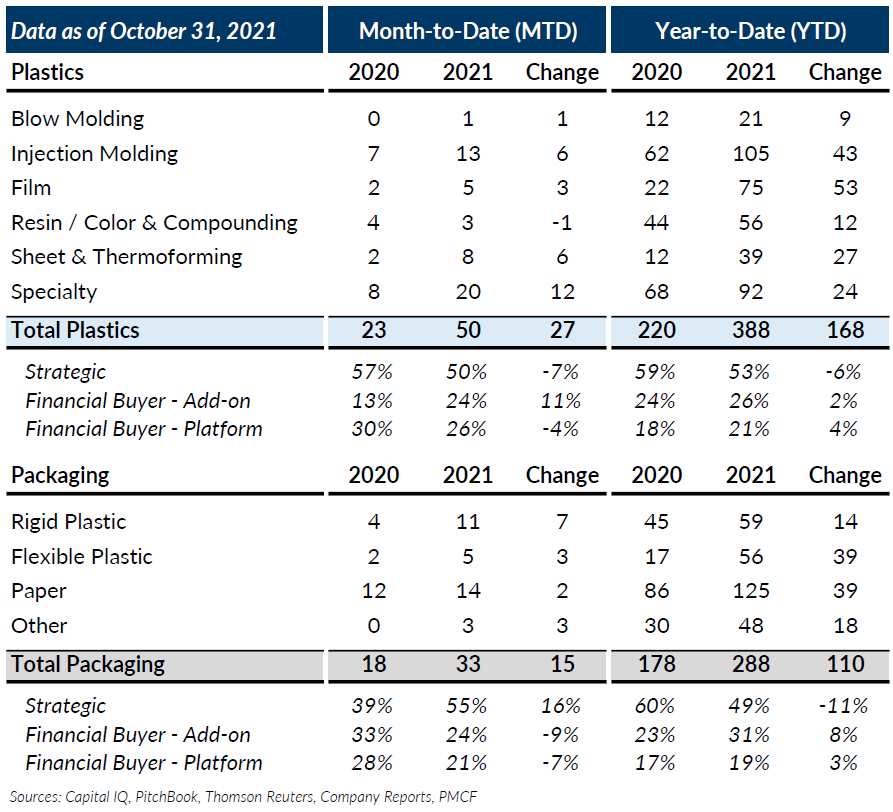

Global Plastics M&A continued the trend of high deal volume in the month of October. The month saw the highest level of activity recorded on the year with 50 transactions. Deal volume more than doubled last year’s October levels as strategic and financial buyers actively participated in the plastics M&A market.

From a subsector standpoint, October brought with it a new high for Specialty transactions which include Extrusion, Rotomolding, and Distribution. Specialty transactions accounted for 20 deals on the month, or 40% of the deal volume. These deals were driven by consolidation in the Extrusion market; 8 of the 20 Specialty transactions on the month were Extrusion related. Other notable subsectors that contributed to high October transaction levels were Injection Molding, Film, and Sheet & Thermoforming. These subsectors combined to account for 26 transactions in the month.

Plastic M&A occurred in a diverse set of end-markets in the month of October led by Industrial and Consumer transactions. Through the year-to-date, Industrial and Consumer transactions have accounted for 208 deals, up from 129 deals through this same time last year. Plastic Construction deals were up over October 2020; while there were no recorded Construction deals in October 2020, Construction volume accounted for 6 deals in October 2021.

Global Packaging M&A rebounded from an average month last month by posting 33 transactions in October 2021. This level of volume was 15 transactions greater than October 2020, or a ~83% increase. Packaging subsectors were once again paced by Paper packaging transactions which recorded 14 deals on the month, accounting for ~42% of deal volume. Plastic Packaging, which includes Flexible and Rigid Plastic packaging products, accounted for 16 transactions and saw strong growth relative to October 2020 when the subsector only posted 6 total transactions. On the year, Rigid Plastic transactions have already matched 2020 levels while Flexible Plastic transactions have more than doubled.

October 2021 was an extremely active month from an M&A standpoint, building on the high transaction volumes seen throughout the year. As the end of the year approaches and uncertainty around the taxation environment intensifies, high deal volumes should continue through the remainder of the quarter.

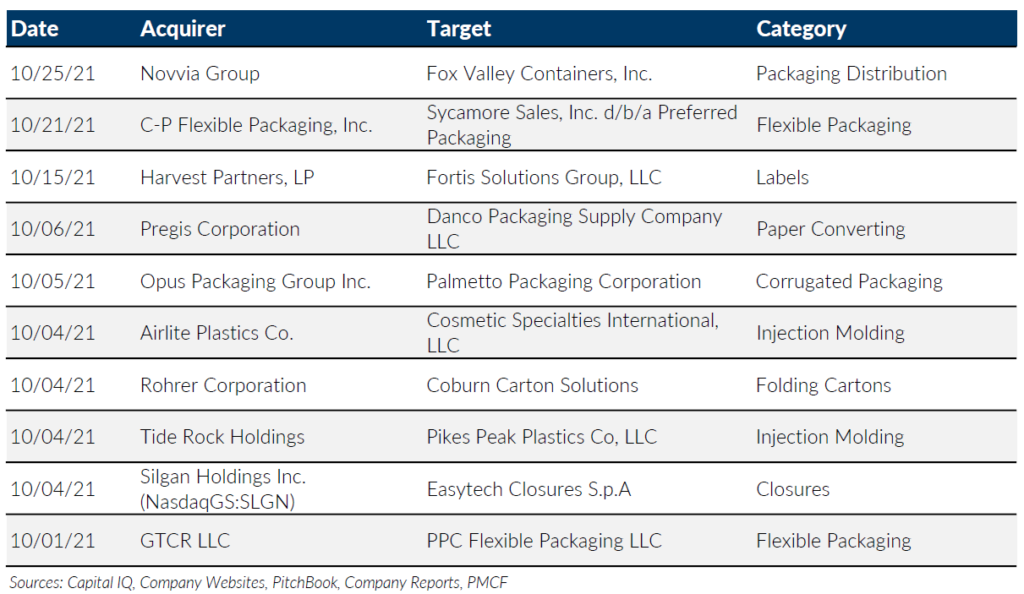

Notable M&A Activity

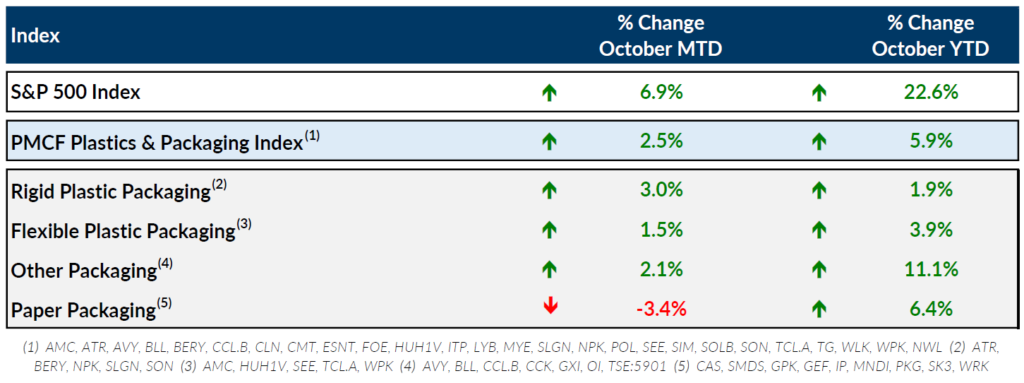

Public Entity Performance

Major News in Plastics & Packaging

- Pandemic Economic Impact Shrinks US Plastics Exports (Plastics News)

https://www.plasticsnews.com/news/plastics-exports-shrunk-amid-economic-impact-pandemic - As Hiring Problem Grows, Automakers, Suppliers Get Creative (Plastics News)

https://www.plasticsnews.com/news/hiring-problem-grows-automakers-suppliers-get-creative - US Prices, Wages Rise at Fastest Pace in Decades (Wall Street Journal)

https://www.wsj.com/articles/consumer-spending-personal-income-inflation-september-2021-11635449959?mod=Searchresults_pos8&page=2 - Economies Growing in 2021 Even with Continued Supply Chain Challenges (Plastics News)

https://www.plasticsnews.com/news/economies-growing-2021-even-continued-supply-chain-challenges