PMCF’s View on the M&A Market

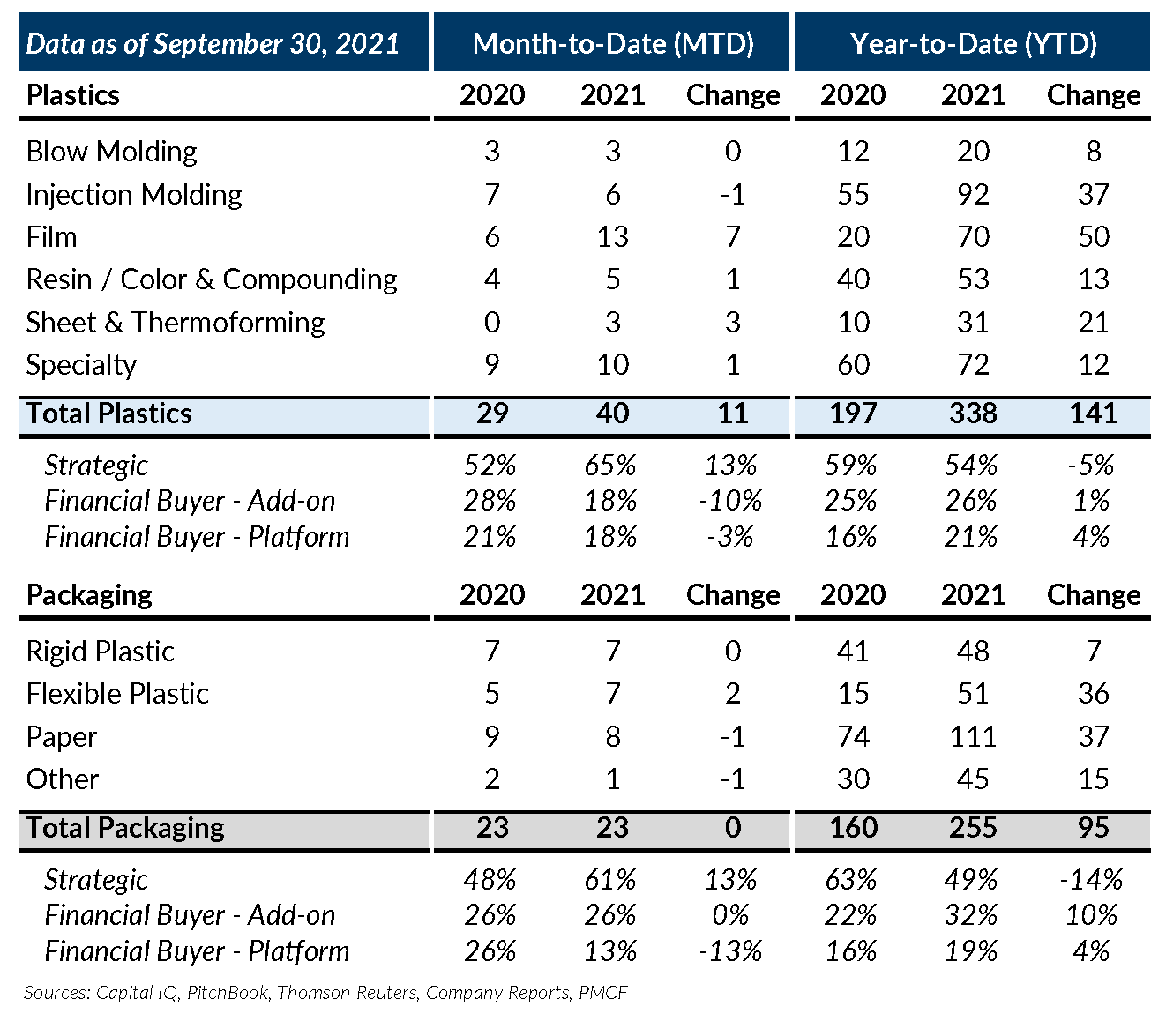

Global Plastic M&A volumes remained at high levels through September 2021. For the fifth month in a row, Plastics M&A volume totaled 40 or more transactions. Transaction levels in September were driven by active participation from strategic buyers, which accounted for 65% of the total deal volume, or 26 transactions. On a volume basis, private equity groups equaled prior year levels with 14 transactions on the month. Overall, the Plastics M&A market activity has been robust in 2021 and has shown no signs of slowing down over the final quarter of the year.

The Food & Beverage end-market exceeded September 2020 levels by 4 transactions and accounted for 18% of deal volume on the month. The Consumer end-market similarly outpaced previous year levels with 12 transactions on the month compared to 7 recorded in September 2020. From a process standpoint, Film led all subsectors with 13 transactions in September 2021, which represented a large increase over the 6 transactions seen in September 2020. Through the year-to-date, Film has benefited from increased private equity add-on acquisitions; 22 of the 35 total private equity transactions in the Film subsector have been add-on acquisitions. Aside from Film, Injection Molding, Blow Molding, Resin, and Color & Compounding helped to drive high transaction volumes for the month, combining to account for 35% of recorded transactions, or 14 deals.

Global Packaging M&A remained steady in September 2021, with 23 total transactions on the month. Similar to the Plastics deals in September, Packaging transactions were driven by active strategic buyers, which accounted for 61% of the total transactions. On the year, the Paper subsector has already exceeded 2020 transaction levels which points to the market’s strong rebound from a down year last year. Flexible Plastic deals increased by 2 transactions compared to September 2020 and the subsector has seen transaction growth of 36 transactions compared to year-to-date 2020. While Packaging M&A has normalized over the past two months, robust transaction levels early in the year are set to push sector transaction levels to record highs for the year.

M&A volumes in the Plastics and Packaging sectors have been on record pace through the first three quarters of the year. With highly active strategic and private equity buyers and a flurry of sellers trying to get transactions closed by year end, the sectors are set to continue this strong pace in the fourth quarter.

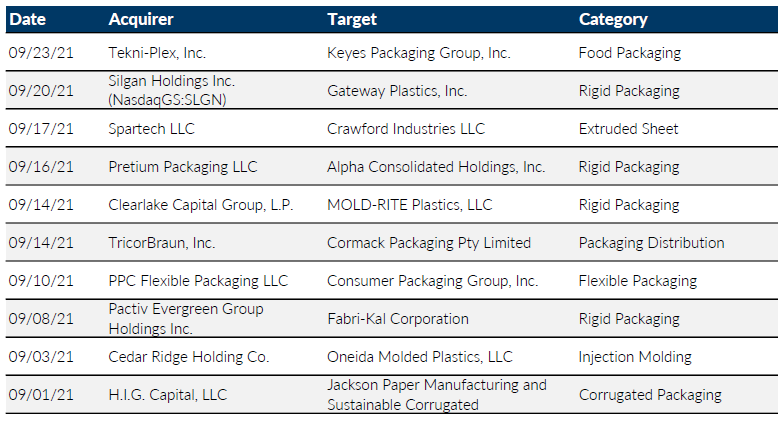

Notable M&A Activity

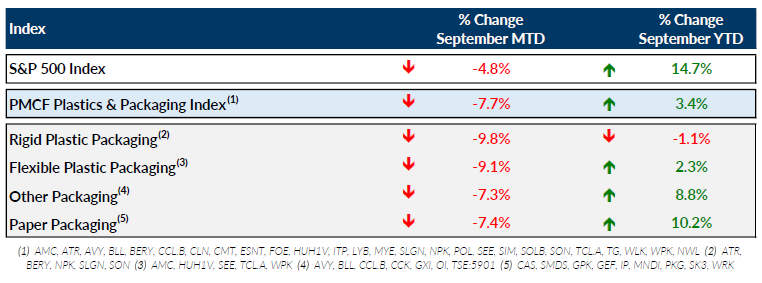

Public Entity Performance

Major News in Plastics & Packaging

- Plastics Executives Face Daunting Labor Crunch (Plastics News)

https://www.plasticsnews.com/news/plastics-executives-face-daunting-labor-crunch - Supply Chain Shortages May Cut Into Holiday Wish Lists (Plastics News)

https://www.plasticsnews.com/news/supply-chain-shortages-may-cut-holiday-wish-lists - The Pandemic’s Impact Evident on Packaging (Plastics News)

https://www.plasticsnews.com/news/pandemics-impact-evident-packaging - Corporate-Buyout Loans Near Highs of 2007 (Wall Street Journal)

https://www.wsj.com/articles/corporate-buyout-loans-near-highs-of-2007-11632648602?mod=hp_lista_pos2