Artificial Intelligence (AI) is redefining the future of healthcare, enabling forward-thinking leaders to enhance patient outcomes, streamline day-to-day operations, and unlock significant value in both performance and M&A.

The global market for AI in healthcare reached $19.3 billion in 2023 and is projected to grow at a 38.5% annual rate, to $187.7 billion by 2030.

The AI revolution represents a far-reaching strategic overhaul of the healthcare sector, positioning it as a priority for executives seeking competitive advantages. A recent poll of healthcare executives indicates 95% believe generative AI will transform the industry, and 54% are already seeing meaningful return on investment after one year of AI implementation. For businesses considering a sale transaction in the short, medium or long term, integrating AI into their strategy can drive valuations and buyer interest, as buyers continue to pay premium value for AI-enabled solutions.

AI offers significant operational benefits to address a range of healthcare business challenges, including:

- Promoting efficiency and cost savings – automating manual and repetitive operational or administrative tasks, such as billing and revenue cycle management

- Data management and analysis – the increase in availability of data through proliferation of EHRs drives a need for powerful data management and analysis tools

- Reducing human error – AI management of complex and high-risk tasks such as diagnostics, where human error poses significant risks, thereby enhancing accuracy and patient safety

AI Adoption and Transaction Trends

As the healthcare AI market has grown, so has the appetite for M&A deals involving AI, driven by intense competitive pressures and AI’s demonstrated abilities in the marketplace.

This trend has been a major catalyst for healthcare M&A activity in 2024 and 2025, with an increasing number of M&A deals affecting various segments and functions of healthcare.

Medical Device

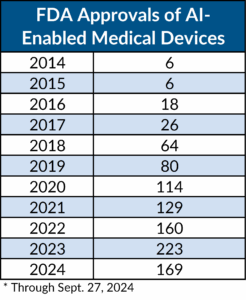

The MedTech industry is expected to invest upward of $10 billion annually into AI by 2025, reflecting the massive commitment within the sector. U.S. Food and Drug Administration approvals of AI-enabled medical devices have increased steadily for the past decade, including a 39% jump in approvals, from 160 in 2022 to 223 in 2023.

Example M&A Transactions

- GE Healthcare has made several acquisitions in recent years designed to strengthen its AI capabilities in medical technology, including: MIM Software, which makes image analysis and workflow tools used in oncology, urology, neurology, and cardiology, in 2024; Caption Health, a maker of ultrasound and disease detection technology, in 2023; and BK Medical, an ultrasound and surgical visualization company, in 2022. Stryker Corp. purchased San Jose-based Vocera Communications in 2022, a provider of workflow analytics and smartphone app technologies, for $3 billion, as part of its overall AI-driven healthcare strategy.

Clinical

Companies are taking advantage of AI’s powerful capabilities to improve diagnostics and imaging technology, such as MRIs, as well as for managing large volumes of data to improve clinical trial access and outcomes.

Example M&A Transactions

- Tempus AI, a Chicago-based company that uses AI-driven data management to deliver personalized patient care, announced in March 2025 it acquired Pasadena, Calif.-based Deep 6 AI, which precision-matches patients to clinical trials, underscoring the importance of AI in precision medicine.

- France-based Gleamer, a leader in AI medical imaging, expanded its capabilities by acquiring two French AI companies, Pixyl Medical (neurological MRI) and Caerus Medical (lumbar MRI) in March 2025, enhancing its AI-driven diagnostic tools across X-ray, mammography, CT, and MRI.

Patient Engagement and Care Delivery

Medical technology companies are combining AI with innovative solutions to revolutionize the way providers treat and interact with patients.

Example M&A Transaction

- Boston-based XRHealth, a pioneer in therapeutic virtual reality, mixed reality, and extended reality solutions, announced in February 2025 it acquired Elizabethtown, Ky.-based digital therapeutics company RealizedCare, enabling new evidence-based methods to manage chronic pain, stress, and anxiety. The company’s AI-powered extended-reality therapeutic platform is designed to improve patient outcomes through innovative care-delivery models.

Data Analytics and Interoperability

AI is a natural fit for healthcare companies seeking to get greater value from data, for example by unifying healthcare data from diverse sources, which is essential for risk management and value-based care.

Example M&A Transactions

- Chicago-based RLDatix, a provider of safety, workforce, and data solutions for healthcare systems, acquired Lewisville, Texas-based IPeople Healthcare, a business continuity and data accessibility provider, in March 2025.

- In January 2025, San Francisco-based Innovaccer, a leading healthcare AI and data management company, acquired Humbi AI, a specialized healthcare actuarial software, services and analytics company based in Nashville, Tenn., combining healthcare intelligence with advanced actuarial expertise to improve healthcare outcomes.

Administrative

AI is supporting healthcare companies streamline back-office tasks like payments, billing, coding, and revenue-cycle management.

Example M&A Transactions

- New York-based PE firm New Mountain Capital announced in January 2025 it will acquire Machinify, a healthcare intelligence company based in Palo Alto, Calif. The deal will combine the company, which uses AI to streamline healthcare payments, with three health technology companies, The Rawlings Group, Apixio’s Payment Integrity, and Varis, to create a $5 billion company focused on payment speed and accuracy, to be called Machinify.

Challenges and Risks

While the potential benefits are numerous, AI integration in healthcare M&A presents several challenges:

- Data privacy and security: Healthcare data is governed by regulations like HIPAA in the United States and GDPR in Europe. AI systems accessing protected data during M&A must promote compliance, with risks of breaches posing significant liability.

- Regulatory scrutiny: U.S. antitrust regulators are showing stricter attention to healthcare industry consolidation, with recent guidelines from the FDA about development and use of AI in healthcare.

- Potential biases: AI systems can perpetuate biases from historical data, leading to skewed analyses in due diligence or valuation, potentially affecting investment decisions. This is particularly sensitive in healthcare, where biased algorithms could impact patient care outcomes.

- Ethical concerns: The use of AI raises questions about transparency, accountability, and potential job displacement, especially in administrative roles. Stakeholders must balance innovation with ethical considerations to maintain trust.

Healthcare companies are contending with pivotal challenges in today’s market including declining margins, rising costs of labor and supplies, rapidly changing patient expectations and regulations, and demand for better patient outcomes and efficiency. Despite these headwinds, external factors including lower interest rates and an anticipated business-friendly regulatory environment under the Trump administration is likely to facilitate deal-making. Healthcare AI may be attractive to potential dealmakers who regard it as comparatively insulated from tariff uncertainties affecting sectors with greater exposure to international trade and supply chains.

Outlook and Opportunities

With increasing use cases across the entire healthcare market, AI-driven solutions are driving a generational shift in the industry, increasingly gaining the interest of buyers. Sellers with integrated AI-solutions have commanded aggressive valuations, with buyers seeking high-growth, capital efficient companies. The following considerations have been critical to successful AI adoption within healthcare organizations:

- Develop a roadmap with a view of the future-state and the expected, and realistic, value to be achieved through AI

- Identify and obtain the required skills and capabilities to implement new solutions

- Acquire the technology and tools required to support the initiative

- Use data and analytics tools to create value from data

- Support new initiatives with appropriate change management, communication and training.

Whether you’re exploring strategic options or positioning your business for an exit, understanding AI’s role in driving valuations in the current market is essential. PMCF’s Healthcare and MedTech investment bankers can help you navigate the strategy and priorities of the market for the value of your business.