There is a burgeoning sense of optimism surrounding middle market M&A in 2025, bolstered by significant financial sponsor ‘dry powder,’ potential regulatory adjustments, and a favorable trajectory in interest rates.

Furthermore, the private credit market is anticipated to invigorate M&A and LBO deal activity throughout the year, based on market insights from Pitchbook.

While 2024 exhibited signs of promise, it occasionally fell short of expectations, paving the way for auspicious opportunities in 2025. The investment bankers at PMCF are attuned to these trends as we enter 2025, including:

- Positive trending market dynamics providing fertile ground for strategic investments

- A rejuvenated private credit market, poised to fuel M&A and LBO activities

- Active deal-making and enhanced valuation prospects in the middle market

Key factors impacting the middle market in 2025 include:

1) Positive Macro Environment Improving Consumer Confidence

Recent improvements in key macroeconomic indicators have created optimism among consumers heading into 2025. While high prices, interest rate hikes, and volatility in the stock market have disrupted economic activity in recent years, consumers stand to benefit as these trends are reversed.

The University of Michigan’s Consumer Sentiment Index, one of the leading indicators of economic activity and consumer attitudes, edged higher for the 5th consecutive month in December of 2024 to 74.0, a 3.1% increase from November 2024 and up over 6% from December of the previous year, demonstrating improved opinions on the current conditions and future expectations of the economy. This is exhibited in real GDP, which grew roughly 3% in 2024, reflecting increased consumer spending and business investment.

The anticipation is that this spending continues into the new year as various macroeconomic factors improve. First, the labor market steadily progressed throughout 2024, as unemployment has decreased to roughly 4%, which is on par with healthy pre-pandemic levels. Consumers have also benefited from strong stock market performance to kick off 2025, a continuation of a fruitful 2024, which saw the S&P 500 Index close out the year with a gain of 23.3%.

Coupled with the implementation of several rounds of interest rate cuts, these trends indicate that consumer confidence is well-positioned to strengthen in 2025, fueling activity and growth in the economy.

2) Favorable Regulatory Changes Following the 2024 U.S. Presidential Election

Leading up to the 2024 U.S. presidential election, there was apprehension regarding dealmaking due to uncertainty around changes in M&A regulatory oversight. The Biden Administration introduced a heightened level of scrutiny to the dealmaking environment which created additional hurdles to complete transactions throughout the latest presidential term. Amidst the impending change in administrations, there are several factors which are anticipated to drive increased M&A activity in 2025.

First, personnel changes at regulatory agencies such as the FTC and DOJ may lead to a more lenient approach in M&A approvals in the upper middle market. The banking sector may also observe less stringent capital requirements, facilitating an uptick in transaction activity.

Second, the Trump Administration’s proposed tax cuts would leave companies with additional capital to pursue acquisitions. This includes the extension of the 2017 Tax Cuts and Jobs Act (TCJA), sustaining a corporate tax rate of 21% versus 35%.

Lastly, the incoming administration’s stance on imposing higher tariffs on imports has significant implications for global supply chains. The threat of increased tariffs may drive companies to pursue domestic acquisitions to minimize the impact. While we don’t yet know the extent of the regulatory changes that will take effect beginning in 2025, the stock market’s positive reaction to the U.S. presidential election may hint at an impending uplift in M&A activity.

3) Improved Lending Environment Bolstered by Private Capital Growth

Like last year, 2025 is poised to present the credit market with a mix of opportunities and challenges, though many private credit lenders are optimistic as we enter the New Year. Private capital has assumed a growing role in dealmaking through the latter half of 2024 and will seek to retain its market share as the lending environment becomes more competitive. The prospect of less stringent antitrust regulations and lower interest rates is anticipated to invigorate the M&A market while driving dealmaking in private credit.

An uptick in transaction volumes would likely increase competition among lenders, tightening spreads, relaxing covenants, and leading to compressed deal returns. A widespread optimistic outlook is expected to drive competition between private debt funds and banks, who are getting back into the market by offering competitive terms to borrowers to recapture market share lost in recent years.

As private debt funds face increased pressure do deploy ample dry powder, they’ll be forced to introduce more creativity in their lending strategies to remain competitive with banks. A low rate environment reintroduces banks as a viable source of capital, while private credit will remain a strong alternative in a reenergized lending market.

4) Private Equity Dry Powder Remains at Record Highs

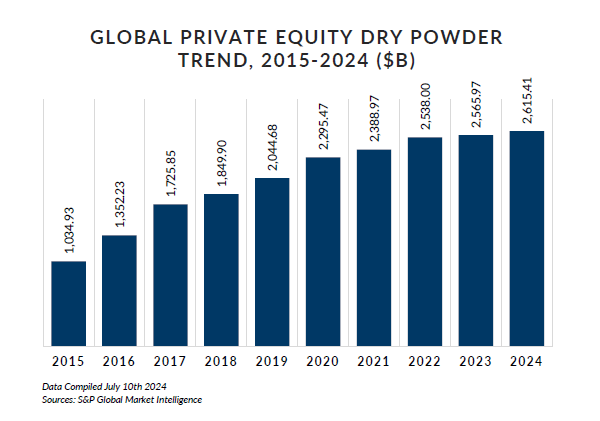

Consistent with the 2024 M&A environment, private equity (PE) funds are anticipated to enter 2025 with record levels of available capital, or ‘dry powder’, following several years of transaction stagnation.

Many PE funds have extended their holding periods in recent years due to a less-than-ideal market. With investors’ increasing pressure to monetize a portfolio of mature assets, PE exits are anticipated to ramp up in 2025 which, in turn, will drive the need for new acquisitions across popular industry sectors in the middle market.

Increased dealmaking, paired with falling interest rates and easing inflation, is setting the stage for growth in valuation multiples. Companies that have been contemplating a transaction in recent years may be enticed to enter the market sooner rather than later.

5) Creativity in Deal Structure Lends Itself to Higher Close Rates

Several years of suppressed M&A activity due to the gap in buyer and seller valuation expectations has led to increased creativity in deal terms to help satisfy both parties and drive transactions across the finish line. This includes alternative structures such as partnerships, alliances, seller equity rollover, earnouts, and other forms of capital structuring.

Lengthier diligence processes, quality of earnings analyses, and the inclusion of representations & warranties (R&W) insurance also help address acquiror caution in an evolving M&A landscape. Even as the gap in valuation expectations begins to narrow, the tailoring of deal terms around a specific transaction’s concerns and uncertainties has become commonplace and is anticipated to aid in bolstering close rates as M&A activity increases.

A Promising Outlook for 2025 M&A

As we progress into Q1 2025, middle market M&A is brimming with potential. With improved economic conditions, potential for favorable regulatory changes, and a dynamic lending environment, there are abundant opportunities for growth.

One unique service that PMCF offers to leadership teams is a Strategic Assessment, leveraging a combination of market research, financial forecasting, and risk assessment to identify opportunities to realize a premium value from the sale or divestiture of your business or begin planning to meet your goals for company growth and diversification in 2025 and beyond.