Plastics and packaging M&A volume continued at a robust pace through the first three quarters of 2017. Driven by both strategic and private equity buyers, deals increased by 24 (or 10%) versus Q3 YTD 2016, creating a strong likelihood that 2017 will surpass 2016’s total. Despite lower volume trends globally for M&A, the plastics and packaging segment remains highly active and 2017 could finish at a multi-year high for completed transactions. As a result, seller’s market conditions remain including elevated valuation levels.

Historically, strategic buyers have been losing ground to private equity for the last four years, decreasing from 65% of plastic and packaging deals in 2013 to 57% through Q3 2016. However, through the first nine months of 2017, strategic buyer activity has gained momentum. These buyers drove the higher overall deal volume and have increased to 61% of total segment M&A in Q3 YTD 2017.

Key Q3 YTD 2017 trends included the following:

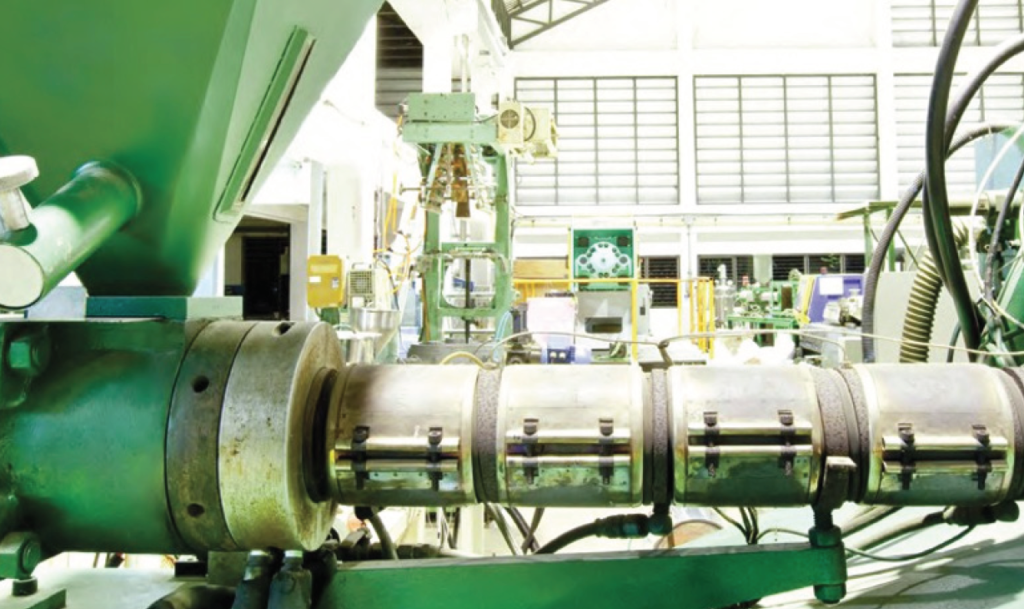

- Strategic buyer M&A has been focused on injection molding, resin, and specialty processing segments.

- Significant increase in rigid and flexible plastic packaging, up 9 deals or 10% versus Q3 YTD 2016

- Notable increase in publicly traded plastic company EV/EBITDA multiples, from 10.1x to 10.9x

Key transactions for Q3 2017 include:

- Multi-Color Corp.’s (NASDAQ: LABL) acquisition of Constantia Flexibles Group labels division for $1.3 billion

- BASF’s (FRA: BAS) acquisitions of Solvay’s integrated polyamide business for €1.6 billion

- ProAmpac’s acquisitions of PolyFirst Packaging and Clondalkin Flexible Packaging Orlando

- ALPLA’s largest historical acquisition with the purchase of Boxmore

- Tekni-Plex’s acquisition of the self-adhesive tape substrate business of Alfatherm

- Michael Dell’s MSD Capital acquisition of Ring Technologies

- Parkway Plastics acquisition of Avenue Mould Solutions and LMR Plastics

Q3 2017 was characterized by a growing economy with improved forward visibility, continued gains in the stock market, ample lending, and relatively stable energy prices. This contributed to the robust environment for plastics and packaging M&A which, at this time, we reasonably expect to continue for the remainder of this year and throughout 2018. The multi-year high in valuation multiples should encourage additional sellers to explore a potential sale including private equity who may consider shortening hold periods. These factors are likely to benefit the supply side of M&A which continues to be outstripped by strategic and private equity demand. However, despite all these positives, we continue to note the extended length of the current cycle and caution sellers that these conditions will eventually revert.